What's a coupled return?

Coupled return is for married or common-law people or widowed-in-tax-year only. Coupled return means two returns in one file. An un-coupled return file is one file one return; Coupled return can exchange spouse income and credit claim information for both tax payer automatically; otherwise uncoupled return file requires you to enter spouse info manually.

There is no advantage to using an uncoupled return for a couple; if an uncoupled return is done properly, it will have the same result as a coupled return.

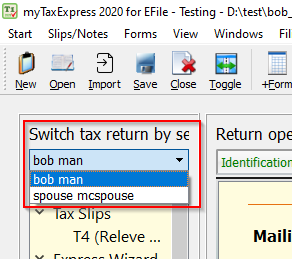

In the newer version of myTaxExpress you can switch between returns by clicking on the "Switch tax return by selecting the name" drop-down list. Then click on the name of the person whose return you want to switch to.

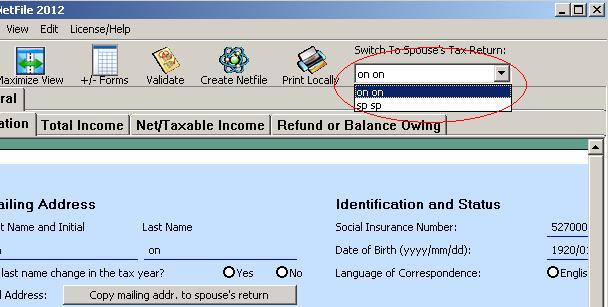

On the older version of the software, you can switch tax returns to your spouse's by the list box labeled as "tax return for", under the title bar. By finishing both of your tax return, spousal tax information are updated in each other's tax return automatically.