How to Re-File (Amend) a T1 tax return?

For tax year 2015 and prior year's tax return, ReFile function doesn't work. Please still use T1-Adj form or CRA web portal to amend tax return (Read this link for more information).

From the tax year 2016, you can Re-File (Amend) an assessed T1 return; The process is like submitting Netfile or EFile again. The following conditions must be met before you can Re-File:

- CRA has completed the assessment or re-assessment of the initial T1 return.

- If you are using EFile, you might need to have a valid form E-Auth (T1013) authorization on file for the taxpayer with the CRA. So you can Re-File to amend the tax return. myTaxExpress EFile software can submit E-Auth (T1013) authorization online as a separate step.

To Re-File a tax return, follow these steps:

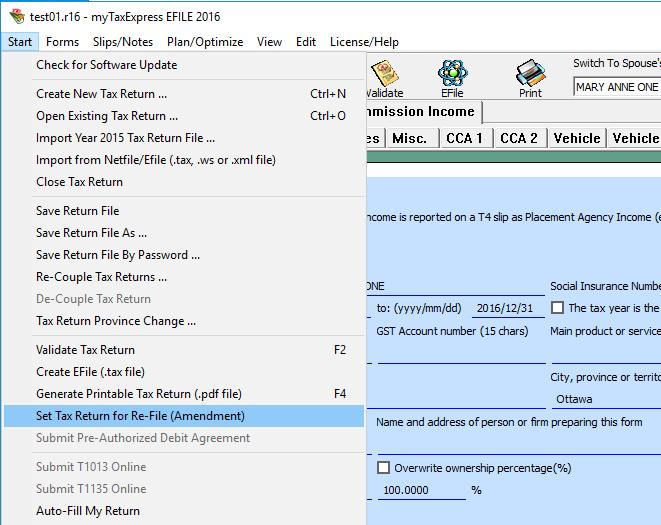

- First, open the return file for ReFile, and choose the menu "Start | Set tax return for Re-File".

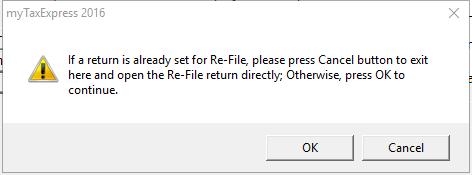

- If you already set this return for Re-File, you will get the following warning message. In other word, you only set tax return for Re-File once in the beginning.

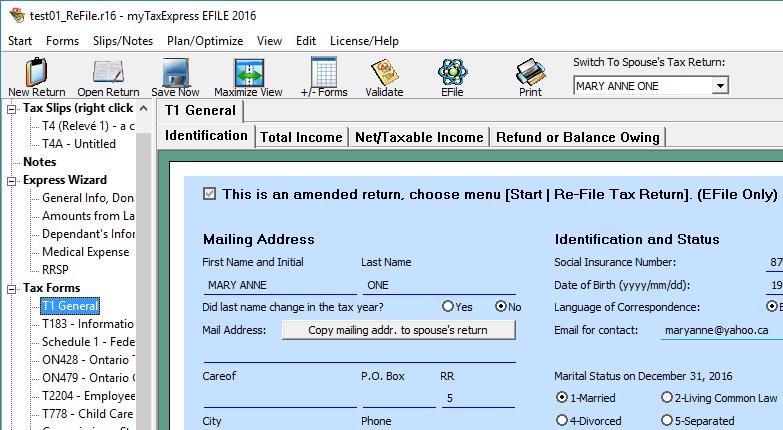

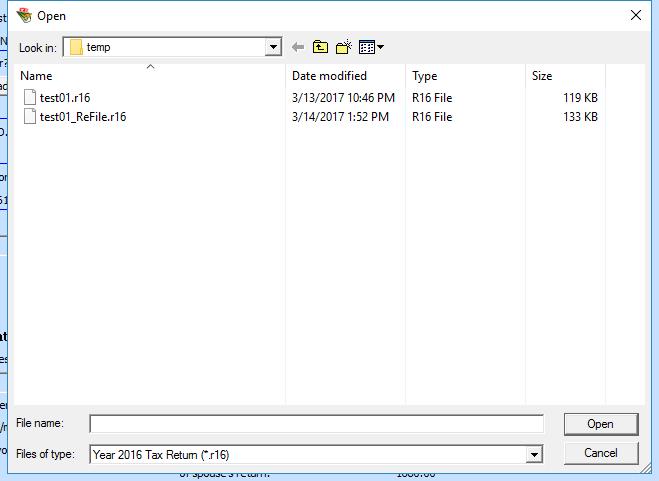

- It will create a new tax return file, adding "_ReFile" in the file name for Re-File purpose. The original tax return file is untouched, so you can reference the original file in the future.

You can see a new file is created for Re-File purpose. Next time, you can simply open this file, no need to use the menu "Re-File" again.

- Work and complete the amended tax return file.

- After you make all necessary changes, save the amended return file, and netfile (or efile) it. As you have done with the original return during Netifle or Efile, you should get a confirmation code from CRA if the amended return is submitted successfully.