FAQ Overview

Common » Common

What are T2Express files?

Author: contact mytaxexpress

Last update: 2023-03-25 14:00

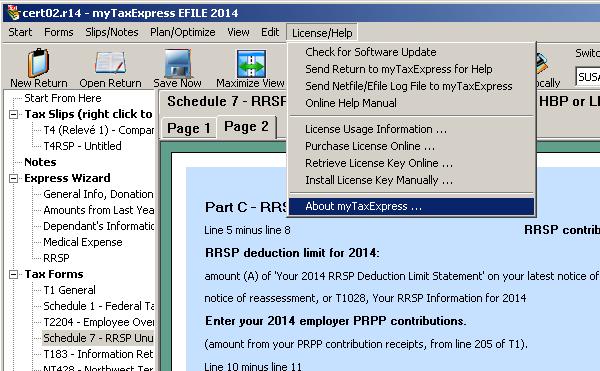

How to send tax return file to myTaxExpress/T2Express for problem solving?

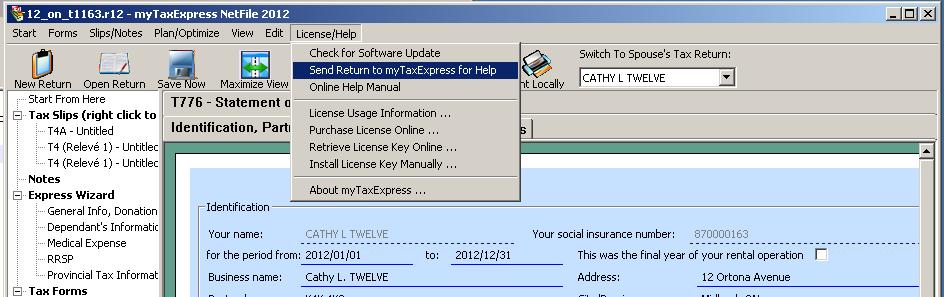

You can send a return file to us in myTaxExpress or T2Express so we can take a look at the file for investigation. Please make sure your computer has an Internet connection during the process.

In myTaxExpress, you can send it by the menu Help > send return to mytaxexpress, as shown in the screenshot below:

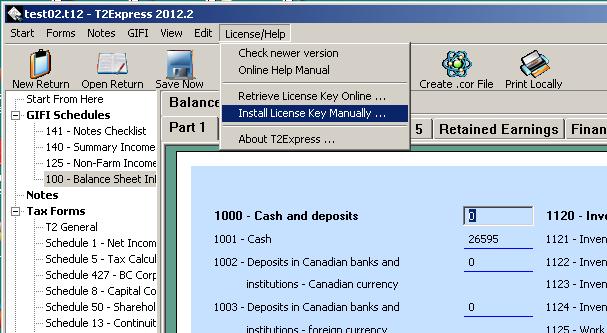

In T2Express, you can send it similarly by the menu Help/License > Send Return File to T2Express.

Author: contact mytaxexpress

Last update: 2023-10-10 09:14

Where to find industry code?

Industry code is a 6-digit code.

Please check this link and find a code related to the business activity

Stats Canada Website Link

or

http://www.mytaxexpress.com/NAICS-2015.html

Author: contact mytaxexpress

Last update: 2023-02-21 20:58

What's myTaxExpress refund policy?

A refund will NOT be granted AFTER a license key is issued or sent to customers. We provide free software download, so you can try our software first, then decide to buy software license.

If the license key is not retrieved or issued, customers could be refunded with $2.00 deducted for the credit card processing fee.

Author: contact mytaxexpress

Last update: 2022-04-07 14:55

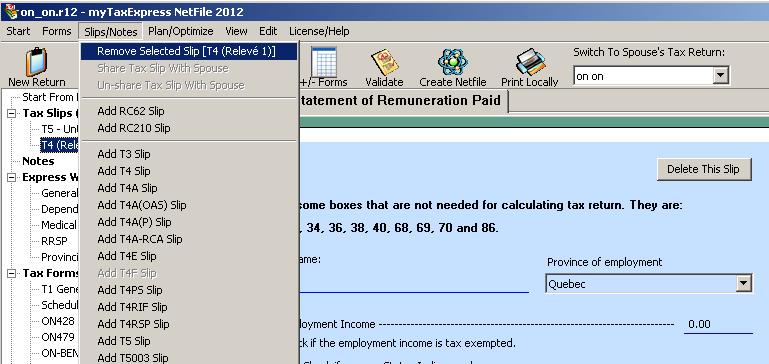

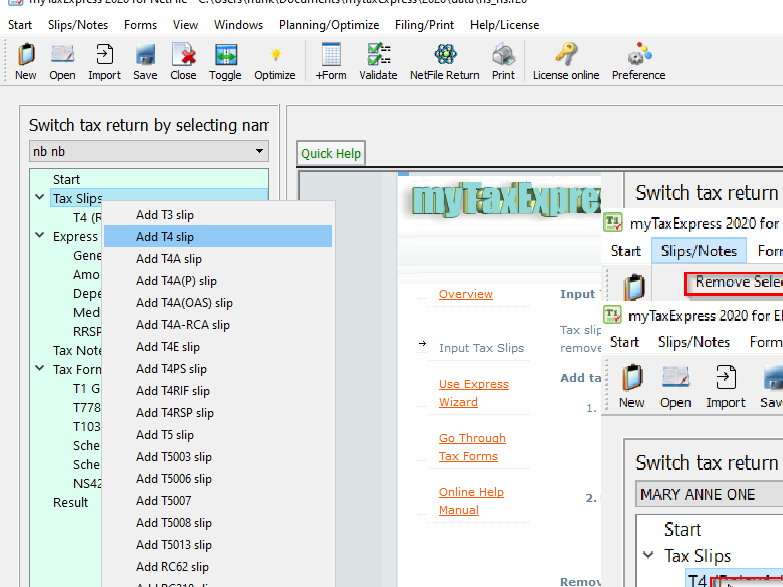

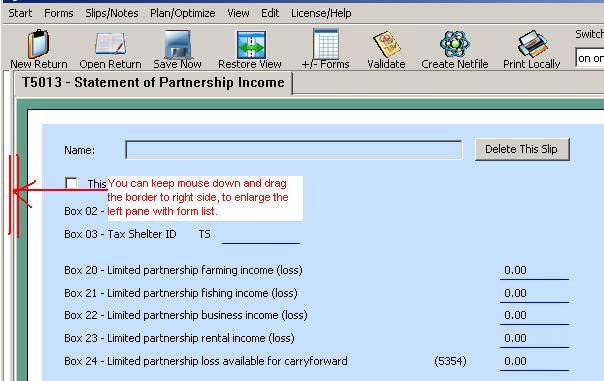

How to delete a tax slip?

There are two methods to remove/delete a tax slip from a return file.

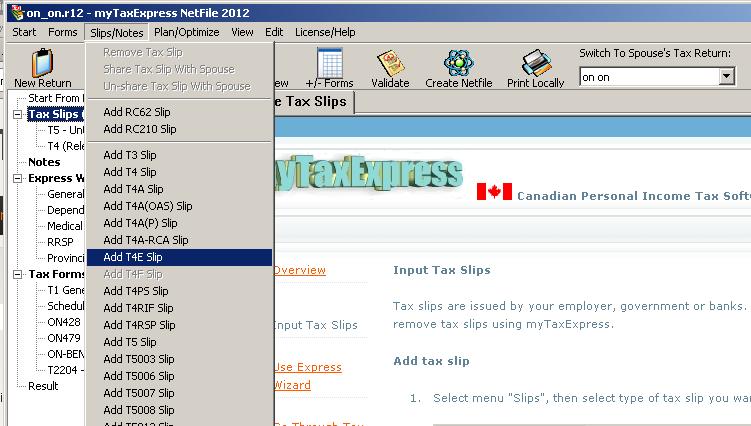

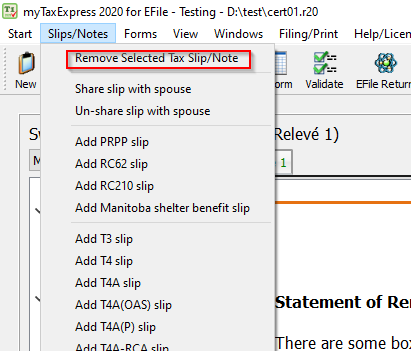

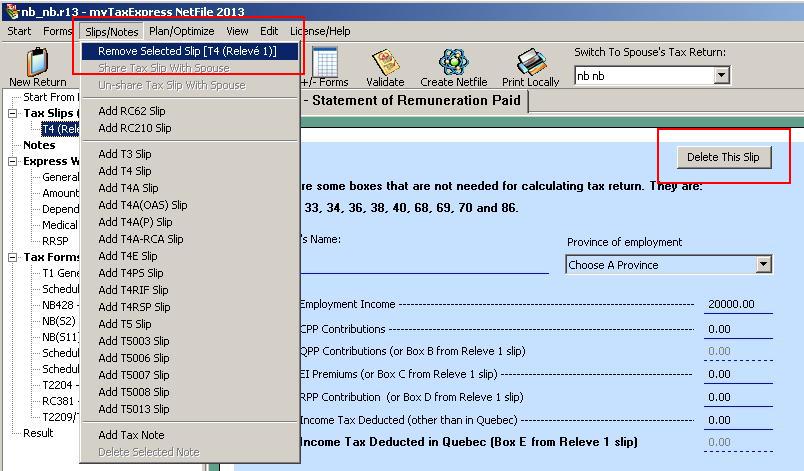

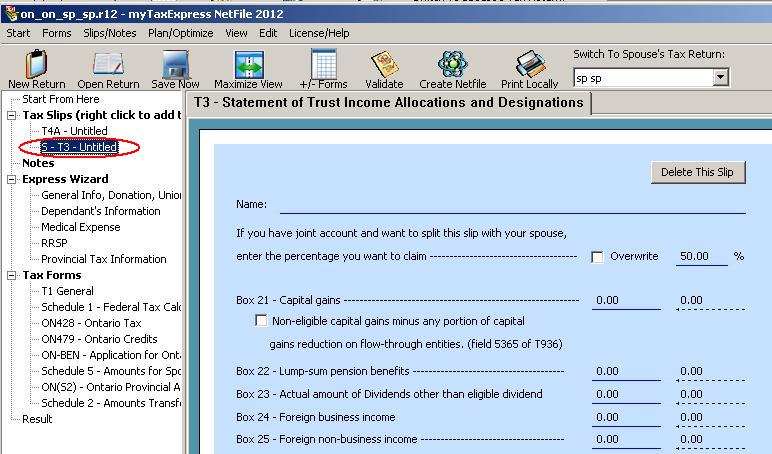

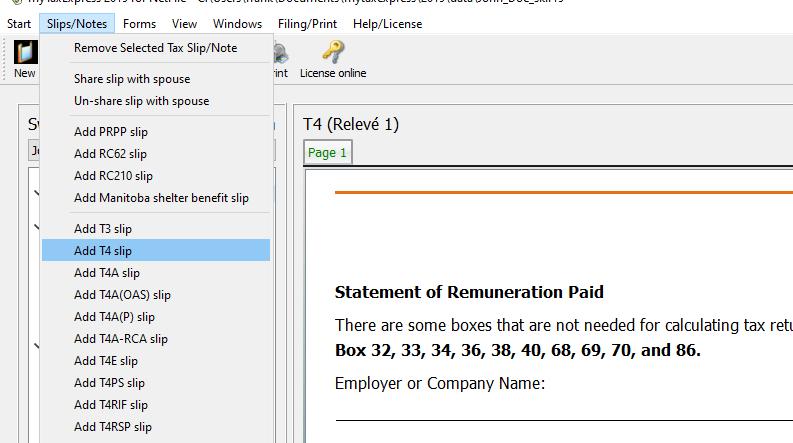

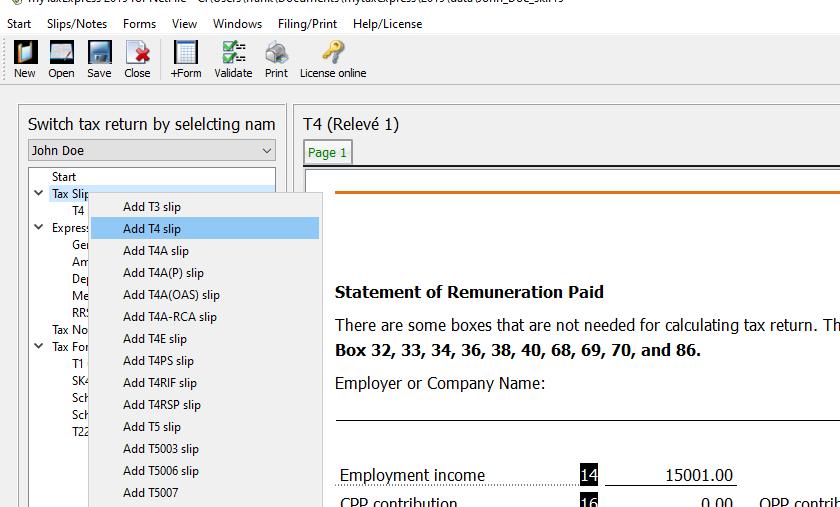

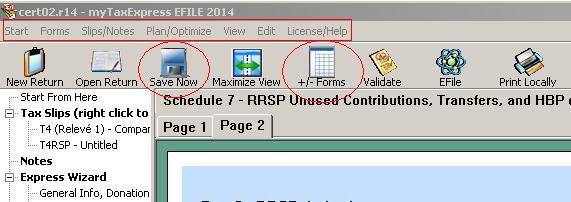

Method 1: Select the tax slip on the left panel under the Tax Slips group, right-click it, and select the Remove Selected Tax Slip/Note option. See the screenshot below.

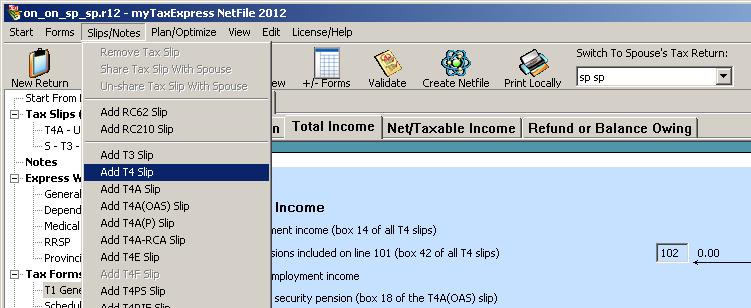

Method 2: Select the tax slip on the left panel first, then choose the menu Slips/Notes > Remove tax slip.

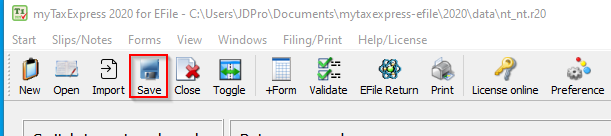

Screenshot in newer software:

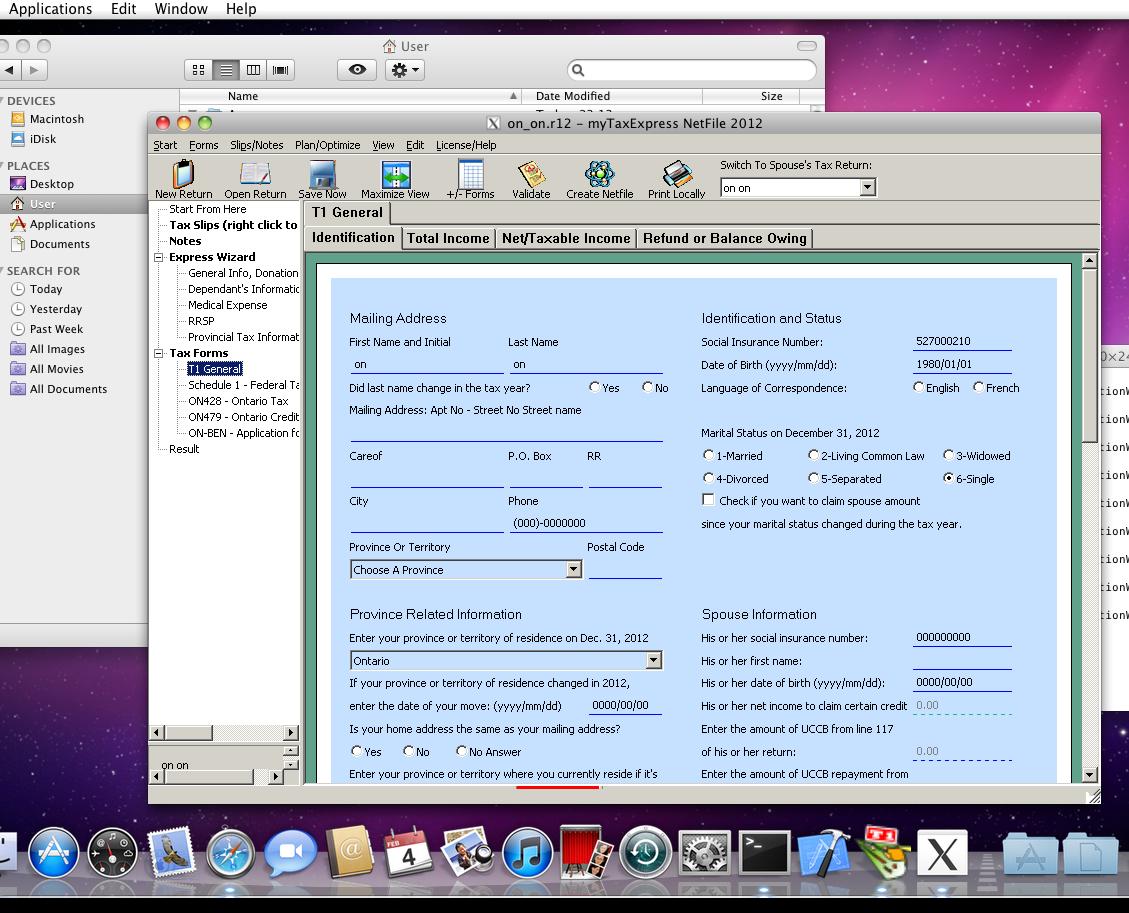

Screenshot in older software:

Author: contact mytaxexpress

Last update: 2023-04-07 13:40

How to email money transfer to myTaxExpress?

First you do a email money transfer from your bank account to contact@mytaxexpress.com. Please make sure you send enough amount for the software license key you want. Then you send another email to us with the answer to your money transfer security question. Note the security answer is case sensitive.

Author: contact mytaxexpress

Last update: 2013-03-31 04:44

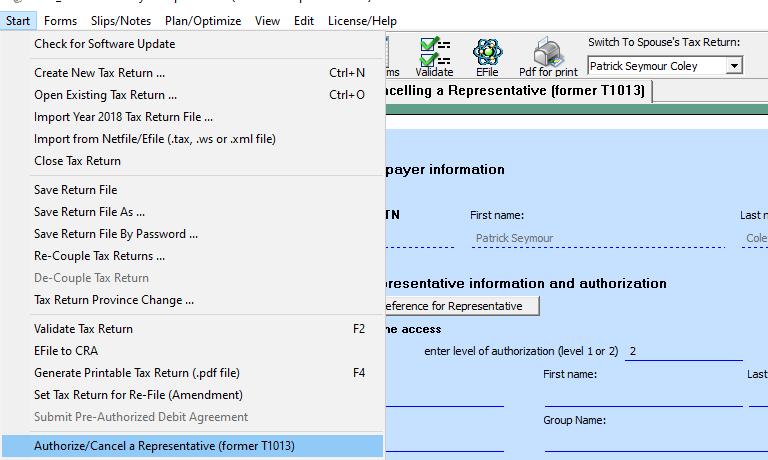

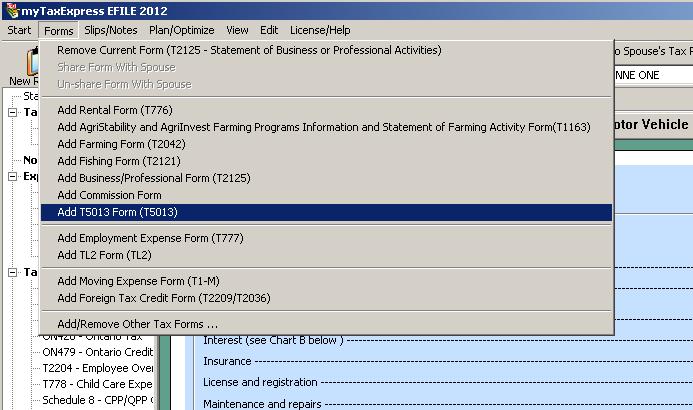

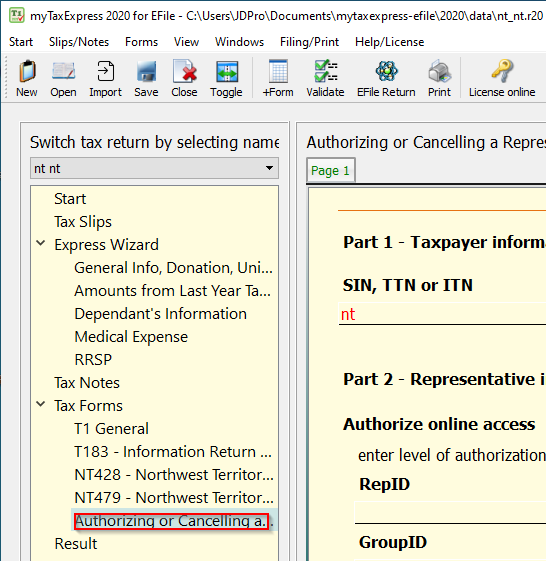

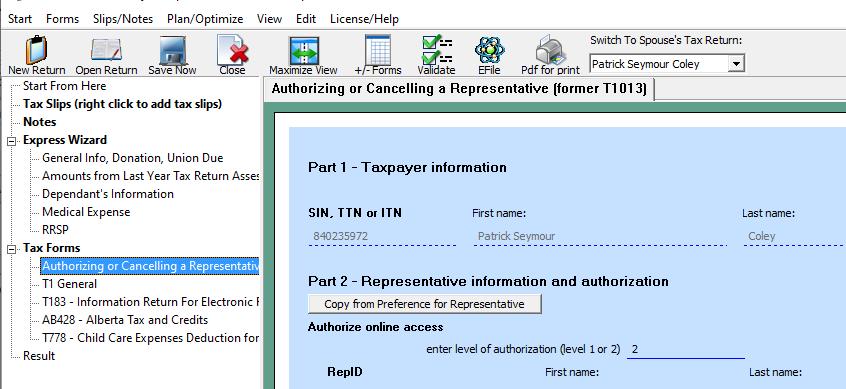

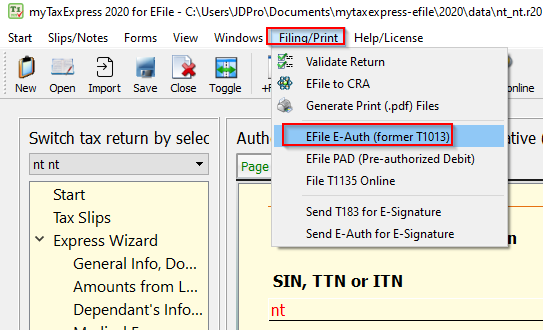

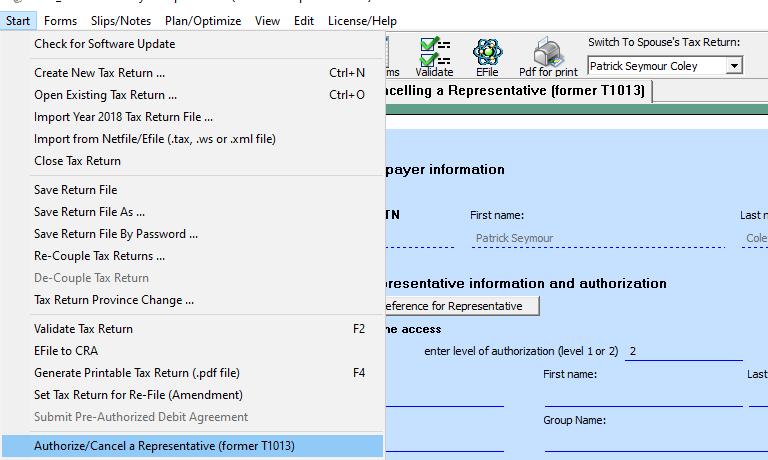

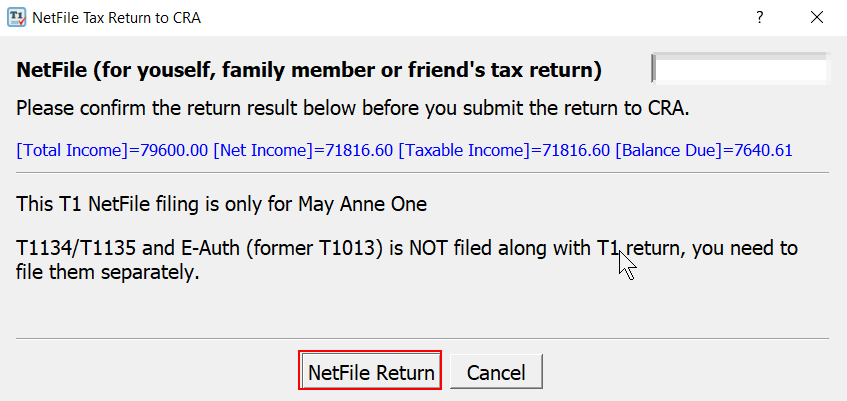

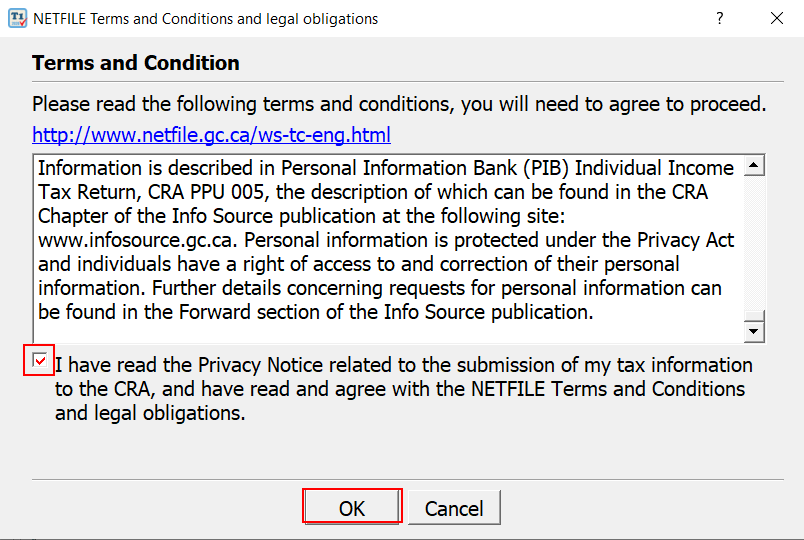

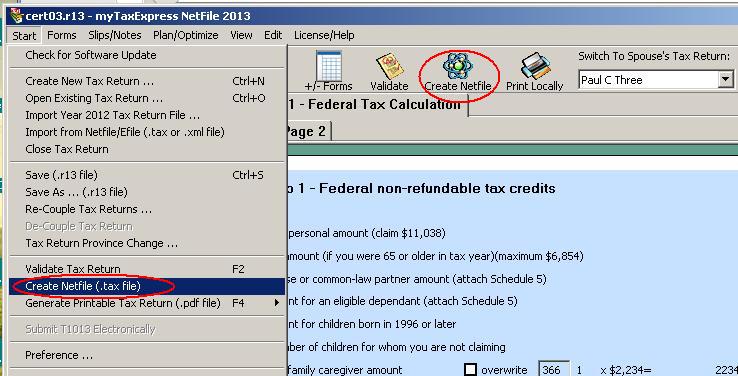

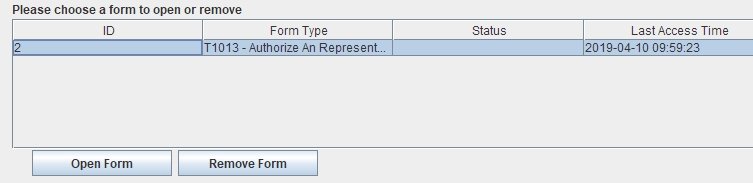

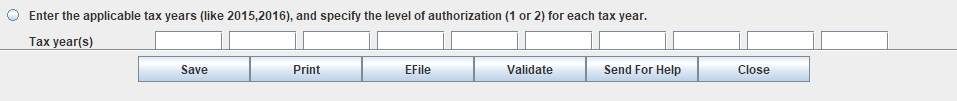

Does T1 return contain T1013 information?

T1013 is submitted separately from T1 return, even when you have T1013 form in return file, it won't file to CRA if you only do efile/netfile.

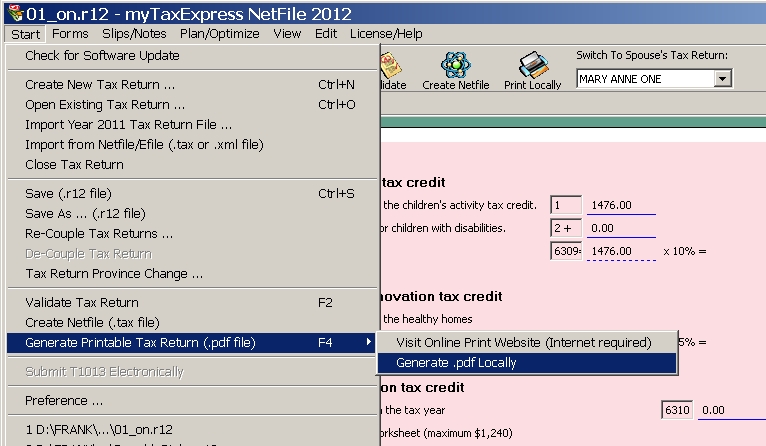

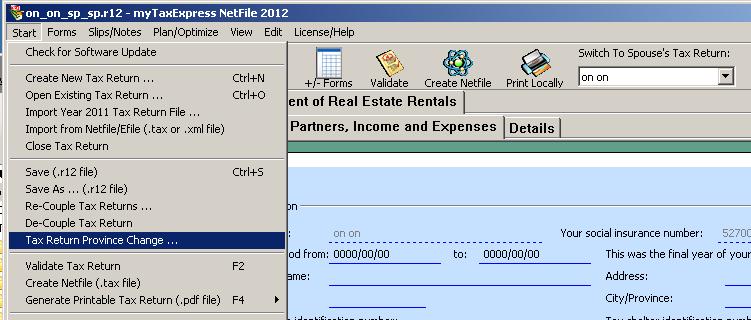

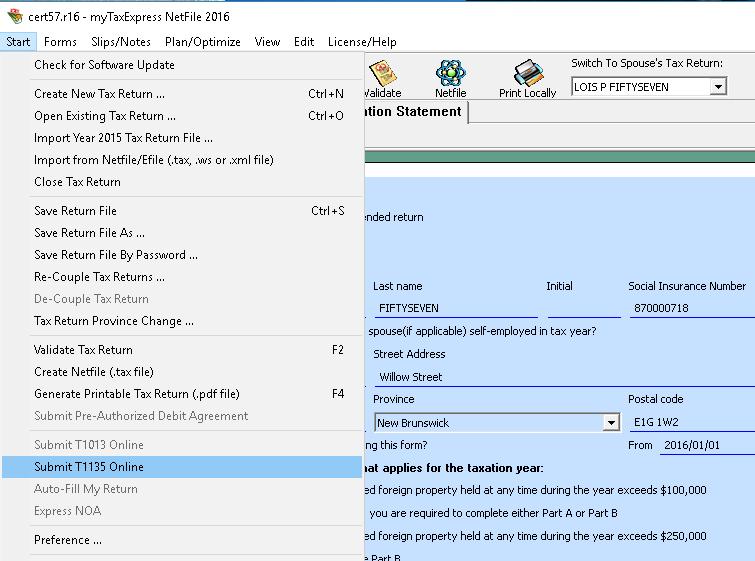

To file T1013, you need to choose menu "Start | Submit T1013 Electronically". Filing T1013 only contains T1013 information, no T1 return amounts are transferred to CRA.

Author: contact mytaxexpress

Last update: 2022-09-07 22:52

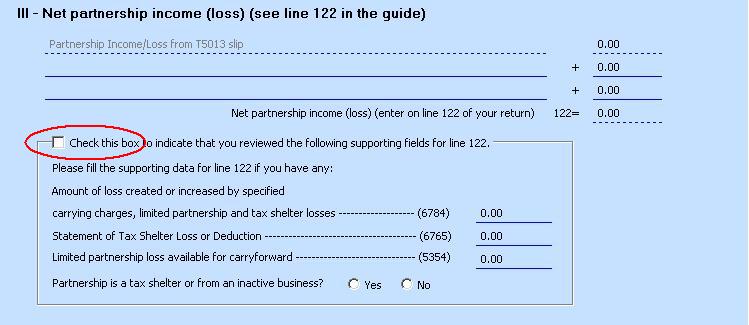

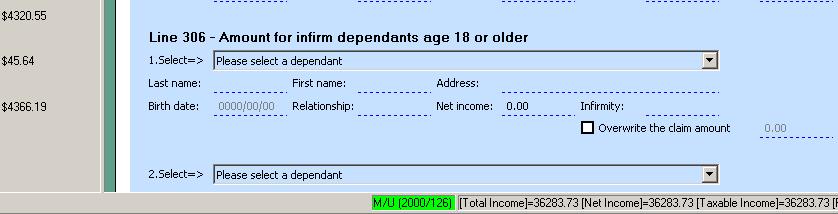

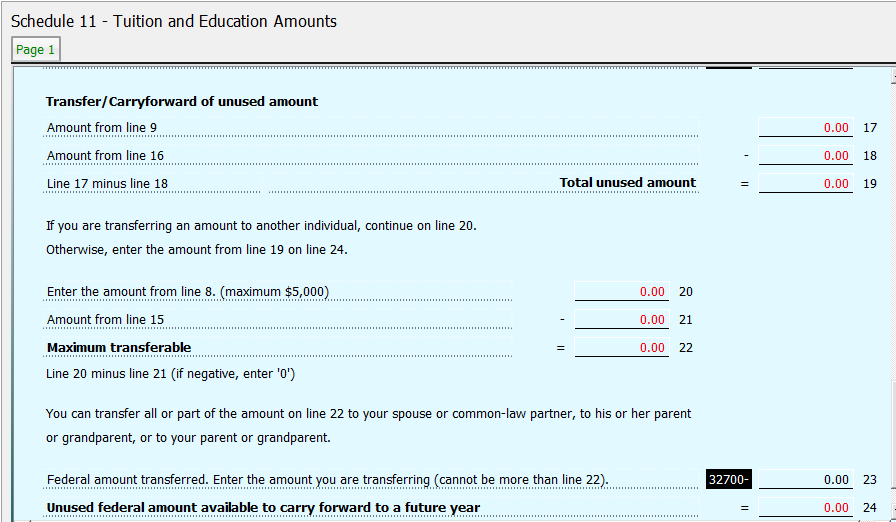

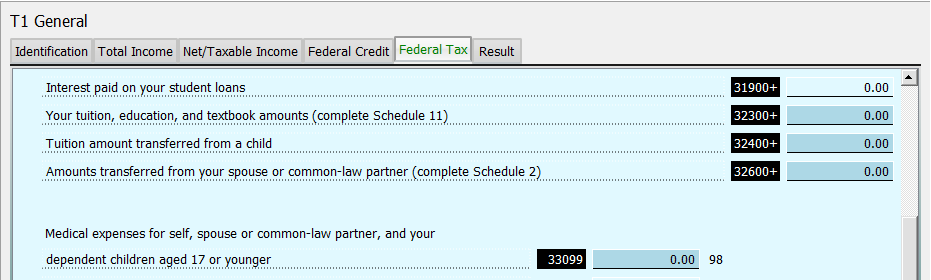

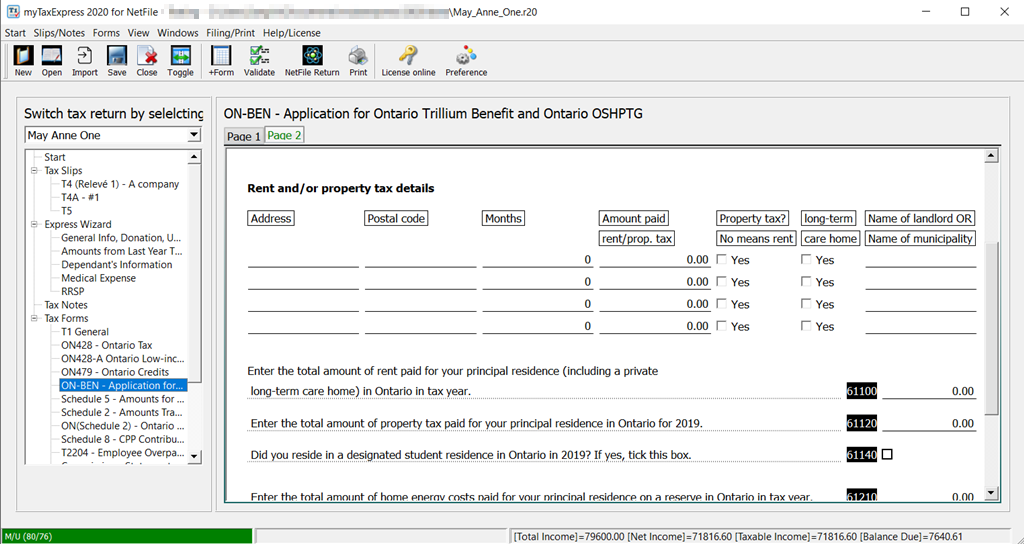

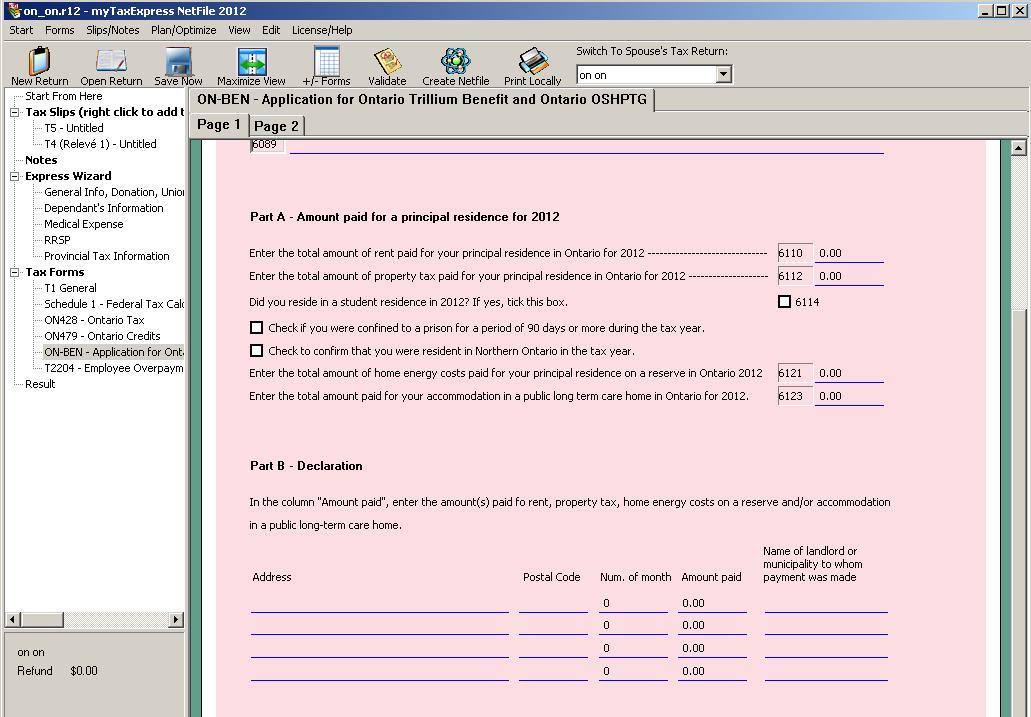

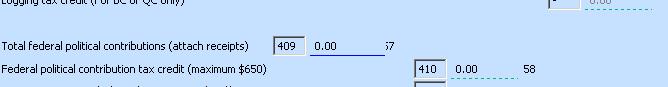

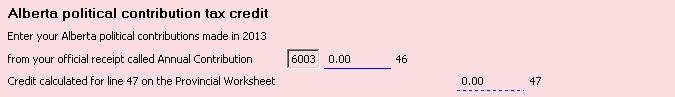

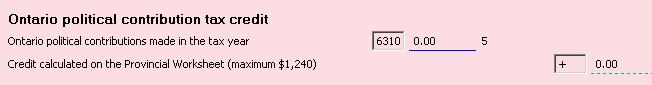

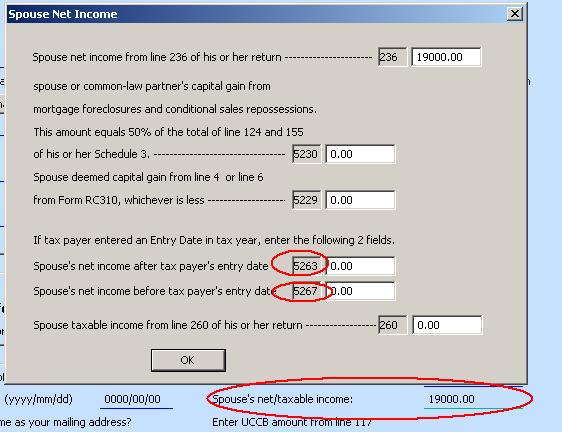

Why some line numbers are missing in the tax form?

CRA assign a field both field and line number; however, currently in software, we display field number in favor of line number. That's why you can see some line numbers are missing. But you can figure it out from previous and after line numbers.

From year 2013, software will display both field and line numbers as an improvement.

Author: contact mytaxexpress

Last update: 2013-04-08 21:44

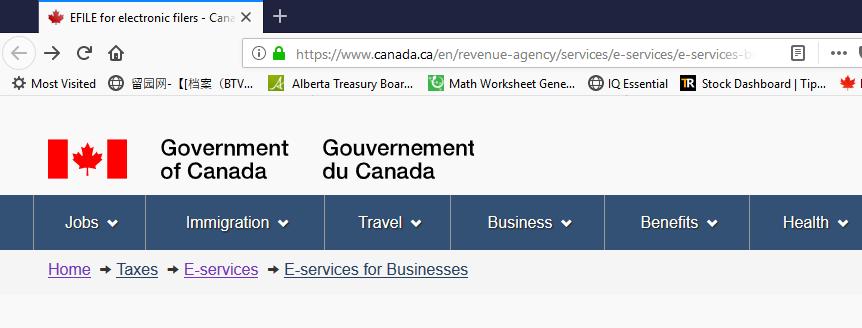

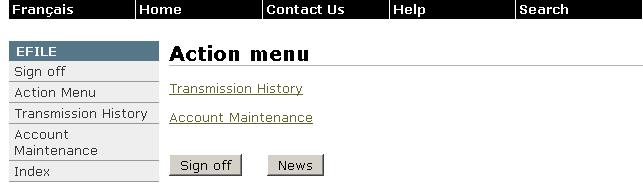

How to apply for an EFiler ID?

It's free to apply an EFILER ID from CRA. Please apply/renew it prior to tax season (at least one month before it). Please apply it on CRA website (https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/apply-efile.html.

Author: contact mytaxexpress

Last update: 2017-12-29 23:07

How employer calculates cpp contribution payment?

Here is CRA guide for employer to deduct CPP through payroll.

http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/clcltng/cpp-rpc/mnnl-eng.html

In case there is under-deducted CPP payment, CRA will contact employer to fix payment.

Author: contact mytaxexpress

Last update: 2014-02-06 21:00

How to access CRA SEND system?

Starting in February 2014, the SEND web page service will be discontinued. It will be replaced by the Client Data Enquiry (CDE) service.

To access the CDE service, you must log in to Represent a Client. You do not need to submit a Form T1153, Consent and Request Form. You need to file T1013 to represesnt a client. Search T1013 in FAQ, you will find out how to use myTaxExpress EFile software to submit T1013 online.

Author: contact mytaxexpress

Last update: 2014-02-21 00:00

Where is the latest tax year tax guide?

For T1 personal return, the federal tax guide is

http://www.cra-arc.gc.ca/E/pub/tg/5000-g/5000g-13e.pdf

The provincial tax forms and guides are here

http://www.cra-arc.gc.ca/formspubs/t1gnrl/menu-eng.html

For T2 corporation tax returns,

(update pending)

Author: contact mytaxexpress

Last update: 2014-03-02 18:32

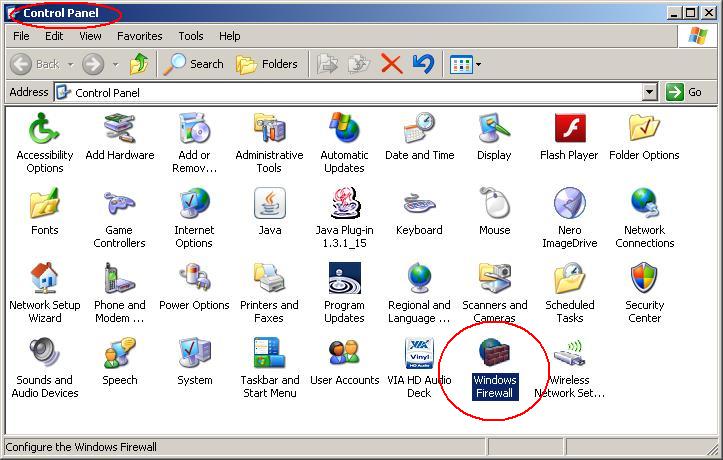

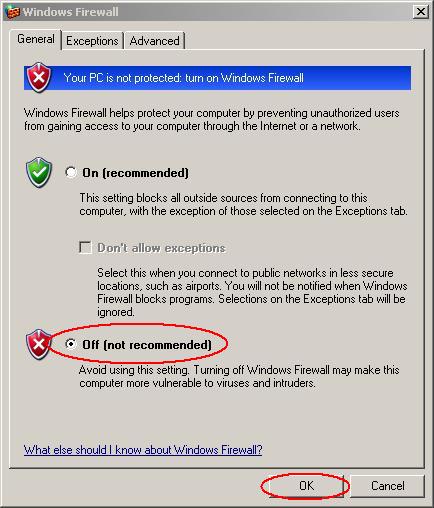

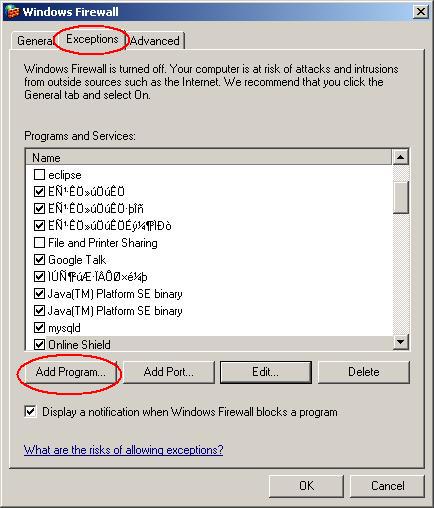

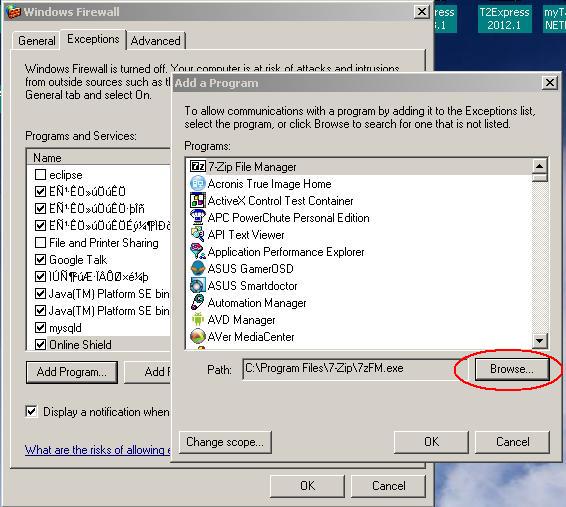

Efile web service was not performed due to Internet problem

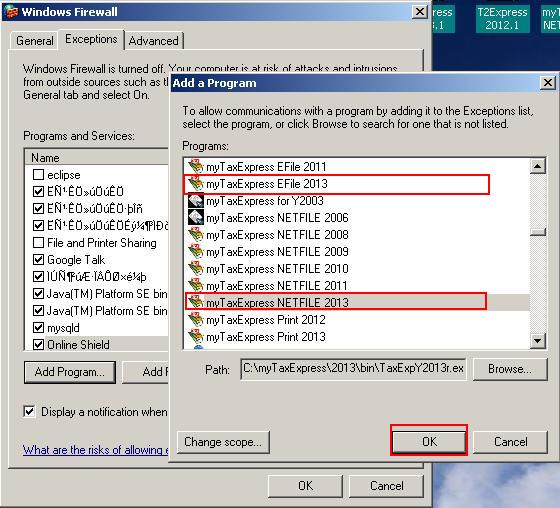

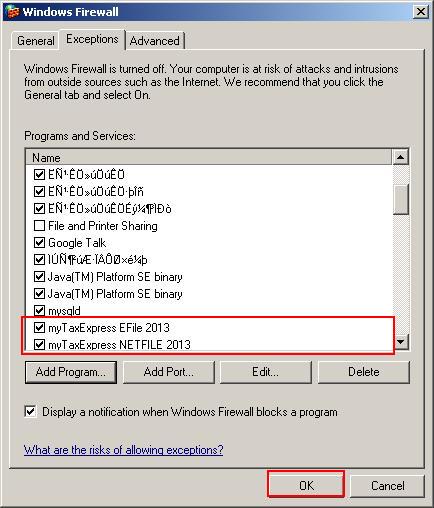

1.First please check your computer firewall settings, which should allow myTaxExpress/T2Express program to use Internet.

2.Check your computer date, see if it's accurate.

3.Contact myTaxExpress for more help if the above doesn't solve the problem.

Author: contact mytaxexpress

Last update: 2014-03-06 16:07

Where do I enter an unused moving expense, carried forward from last year?

There is a field 219a before field 219 on page 3 of T1. Field 219a is for unused moving expense credit from previous years.

Author: contact mytaxexpress

Last update: 2014-03-15 16:43

What's EFile error code 184?

EFile error code 184 means there are some errors in the tax return data, you need to fix it first and then efile again. There should be one or more error clue codes following code 184 as the EFILE result.

You need to look up the error clue code, (note, not code 184, but the error clue code) from Chapter 2 of CRA's EFILER manual.

Electronic Filers Manual for Income Tax and Benefit Returns: Chapter 2 Error Messages

Author: contact mytaxexpress

Last update: 2023-02-25 10:39

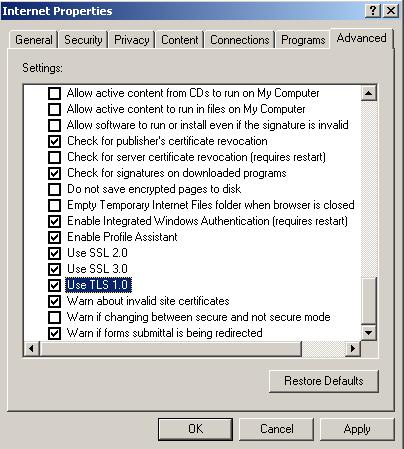

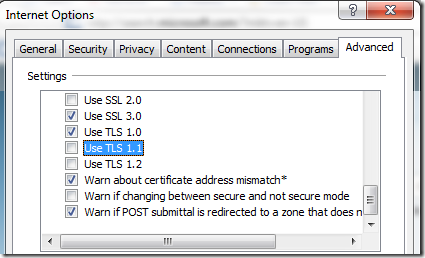

How to enable TLS connection after CRA servers remove SSL?

This information only applies to Windows and for prior 2015 tax year software. For newer version myTaxExpress, it uses its own TLS function to make secure connection. myTaxExpress and T2Express software have no problem on Mac and Linux system.

CRA removed SSL support from its production system, which might cause connection problem when you Netfile, Efile, E-Filing T1013, or Internet Filing .COR file for T2 return. To solve this problem, you need to enable TLS option in your computer system's Internet Option.

Here are the steps:

1. Launch Internet Option from Control Panel

2. Launch Internet Option

3. Go to 'Advanced Tab'

4. Enable TLS 1.0, 1.1 and 1.2. If possible, enable all of them. At least enable one of TLS option.

note, from some customer's feedback, it's better to disable all SSL options and click

'OK' button to apply, then reboot computer and try netfile/efile again.

5. Apply and keep the TLS settings, and reboot computer and try netfile/efile again.

Author: contact mytaxexpress

Last update: 2022-09-07 22:51

how to report a NR4-OAS slip?

Report the Gross Income from box 26 on line 130 of T1 return, and

the Non-Resident Tax Withheld from box 27 goes on line 437 on

page 4 of T1.

Author: contact mytaxexpress

Last update: 2015-04-09 16:21

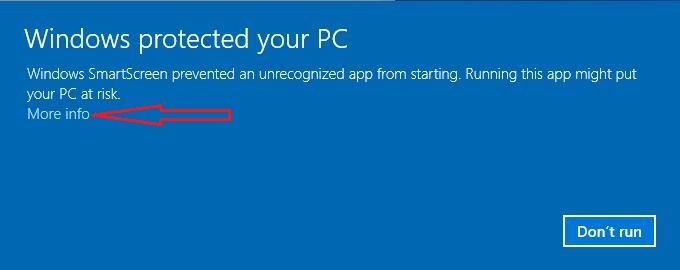

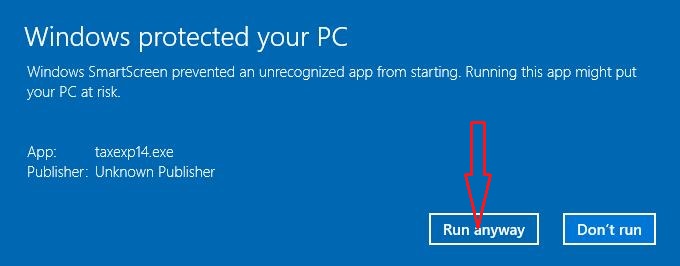

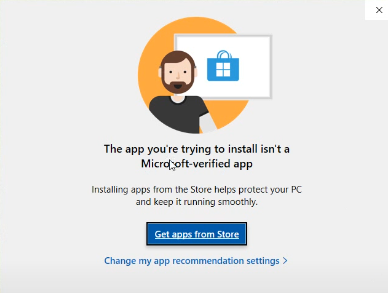

Setup file doesn't run on Windows XP or Vista?

For Windows Vista SP2 user, please read this link

https://support.microsoft.com/en-us/kb/2763674

You need to install the Windows update mentioned in the Resolution section, then myTaxExpress software setup file can be run.

If there is still problem in running myTaxExpress software. Please do the following:

1) right click on taxexp16.exe after you download/unzip it from website, then choose "property"

2) select "run as administrator" and "windows xp sp3 compatibility mode"

3) click OK to apply the settings,

4) run taxexp16.exe again

Contact us if there is any issue.

Author: contact mytaxexpress

Last update: 2017-03-08 18:17

Where can I find the country code for form T1135?

Country codes

For the list of country codes, see the CRA website at

Author: contact mytaxexpress

Last update: 2017-05-01 22:28

What's EFile error code 121?

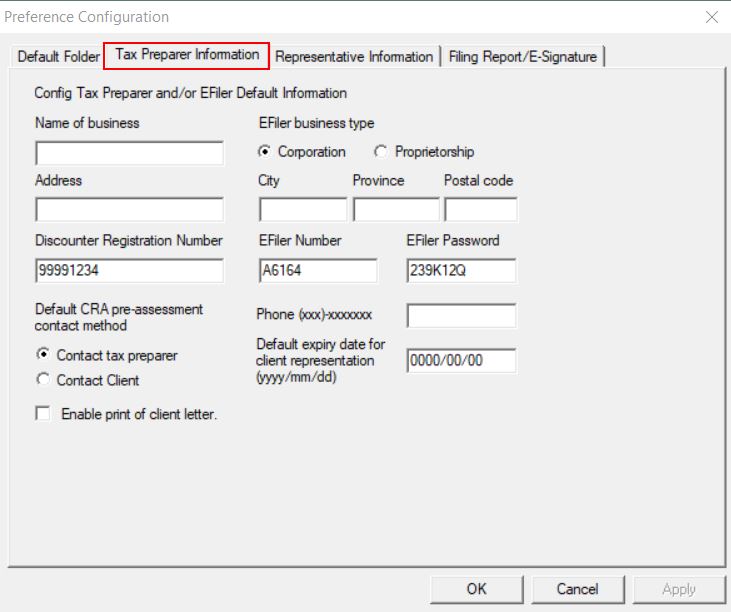

Sometimes you may see error code 121 when trying to efile a return. It basically means the password for your efiler ID during the transmission does't match CRA records. It could happen if the password you set up in the software is not correct, including typos. Another common case is that you forget to update the password in the software after you renew your efile ID and password each year.

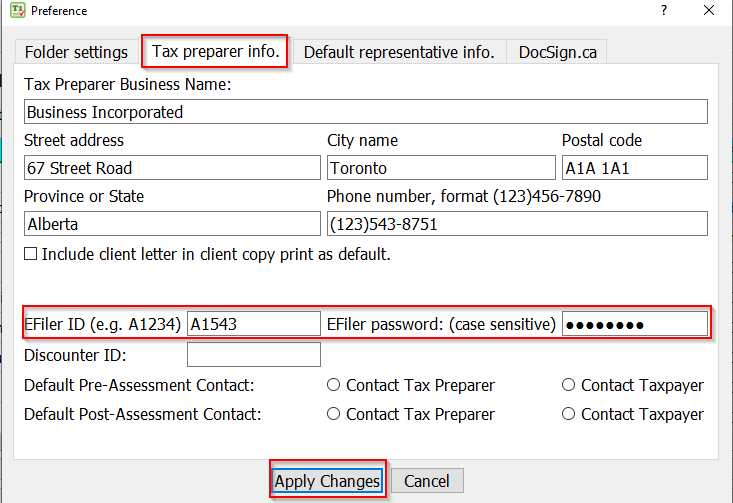

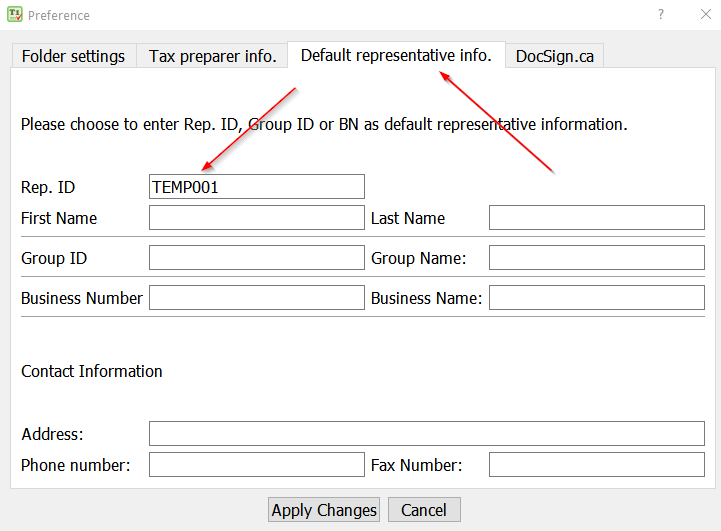

- Anyway, in this situation, please first verify your password setting in the software. You can consult this FAQ if you don't remember where to set up the password: How to change EFiler ID and password. After the password is corrected/udpated, please save the return file one more time to ensure the change is reflected, then efile again.

- If you still get the error 121, don't try to efile again as you account may get locked after 5 unsuccessful attempts. Please call CRA Efile helpdesk to verify if you have the correct password on hand. Please repeat step 1 with the new password.

Author: contact mytaxexpress

Last update: 2018-03-21 15:47

What's EFile error code 121?

Author: contact mytaxexpress

Last update: 2018-03-21 15:39

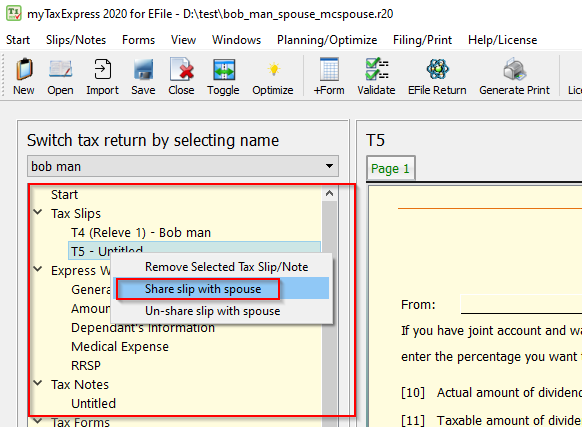

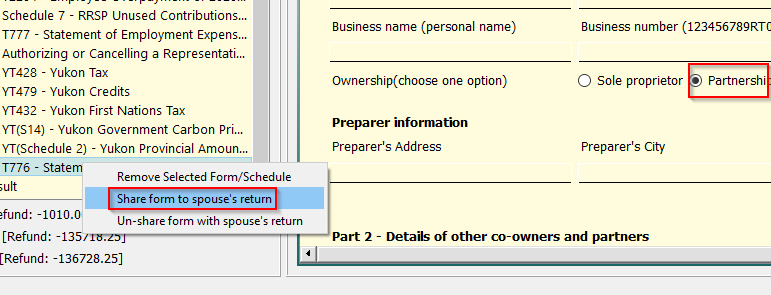

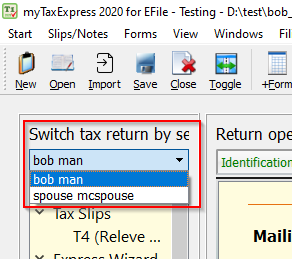

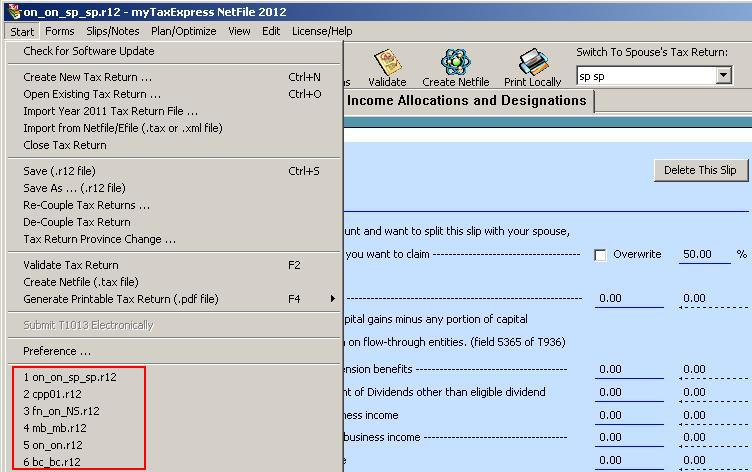

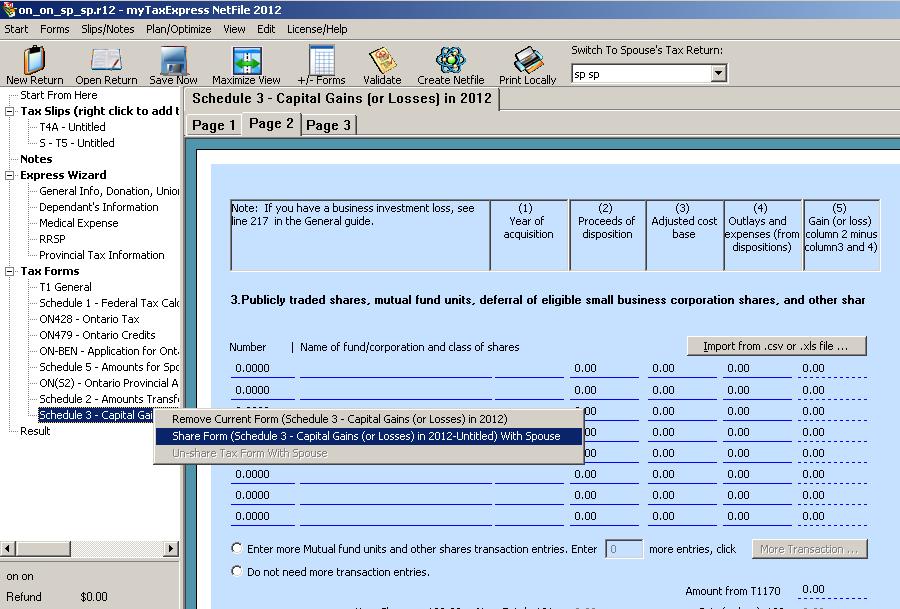

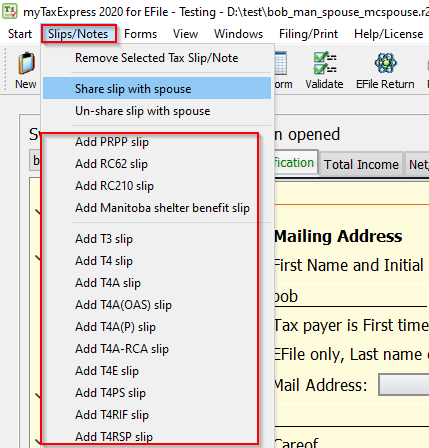

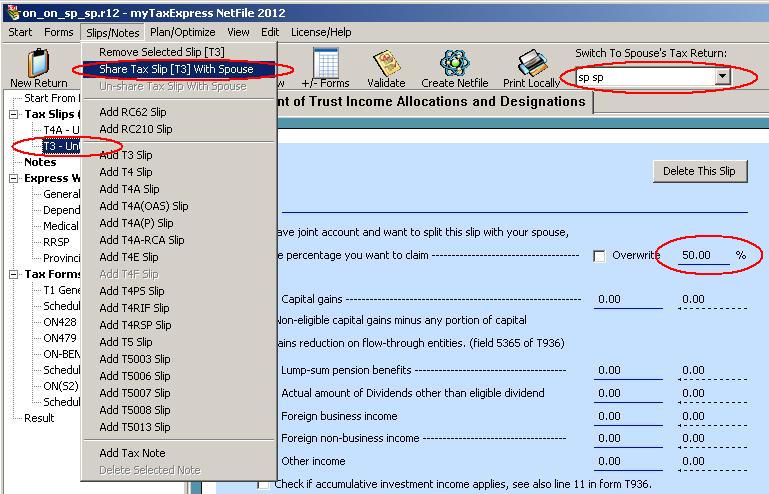

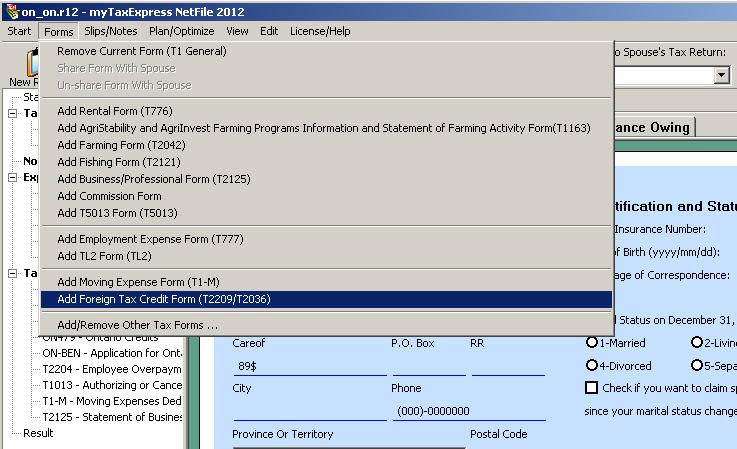

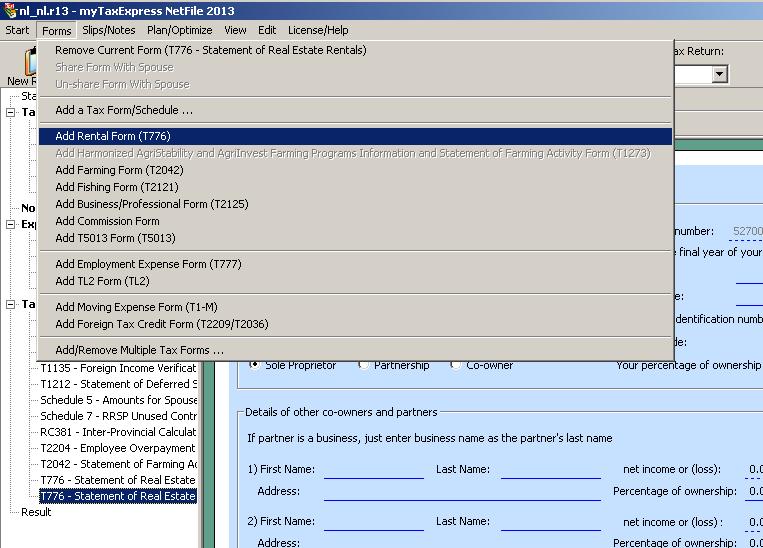

Share slips or forms with your spouse

myTaxExpress has a nice "Share" feature to share applicable slips or forms between you and your spouse. By sharing them you don't need to fill the same slips or forms in your spouse's return which will help you save lots of time on data entry.

Currently the following slips/forms can be shared in a couple return: T3, T5, Schedule 3, T776, T2125, T2042, T1163 and T2091.

In order to share those slips/forms, the returns for the couple must be prepared as a "coupled return" file. Here is the FAQ pages to explain what a "coupled return" is and how to couple two seperate returns together:

How to recouple two single return files to a coupled return?

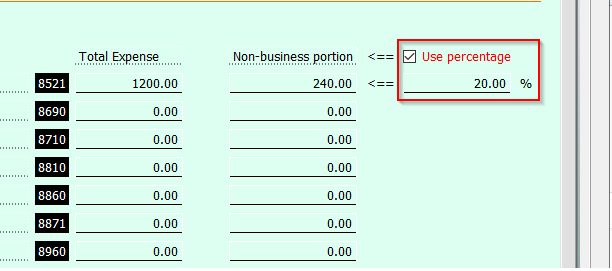

In a couple of return file, manually overwrite the percentage you want to share/split with the spouse first, then select the slip or the form you want to share in the left content panel, press the right mouse button (a.k.a. right-click mouse) to bring up a menu, then choose "Share ... With Spouse" option. This slip or form will be duplicated to the spouse's return and prefixed with "S - Slip/Form name" or "Shared-Slip/Form name" automatically to denote it is being shared.

Author: contact mytaxexpress

Last update: 2022-09-07 22:50

What's the annual CAD exchange rate?

Bank of Canada publishes the following average annual exchange rate.

https://www.bankofcanada.ca/rates/exchange/annual-average-exchange-rates/

Here is a list of tax year 2017 result. For more, click the link above.

| Currency | 2017 |

|---|---|

| Australian dollar | 0.9951 |

| Brazilian real | 0.4071 |

| Chinese renminbi | 0.1921 |

| European euro | 1.4650 |

| Hong Kong dollar | 0.1667 |

| Indian rupee | 0.01995 |

| Indonesian rupiah | 0.000097 |

| Japanese yen | 0.01158 |

| Malaysian ringgit | 0.3020 |

| Mexican peso | 0.06884 |

| New Zealand dollar | 0.9229 |

| Norwegian krone | 0.1570 |

| Peruvian new sol | 0.3982 |

| Russian ruble | 0.02228 |

| Saudi riyal | 0.3463 |

| Singapore dollar | 0.9404 |

| South African rand | 0.09767 |

| South Korean won | 0.001149 |

| Swedish krona | 0.1520 |

| Swiss franc | 1.3189 |

| Taiwanese dollar | 0.04269 |

| Thai baht | 0.03827 |

| Turkish lira | 0.3565 |

| UK pound sterling | 1.6720 |

| US dollar | 1.2986 |

| Vietnamese dong | 0.000057 |

Author: contact mytaxexpress

Last update: 2020-01-17 21:33

New rule on "Allowance on eligible capital property"

As of January 1, 2017, taxpayers can no longer claim an allowance on eligible capital property. They must use capital cost allowance under class 14.1 (depreciable property) instead. Line 9935 has been deleted from the Forms T1163, T1273, T2042, T2121 and T2125.

For more information, please check the following CRA page: Line 9935 - Allowance on eligible capital property

Author: contact mytaxexpress

Last update: 2018-03-28 20:58

What is error code 20?

You may get the following error message when trying to netfile or efile a return:

Cannot connect to CRA server: Code 20

It simply means that CRA servers are not available at this time. CRA performs daily system maintenance 3 hours a day.

Here are their scheculed daily system maintenance window for each timezone. During this window you cannot file any returns.

| Time Zone | Daily System Maintenace |

| Pacific time | Midnight to 3:00 a.m. |

| Mountain time | 1:00 a.m. to 4:00 a.m. |

| Central time | 2:00 a.m. to 5:00 a.m. |

| Eastern time | 3:00 a.m. to 6:00 a.m. |

| Atlantic time | 4:00 a.m. to 7:00 a.m. |

| Newfoundland time | 4:30 a.m. to 7:30 a.m. |

Author: contact mytaxexpress

Last update: 2018-03-29 18:38

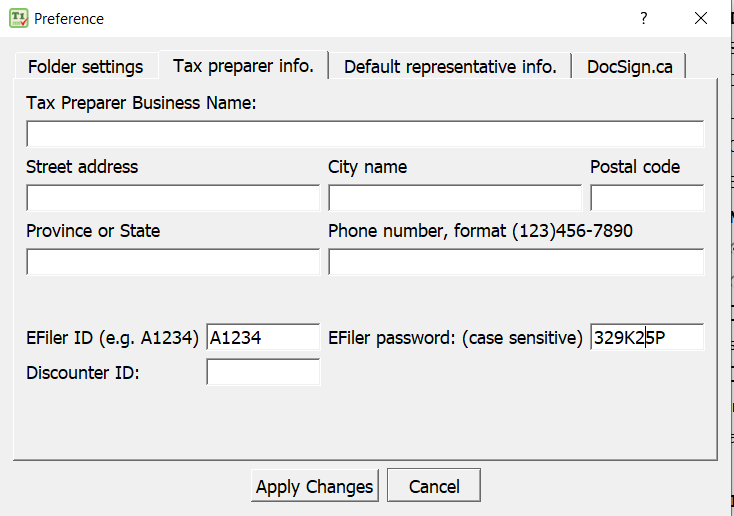

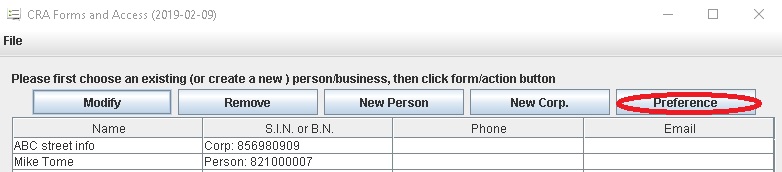

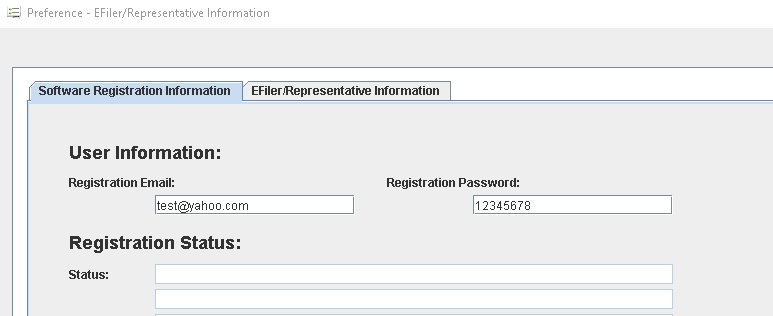

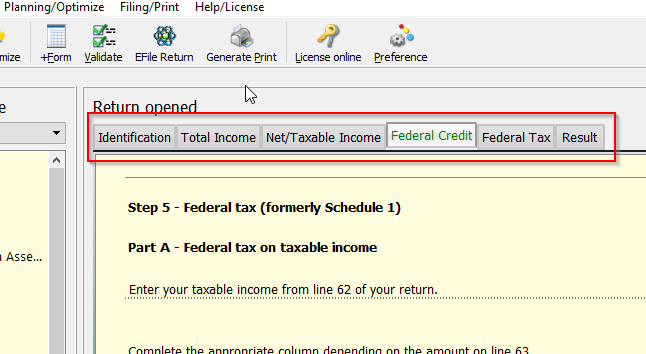

How to setup EFiler ID and registration email in Form&Access ?

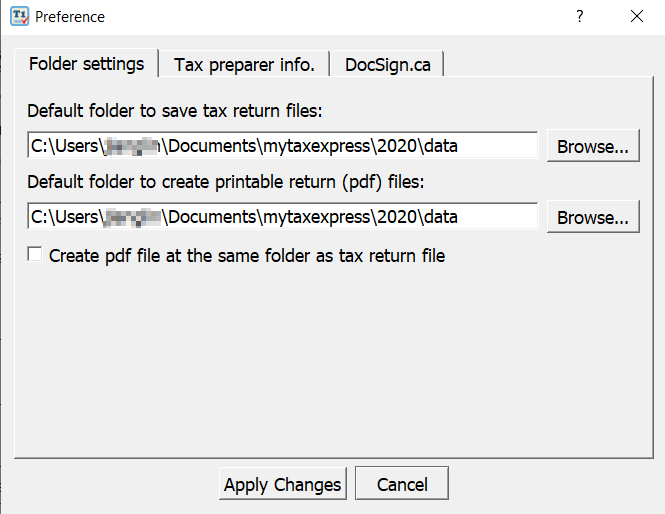

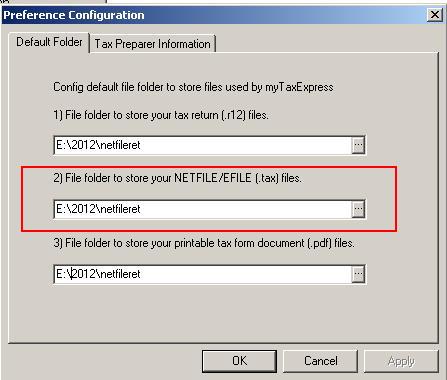

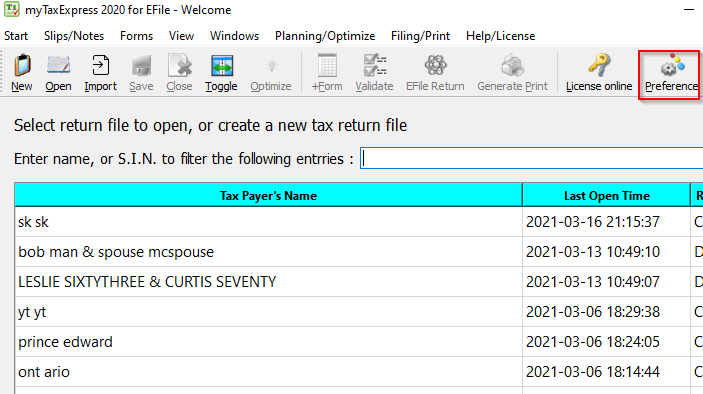

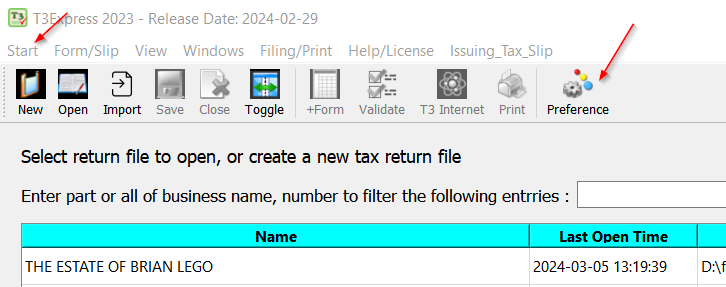

After you run the program, you will see a list of buttons on top of main window. Please click the "Preference" button to open preference pages.

There are two pages, one is for EFiler ID and password; the other page is for registration email and password from support ticket website. Registration email is used to track your paid points and its usage.

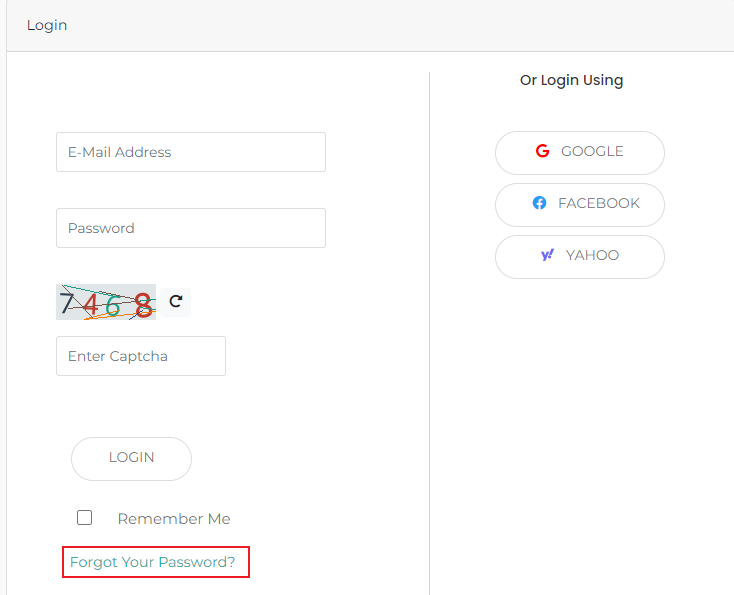

If you don't have registration information, you can create a user login from this link.

https://www.mytaxexpress.com/support/login.php

Preference window

Author: contact mytaxexpress

Last update: 2022-09-07 22:49

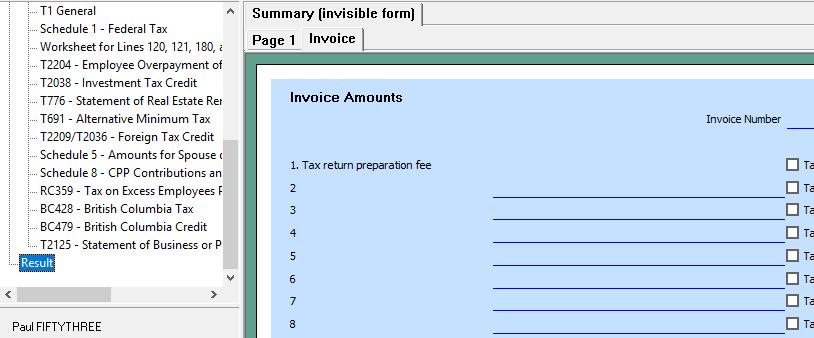

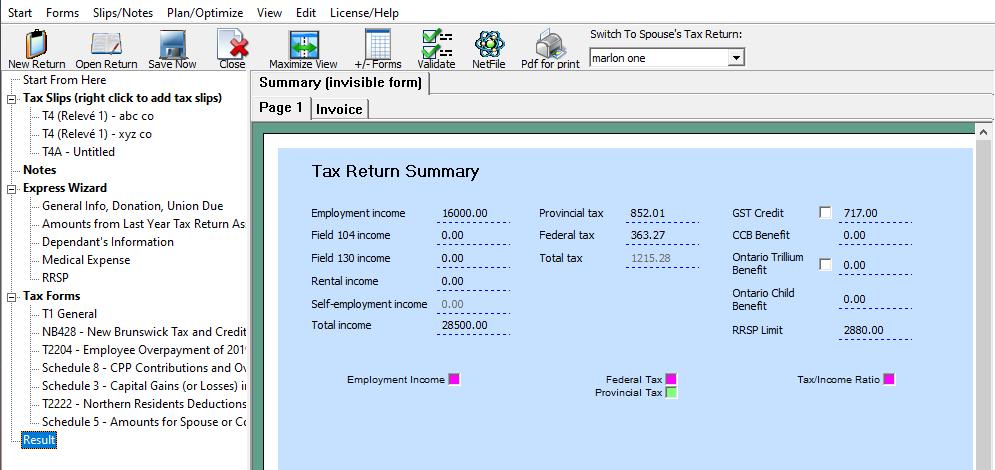

How to setup an invoice for a tax return?

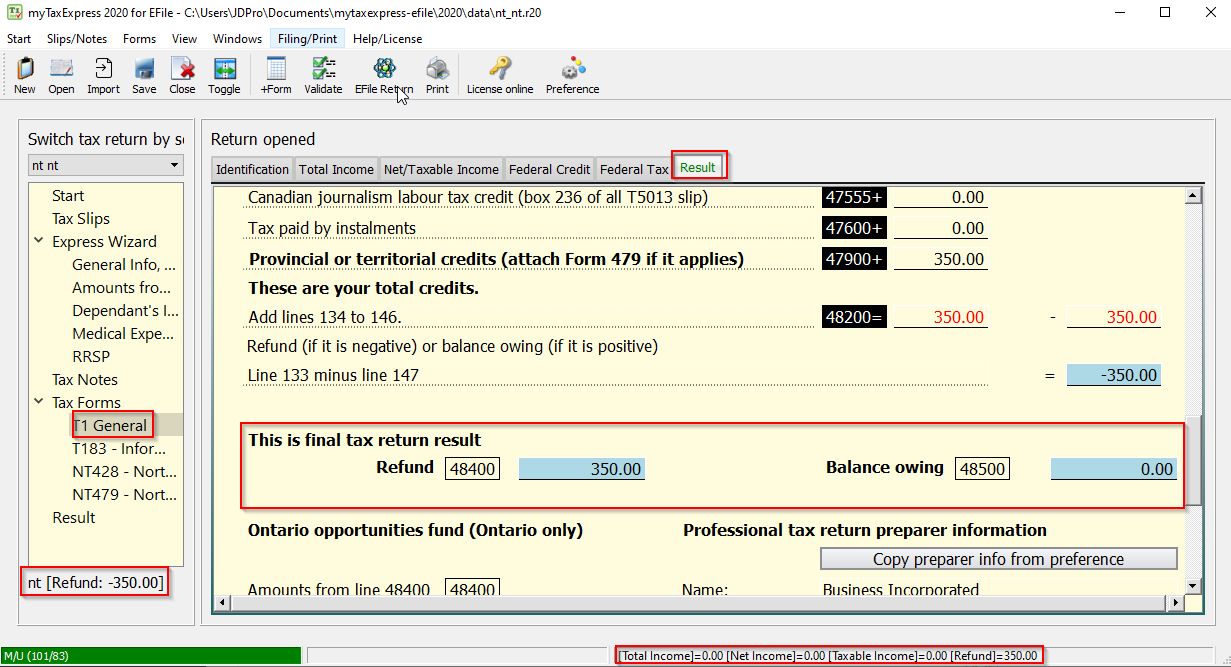

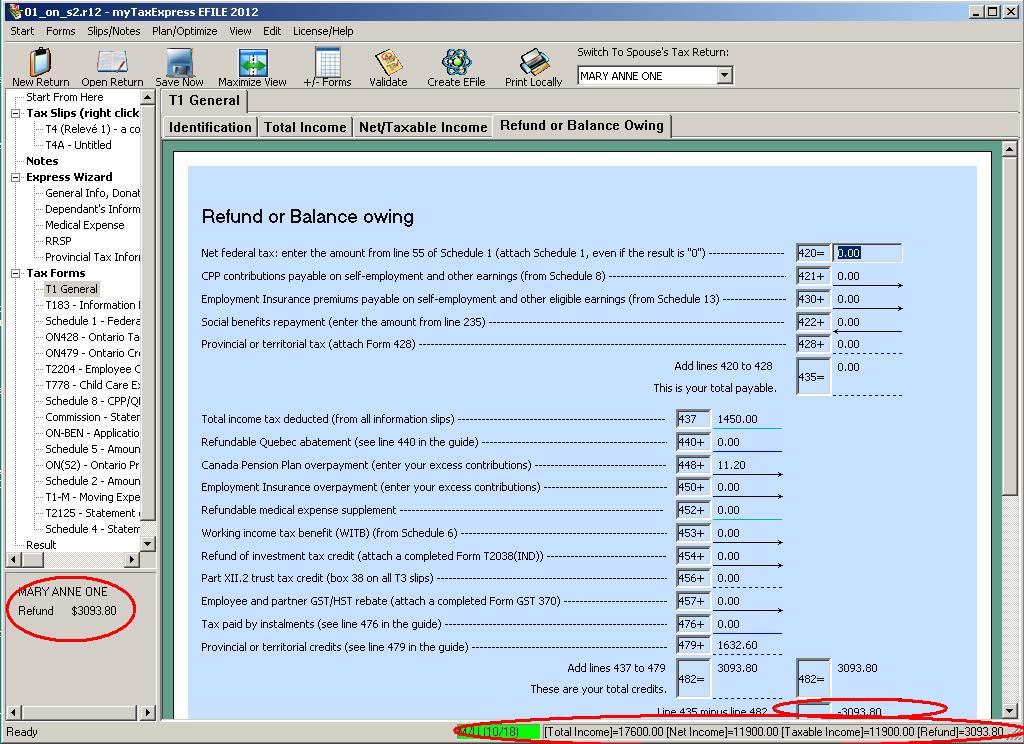

Select "Result" from left pane after you open a tax return, you will see tax summary page and an invoice page. You can enter the invoice information, it can be printed out when genreate tax return print files.

Author: contact mytaxexpress

Last update: 2022-09-07 22:48

How do you use the new compare feature (year on year)? Does it compare line by line? Or better input by input line within mytaxexpress and not just the resulting return (its often difficult to relate the input to the results in the final return), thanks

Author: Peter

Last update: 2019-03-10 20:34

How do I claim CCB? CCB was tax free shouldn't be in any T slip. When I report it I found it was not tax free at this software. UCCB was not applied since 2016 why it was still at my 2018 taxexpress program?

Author: jack

Last update: 2019-03-17 20:46

How to calculate medical travel expenses?

Many of the expenses that you may incur to travel for medical treatment, or expenses that you incur on behalf of your spouse or dependants are tax deductible. Eligible expenses include transportation costs, meals, and accommodation for both the patient and an attendant if required.

To claim transportation and travel expenses with the CRA, the following conditions must be met:

- There were no equivalent medical services near your home

- You took a direct route

- It was reasonable for you, under the circumstances, to travel to the place you did for those medical services.

If you travelled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. bus, train, or taxi fare). If public transportation isn’t available, you may be able to claim vehicle expenses.

If you travelled more than 80 km, you can claim vehicle expenses, accommodation, meals and parking expenses.

Read this CRA link about how to calculate the travel related expenses. The related mileage cost is tabled for each province.

Author: contact mytaxexpress

Last update: 2019-03-26 15:12

How to find 3 letters country code for form T106/T1134/T1135 etc?

read this link from CRA

Author: contact mytaxexpress

Last update: 2019-07-20 21:53

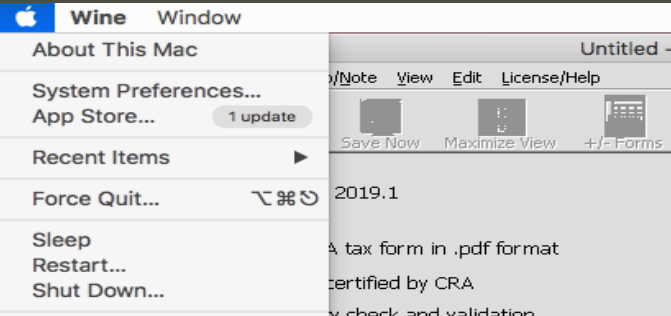

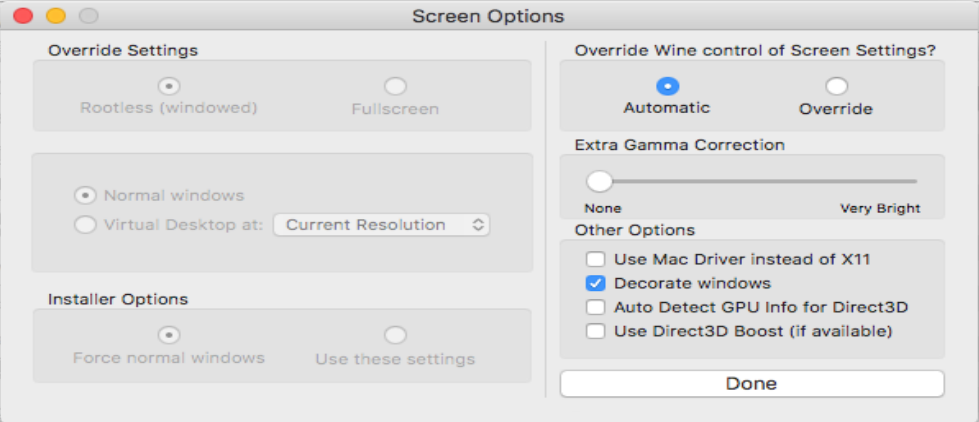

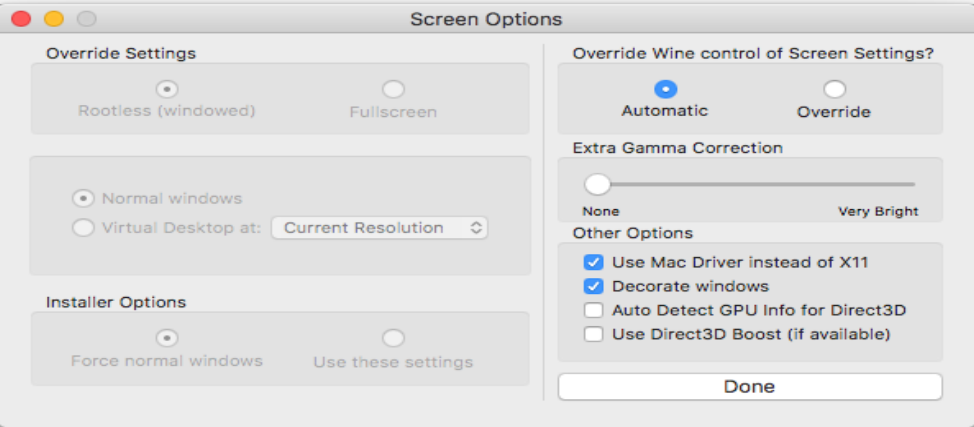

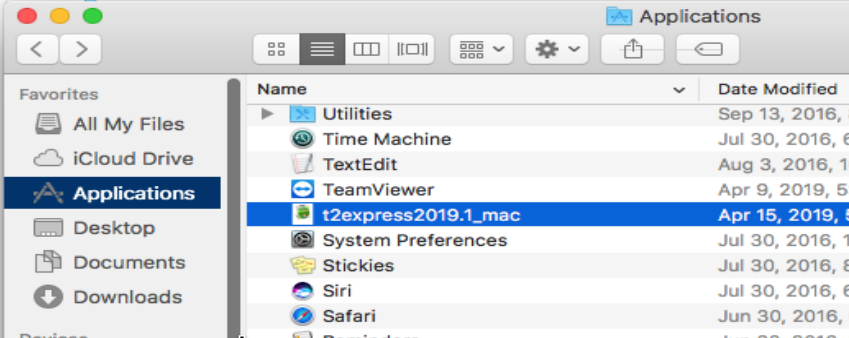

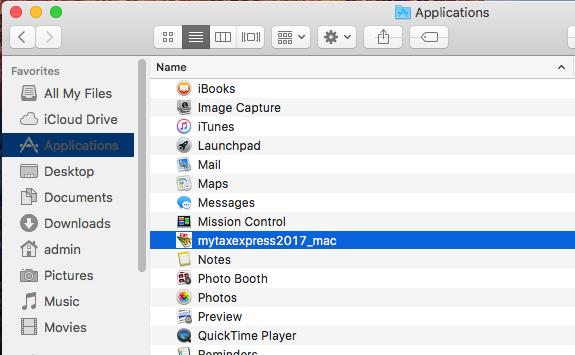

How to change myTaxExpress/T2Express display option in Mac OS?

Sometimes, you need to adjust myTaxExpress/T2Express display option in Mac OS. Please follow these steps:

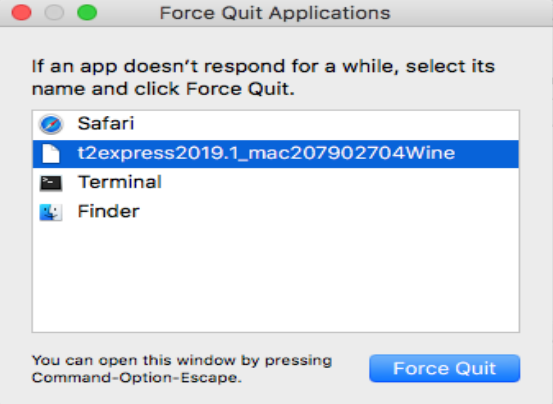

1. First, close myTaxExpress or T2Express; or use Force Quit to close myTaxExpress/T2Express

Select myTaxExpress/T2Express, then choose "Force Quit" button

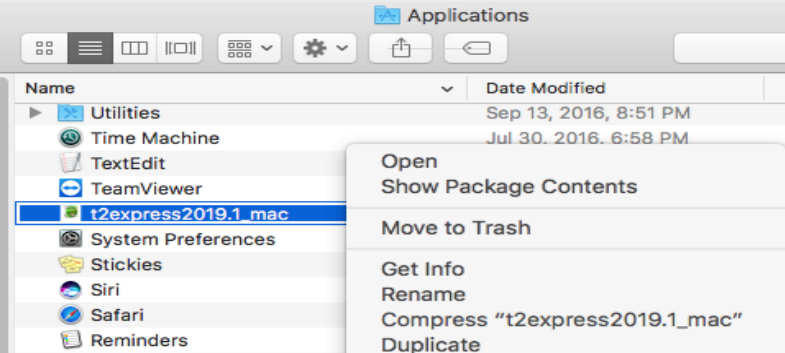

2. Locate myTaxExpress or T2Express in the Applications folder, then right click the mouse

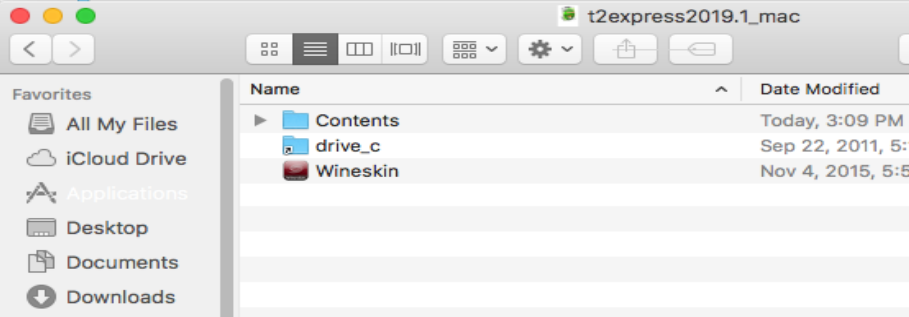

3. Choose menu "Show Package Contents", then double click "Wineskin" to run it.

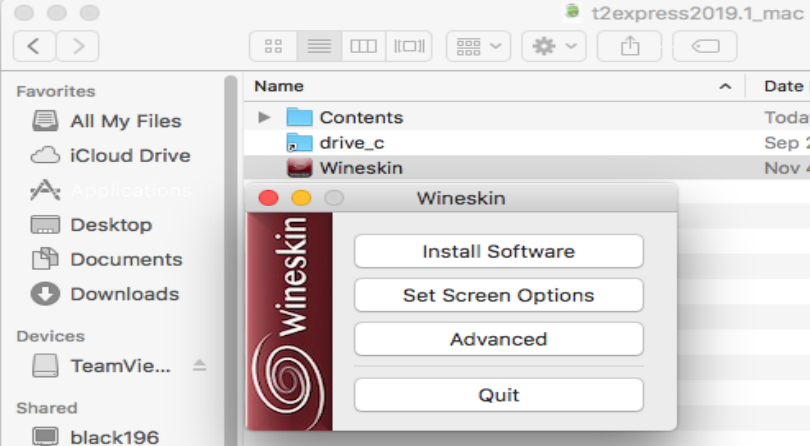

4. Choose "Set Screen Options"

5. You can toggle "User Mac Driver instead of X11" option, one of them will work better for your computer.

6. Click the "Done" button to close the option dialog. Then click the top left "<" icon to go back to the Applications folder to run myTaxExpress/T2Express again.

Author: contact mytaxexpress

Last update: 2022-09-07 22:46

I've downloaded and installed T2Express. I can open the program, but all I have showing when I click new return, is a title bar. When I click preferences, I only see a title bar with a close button. Aside from the 32 bit failing, does it not run on OS X Mojave?

Author: Louis Hornung

Last update: 2019-09-17 20:53

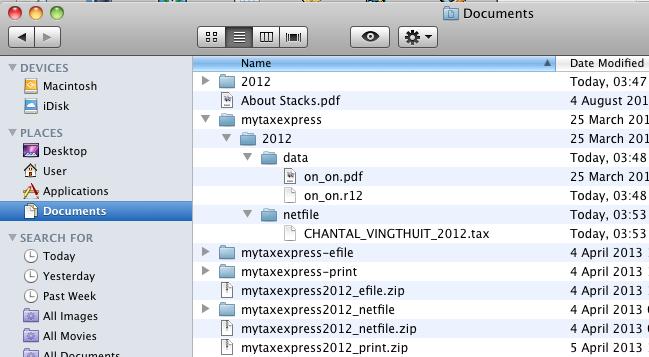

How to run myTaxExpress/T2Express on the latest MacOS Catalina?

We made new software versions for MacOS Catalina and future versions. You will see two MacOS download of myTaxExpress or T2Express on our website. The new software can run smoothly on latest Catalina. The old version will phase out in the years.

To run the new MacOS version software, you need to do the following:

- Download the pkg file from website

- Keep Ctrl key pressed, right click the pkg file and choose open to run the pkg file. It will set up software under MacOS's Applications folder.

- Go to Applications folder to run the new software.

- Please allow new myTaxExpress/T2Express to access the Documents folder, since it creates data return and pdf files there.

Author: contact mytaxexpress

Last update: 2020-11-25 16:35

How to add myTaxExpress/T2Express into allowed programs of anti-virus software?

Anti-virus software are popularly used nowadays. Although it is actively protecting personal computer, however, the way it is using usually just blocks software running or generating result files, like mytaxexpress generating printable return (pdf) file.

In this case, you need to add myTaxExpress and T2Express software into allowed program by anti-virus software. Different anti-virus software have different ways to allow a program, or it is called adding an exception. You can research your software manual for detail instruction. Here are some what we found:

If you enable Windows 10 controlled folder access, read this link to allow specific app:

https://www.windowscentral.com/how-enable-controlled-folder-access-windows-10-fall-creators-update

For Norton software, you need allow mytaxexpress data access and Internet. Read these two links:

https://www.lifewire.com/exclude-files-from-norton-antivirus-scans-153348

https://support.norton.com/sp/en/us/home/current/solutions/v6958602

https://support.norton.com/sp/en/us/home/current/solutions/v80629965

For McAfee, please add mytaxexpress into trusted exclusion list like this link:

so it won't block software running. read this link

https://www.techwalla.com/articles/how-do-i-add-a-trusted-application-in-mcafee

For AVG, you can allow mytaxexpress to run, read this link

https://smallbusiness.chron.com/set-program-trusted-avg-76320.html

For Avast, you can allow a program like this

https://smallbusiness.chron.com/install-program-avast-blocks-80037.html

For Panda security, you can set Panda to choose Ask me when a unknown program attempts to run and add mytaxexpress into allowed program like this link

https://www.pandasecurity.com/en/support/card?id=82012

For MalwareBytes, you need to add both our website and mytaxexpress program to its exclusion list, like this

https://support.malwarebytes.com/hc/en-us/articles/360039024133-Exclude-detections-in-Malwarebytes-for-Windows-v3

Author: contact mytaxexpress

Last update: 2022-02-14 20:28

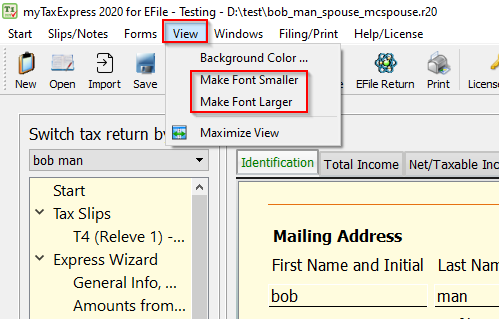

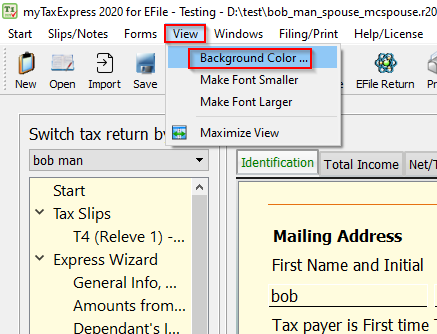

How to change font size and background colour

You can change the font size of the text in myTaxExpress by clicking on the View menu at the top of the program window. Then select the "Make Font Smaller" or "Make Font Larger" option. After doing so, close myTaxExpress and then relaunch myTaxExpress. The font size will be changed depending on which option you selected previously.

To change the background color, go to the View menu again and select "Background Colour". You will be prompted to select a new background color.

Author: contact mytaxexpress

Last update: 2022-04-16 17:49

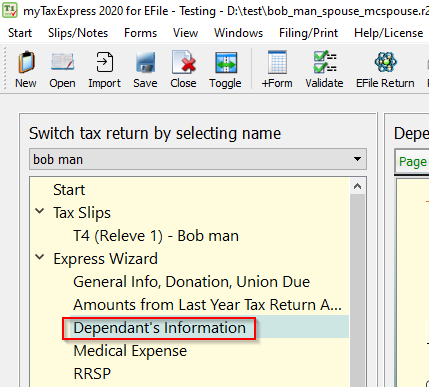

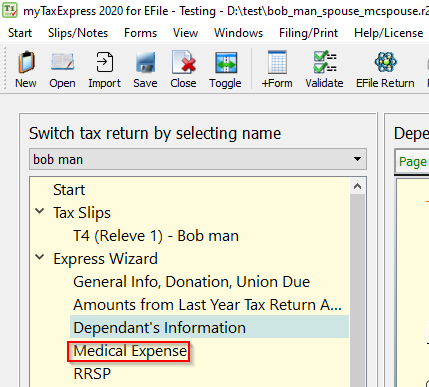

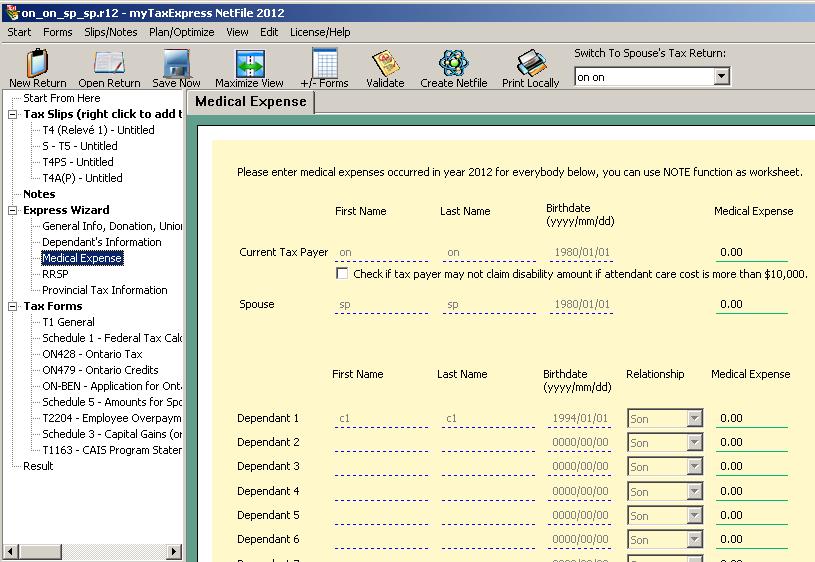

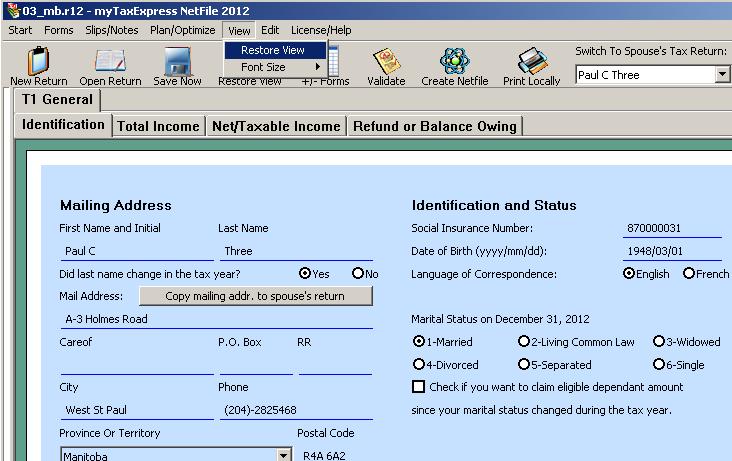

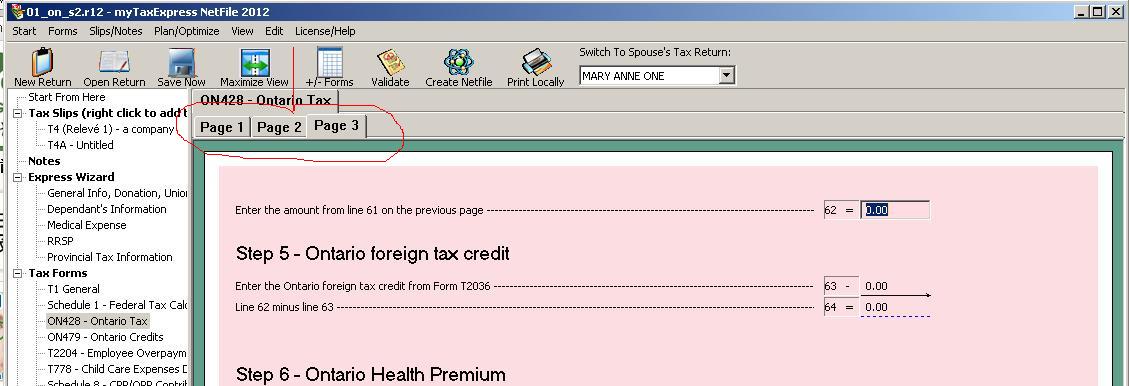

Where to find dependant's information and medical expense.

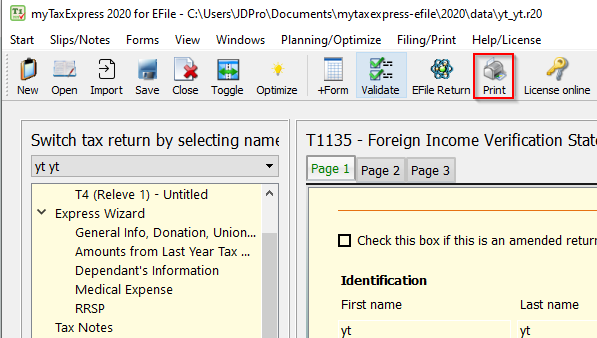

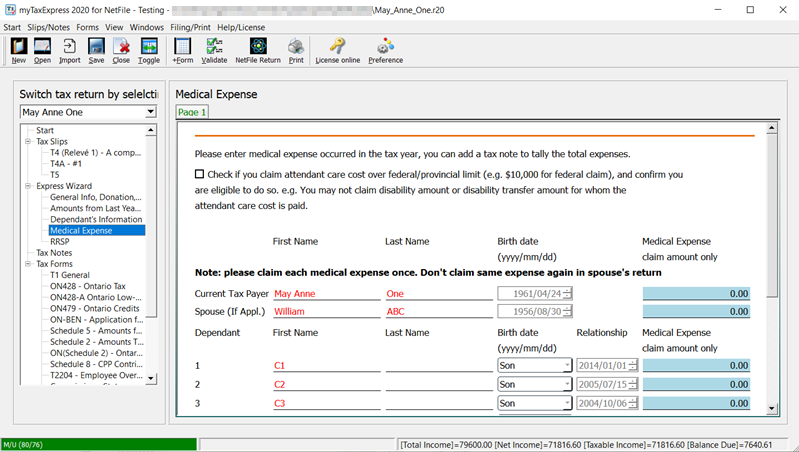

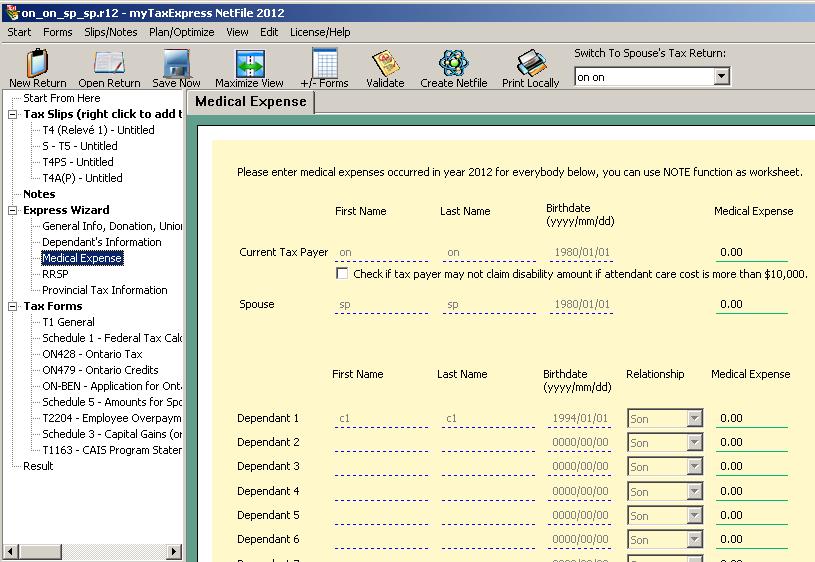

Dependant's information is located on the left pane in myTaxExpress. You can find it under Express Wizard as shown in the picture.

Similarly, medical expense is also located in the left pane under Express Wizard.

Author: contact mytaxexpress

Last update: 2022-09-07 22:44

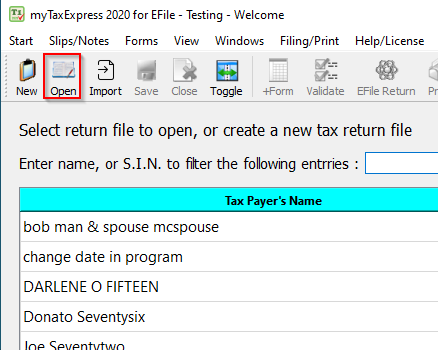

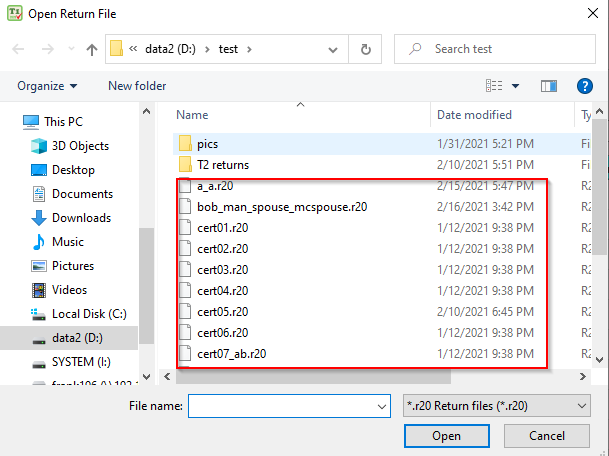

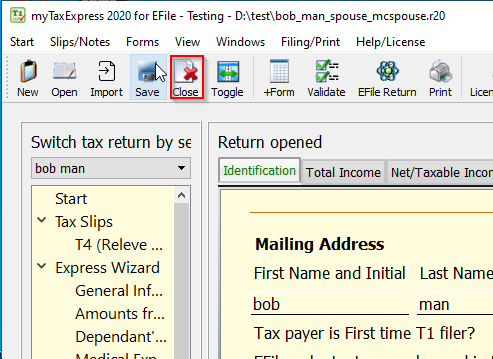

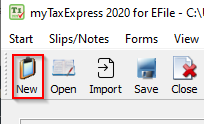

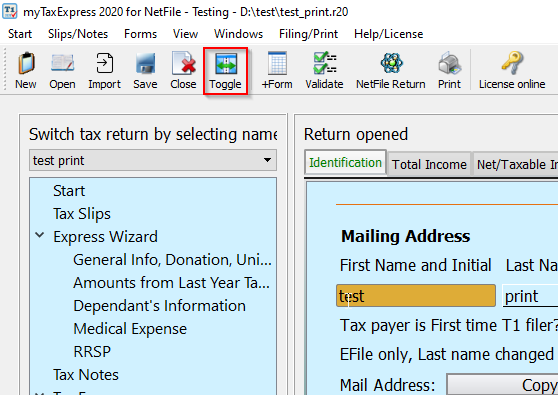

How to open and close tax returns in myTaxExpress.

To open returns in myTaxExpress, select "Open" from the top menu of the software window. A navigation window will pop up. Search for your tax return and double click it to open it.

To cloes a return, select "Close" from the top of the software window.

Author: contact mytaxexpress

Last update: 2022-09-07 22:44

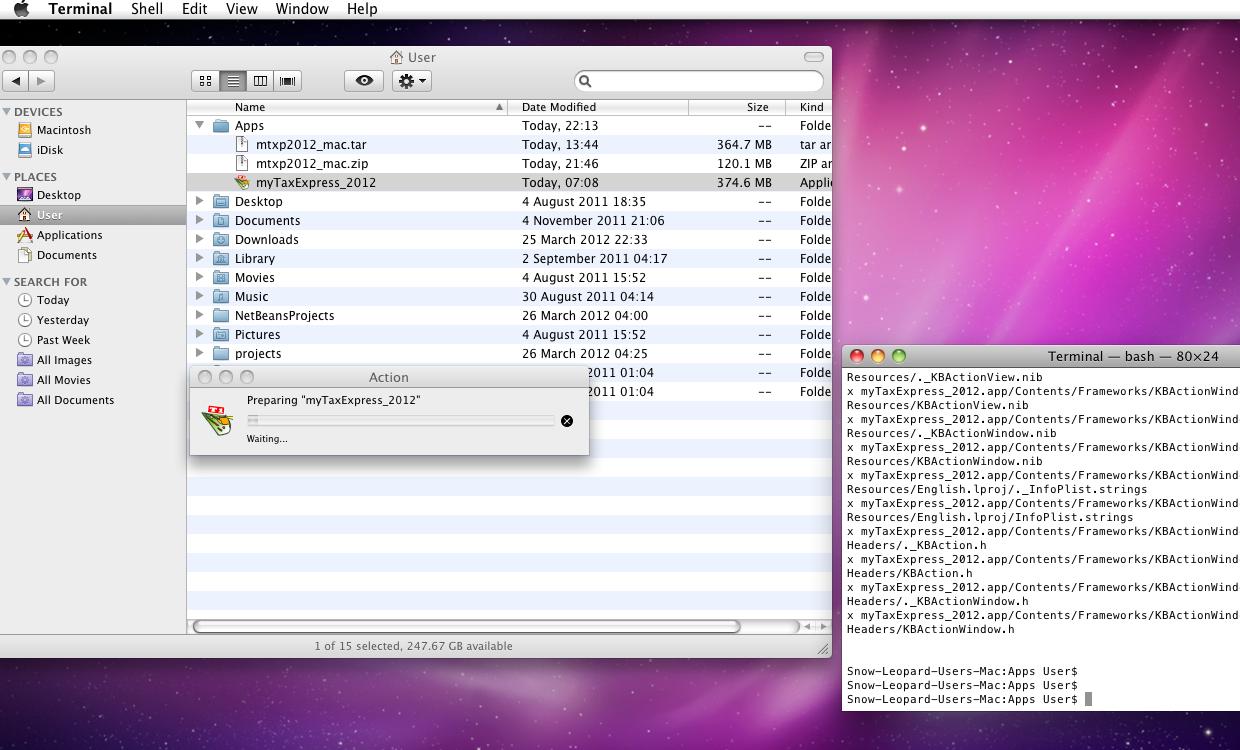

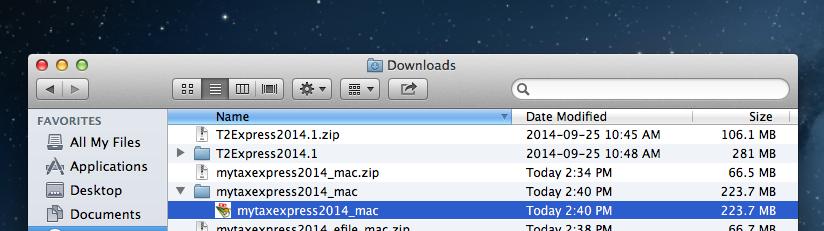

How to install mytaxexpress 2020 on MacOS computer?

Here is a video of installing mytaxexpress 2020 on MacOS. It shows the process of these steps. After install you should see a new application icon inside Applications folder.

1) download mytaxexpress .pkg file

2) run .pkg file (you may need to right click CTRL key when you open/run this .pkg file)

3) After running .pkg file, you will find mytaxexpress installed inside Applications folder

4) Go to Applications folder, you can run mytaxexpress

5) Please give Write/Read access to Documents folder to mytaxexpress.

Video Link: https://www.youtube.com/watch?v=lW7WWaX8WTU

Author: contact mytaxexpress

Last update: 2021-03-10 17:04

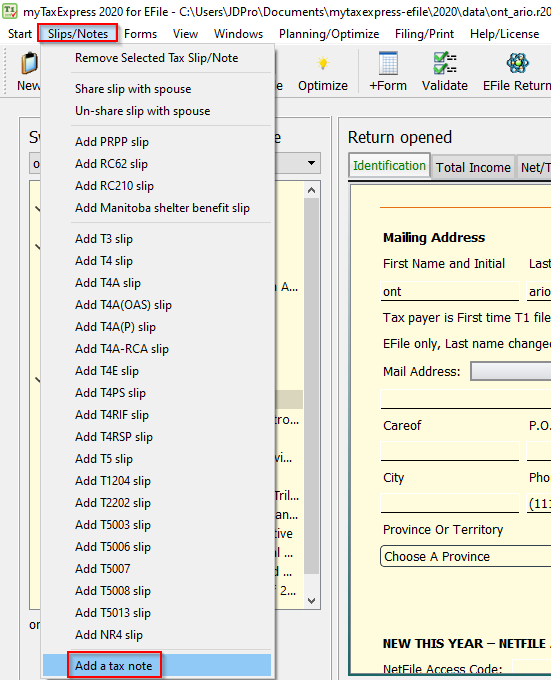

How to Add Tax Notes

To add tax notes in myTaxExpress, go to Slips/Notes at the top of the program window. Next select, "Add a tax note" from the menu.

Author: contact mytaxexpress

Last update: 2022-09-07 22:43

How to run software AppImage file on Linux?

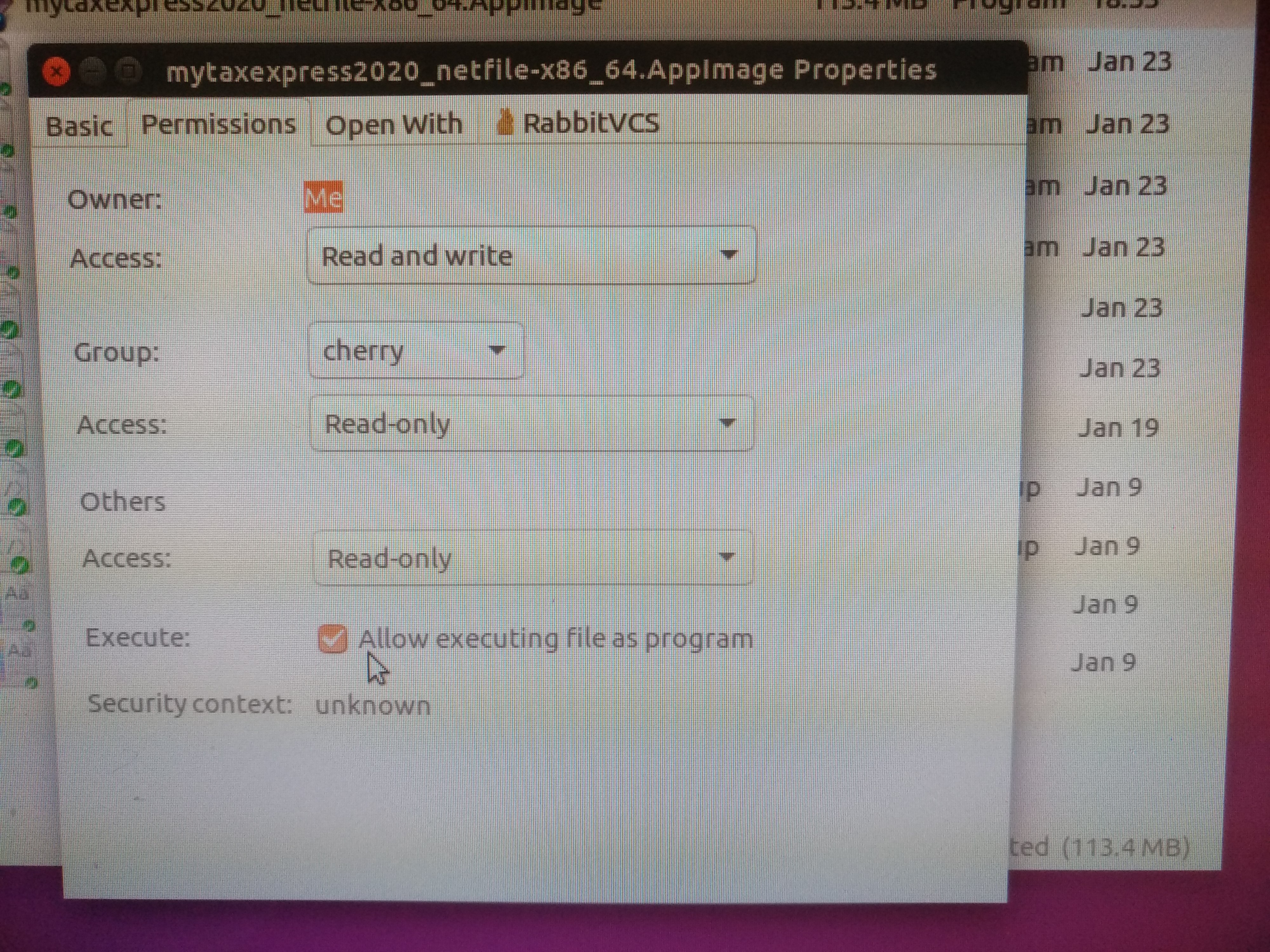

Step 1: Make the AppImage file executable

Open up the folder that contains the AppImage file you've downloaded in a file browser, right-click on the AppImage file with your mouse, select Properties, and go to the Permissions tab. Make sure you select the box "Allow executing file as program". Close the Properties window. Please see the following screenshot as reference. (Note: Your screen may vary depending on which linux version and file browser you use).

Step 2: Run the AppImage file

Once you've set executable permissions for the AppImage file, you can run the software in one of two ways:

- In a file browser, double-click the AppImage file to run, or right-click on the file and select the Run option.

- On a command line, type the name of the AppImage file preceded by the characters ./, then hit the Enter key to execute the command. For example:

./mytaxexpress2022_netfile-ssl11-x86_64.AppImage

If you encountered difficulty, please run the AppImage from command line, it will show detail error message.

./mytaxexpress2023_netfile-ssl11-x86_64.AppImage

dlopen(): error loading libfuse.so.2

-----------------------------------------------------------------------------------------------------

AppImages require FUSE to run.

You might still be able to extract the contents of this AppImage

if you run it with the --appimage-extract option.

See https://github.com/AppImage/AppImageKit/wiki/FUSE

for more information

If the error message is the like the following:

cannot load Qt platform plugin "xcb", please run the following command first:

>sudo apt install libxcb-xinerama0

Author: contact mytaxexpress

Last update: 2024-02-26 13:01

What are T2Express data files?

There are 3 type of files used in T2Express. They are all related to corporate tax returns, but for different purposes.

- The most important are .txx files, the tax return file opened/saved by T2Express. From .txx file, you can create the other 2 type of files. The xx represents the version the return file is made for; e.g. .t20 is from T2Express 2020, .t19 is from 2019.

Tax return files are by default located under user's document folder, e.g.

\\Documents\t2express\2019.2\data

\\Documents\t2express\2020.1\data

\\Documents\t2express\2020.2\data

... - .cor file, is the Internet file for online filing. .cor file only has a subset of information you entered into T2Express.

- .pdf file, is the printable tax return file. .pdf file is opened by adobe acrobat reader or foxit reader. You can choose to print some or all pages from the .pdf files. PDF files are generated from the return files (*.txx).

Author: contact mytaxexpress

Last update: 2021-07-27 01:56

How to fix SSL/TLS error message

If you are on Windows and the erorr message: "This system does not support SSL/TLS, please email OS version to support" appears

Please download this .dll file and save it into software's bin/ folder. Close and restart software,

it might solve the network problem.

As an example the bin/ folder location for the 2021 version of myTaxExpress Netfile folder is

c:\mytaxexpress\2021_x32\bin

For myTaxExpress 2021 Efile, the folder is

C:\mytaxexpress-efile\2021_x32\bin

Author:

Last update: 2023-02-23 14:03

How to install openssl 1.1 on Ubuntu 22.04 (and its like)?

myTaxExpress and T2Express linux versions are using openssl 1.1 and 1.0.

In latest version of Ubuntu 22.04 and its like, the default openssl version is 3.0. To make myTaxExpress and T2Express software works with Internet, you can download a suitable openssl 1.1 package and install on Ubuntu 22.02 and its like.

Details are like the follow:

- You can download openssl 1.1 from these two links, choose one:

1) https://packages.ubuntu.com/focal-updates/libssl1.1

or

2) https://www.mytaxexpress.com/download/libssl1.1_1.1.1f-1ubuntu2.17_amd64.deb

- run this command to install the package into system

>sudo dpkg -i libssl1.1_1.1.1f-1ubuntu2.17_amd64.deb

Author:

Last update: 2023-03-23 23:29

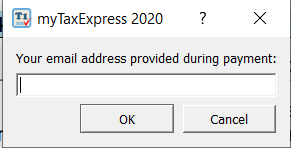

How to solve error code 99 during online license key process?

Author:

Last update: 2023-03-25 13:57

what is efile error 184, with error clue 139926?

Error code: (139926)

Error Message:

The last four digits identify the line number from the statement that is in error. A financial statement is one or more of Form T776, Form T777, Form T777S, Form T1163, Form T1273, Form T2042, Form T2091, Form T2121, Form T2125 and/or Form TL2.

The "3" before the line number identifies that the entry on this line cannot be negative. The first digit (or first 2 digits if you submitted 10 or more statements and the error is in the 10th, 11th or 12th statement) of the message number identifies the sequence of the financial statement in which the error was detected.

Author:

Last update: 2023-04-07 12:39

Recaptured Capital Cost Allowance (Field 9947) on T776

A recapture of capital cost allowance (CCA) can occur when the proceeds from the sale of depreciable rental property are more than the total of both: the undepreciated capital cost (UCC) of the class at the start of the year and any additions to this class made during the year.

Field 9947 (Recaptured capital cost allowance) on T776 is calculated by the software, so you need to complete Area A of Form T776 first. If there is a negative number in column 7 (UCC after additions and dispositions), Field 9947 will be populated with an amount based on your percentage of partnership.

Author:

Last update: 2023-04-20 08:54

How to select/clear Indian Act - Exempt Income option?

Author:

Last update: 2023-04-19 09:25

Digital Access Code (DAC) for CRA's e-Documents Service

The Digital Access Code (DAC) is required when using the Canada Revenue Agency’s (CRA) Special Elections and Returns (SER) and Submit e-Documents Service from your account on our docsign.ca website.

You need to enable the "Track returns" feature in the software first in order to use the SERS e-Documents service on the docsign.ca website.

Currently, you can use e-Documents services if you have filed T2 Schedule 89 in FormExpress. We are working on adding to support more schedules.

You can visit the following page to request your Digital Access Code (DAC) when using SERS e-Documents service on our docsign.ca website:

https://www.mytaxexpress.com/phpproj/t2wac/getdac.php

Related FAQs

- Track returns you have filed on the docsign.ca website

- Set up docsign.ca preference in myTaxExpress/T2Express

- How to purchase points on docsign.ca?

Author:

Last update: 2023-10-27 17:41

CRA SERs Submit e-Documents Service is supported

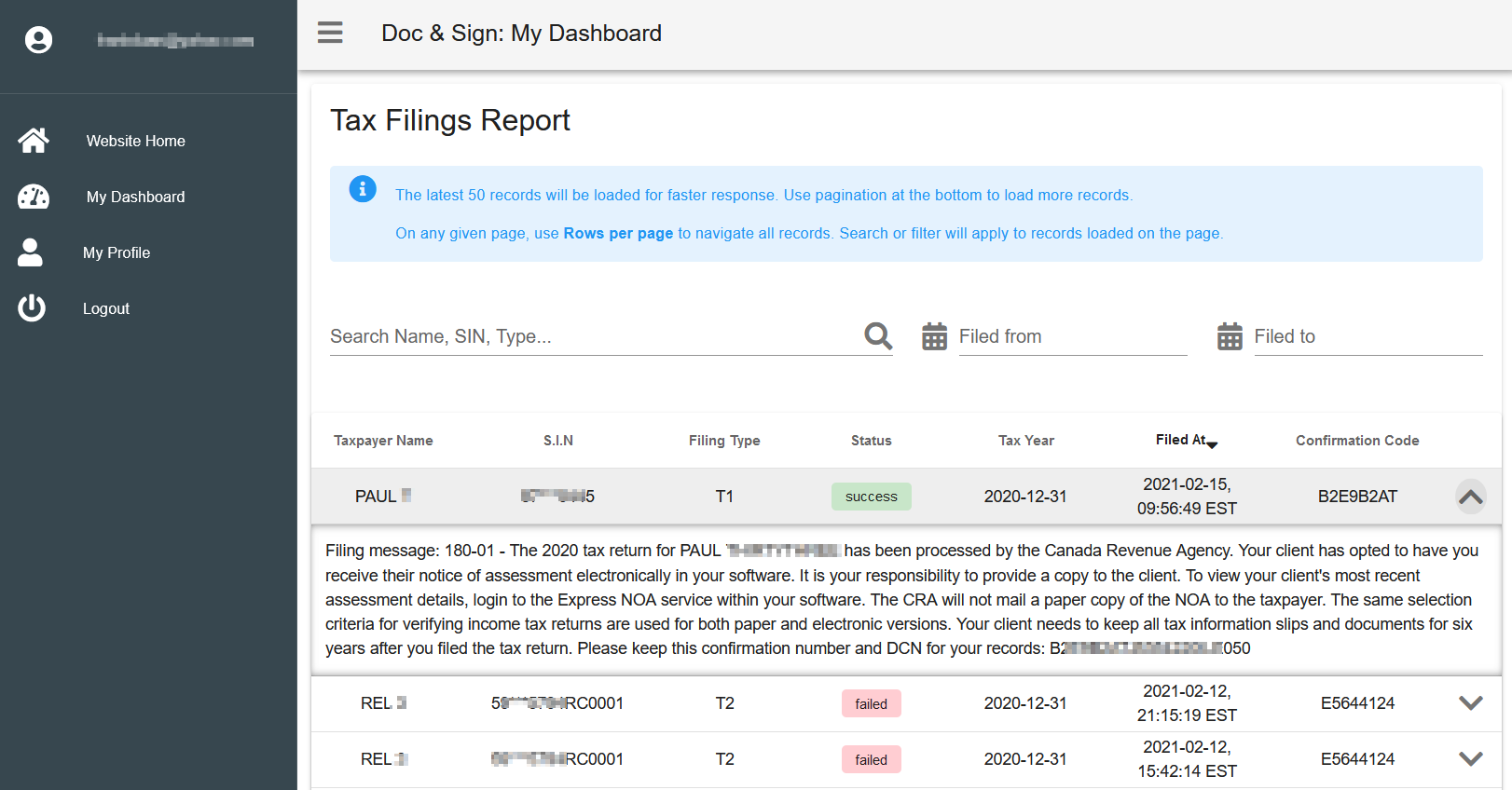

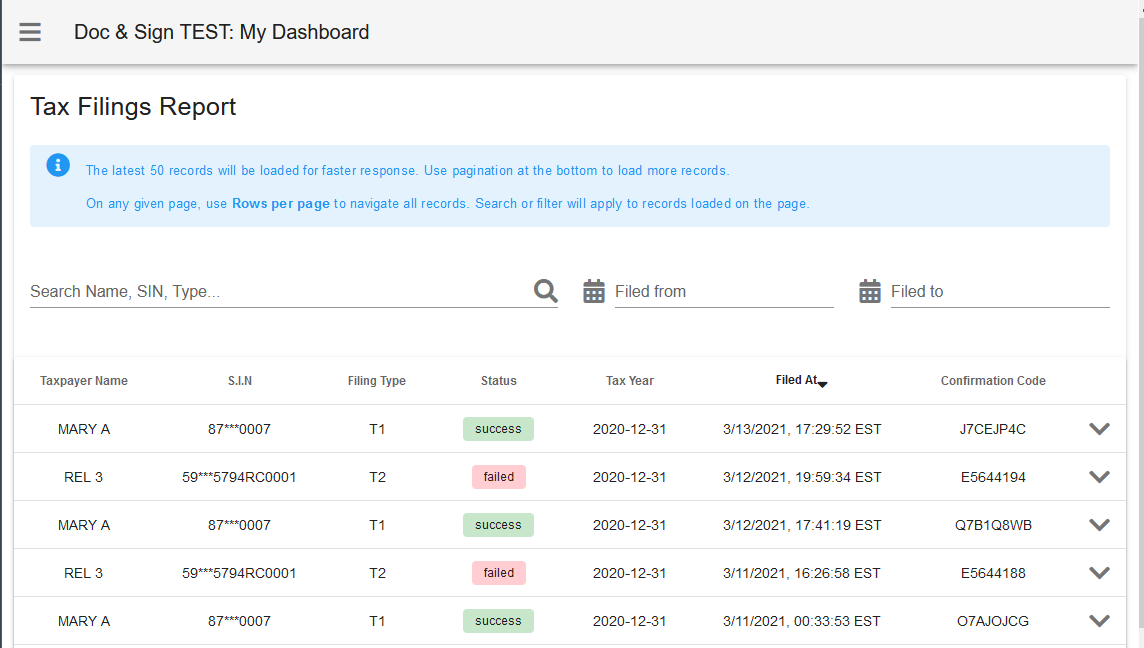

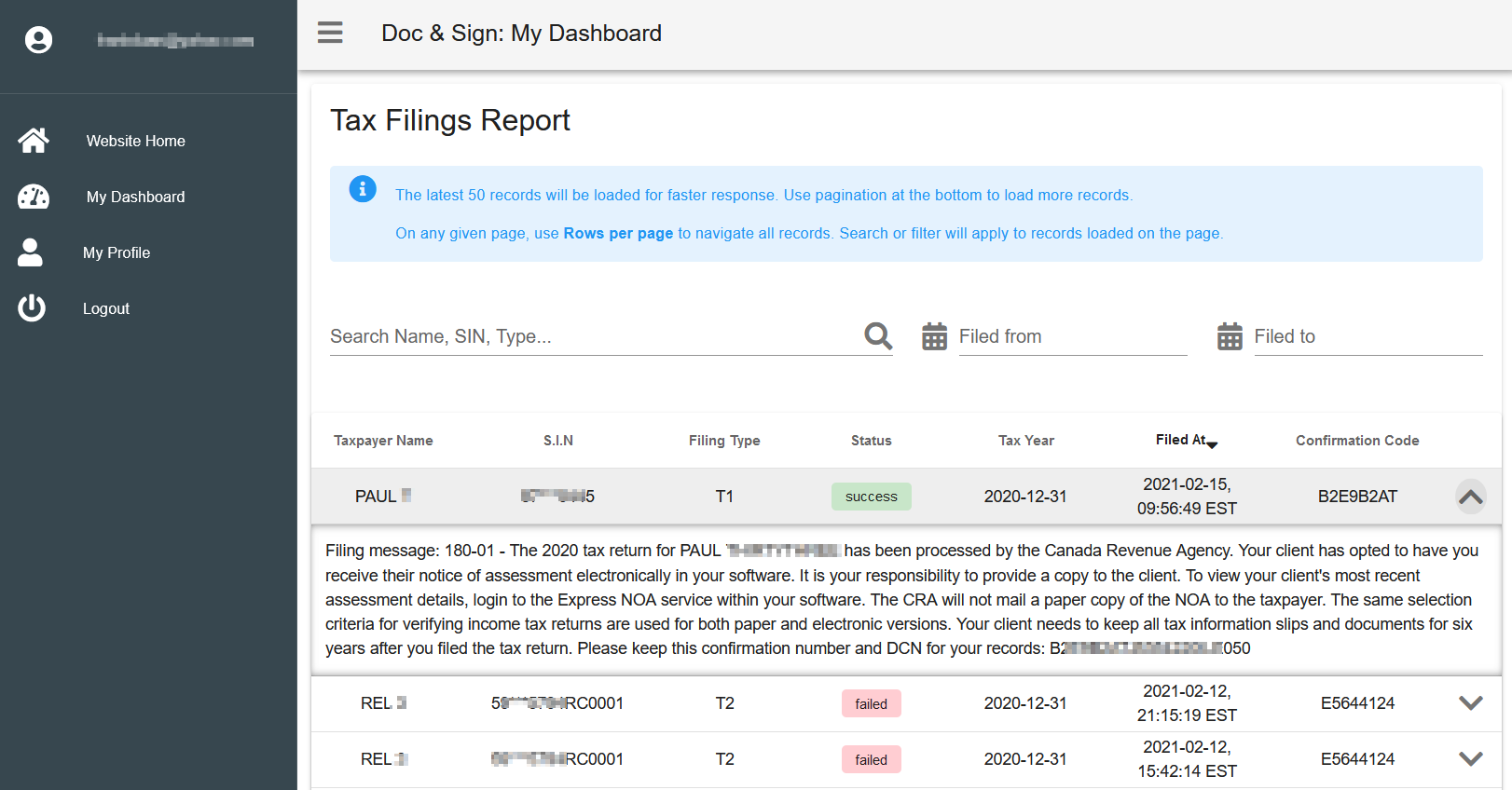

For FormExpress customers, we offer CRA Special Elections and Returns (SER) and Submit e-Documents Service through Tax Filings Report on your docsign.ca account.

Prerequisites

Register a docsign.ca account and set it up in T2Express, if you haven't done so.

You need to enable the "Track returns" feature in the T2Express software first in order to use the attach-a-doc service on the docsign.ca website.

Each submission will charge you 50 points ($5). Please purchase enough points in advance.

Steps to use attach-a-doc service

Currently, you can use e-Documents services if you have filed T2 Schedule 89 in FormExpress. We are working on supporting more schedules.

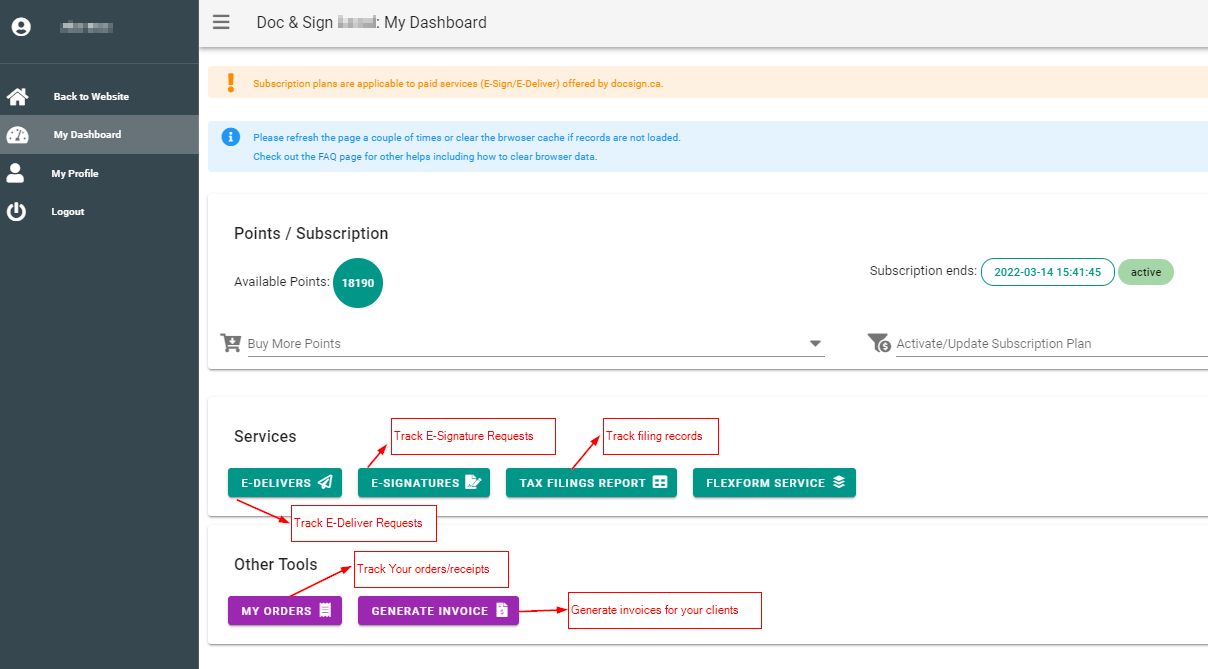

1. Log in to the docsign.ca website and click the Tax Filings Report icon on your dashboard.

2. Locate the filing record. The record should have Filing Type = T2Sch89, and Status = success, with a CRA confirmation number.

3. Click the down arrow at the end of the record to expand the Filing message panel. A SERS e-docs action icon is enabled and displayed. Click the icon to access the service.

4. Click Yes to continue

5. On the new screen, enter the required fields and attach documents. A maximum of 5 documents can be attached for each submission.

6. A success or error message will be displayed based on responses from CRA servers.

Related FAQs

Author:

Last update: 2023-11-20 18:48

How to hard refresh/reload a webpage?

What is a hard refresh/reload a webpage? It's a way to make sure your webpage shows the latest version by clearing its cache, which holds scripts, styles, and features. Here's how to do a hard refresh on various browsers:

Google Chrome:

- For Windows users: Hold Ctrl and press F5.

- For Mac users: Hold Cmd and Shift, then press R.

Firefox:

- For Windows users: Hold Ctrl and press F5.

- For Mac users: Hold Cmd and Shift, then press R.

Safari (Mac):

- Go to Safari > Empty Cache, or press Opt + Cmd + E.

- To refresh, click the refresh button or press Cmd + R.

Internet Explorer/Microsoft Edge (Windows):

- Hold Ctrl and press F5.

Related FAQs

Author:

Last update: 2024-01-24 10:38

How to clear browser cache?

Why do you need to clear your browser cache?

Most of the time, browser caching operates seamlessly in the background without impacting your browsing experience. However, there are instances where clearing the cache becomes essential. For example, after making changes to a website, you may find that your browser continues to display the old version due to caching. Additionally, cache corruption can occasionally disrupt a webpage's proper functionality, making it necessary to clear the cache for a fresh and accurate browsing experience.

Here's a quick guide on how to clear the cache for popular browsers on both Windows and MacOS:

Google Chrome:

- Windows: Press Ctrl + Shift + Del, select "Cached images and files," and click "Clear data."

- MacOS: Press Cmd + Shift + Del, select "Cached images and files," and click "Clear data."

Firefox:

- Windows: Press Ctrl + Shift + Del, select "Cache," and click "Clear Now."

- MacOS: Press Cmd + Shift + Del, select "Cache," and click "Clear Data."

Safari (Mac):

- Go to Safari > Preferences > Privacy.

- Click "Manage Website Data," select "Remove All," and confirm.

Internet Explorer:

- Windows: Press Ctrl + Shift + Del, select "Temporary Internet files," and click "Delete."

Microsoft Edge:

- Windows: Press Ctrl + Shift + Del, select "Cached data and files," and click "Clear."

Related FAQs

How to hard refresh/reload a webpage?

Author:

Last update: 2024-01-24 10:40

Control access to files and folders on Mac

Some apps and websites can access files and folders in your Desktop, Downloads, and Documents folders. You can decide which apps and websites are allowed to access files and folders in specific locations.

-

Choose Apple menu

in the sidebar. (You may need to scroll down.)

in the sidebar. (You may need to scroll down.) - Click Files and Folders on the right.

-

For each app in the list, turn the ability to access files and folders in specific locations on or off.

For more information, check Apple support website

https://support.apple.com/en-ca/guide/mac-help/mchld5a35146/mac

Author:

Last update: 2024-03-04 10:46

How to customize client letters?

We are excited to offer a new client letter customization service that is both flexible and in high demand. With this service, you can customize your client letters with the exact wording and format you prefer. There is a one-time setup fee to customize a client letter in supported software, but you can continue to use the customized letter in future versions of the software. The average cost is approximately 400 points, which is equivalent to $40 plus tax.

Currently, the service is available for myTaxExpress 2023 and later versions, and will soon be available for T2Express and T3Express.

To request the customization service, follow these simple steps:

Step 1: Email us at contact@mytaxexpress.com and let us know you want to customize a client letter.

Include the following information:

- Software name (e.g., myTaxExpress)

- Software version (e.g., 2023)

- Attach a sample client letter that you would like us to follow. This can be a PDF or Word document, but make sure it includes the wording and format you prefer. You can replace client details with fake information if necessary.

After receiving your email, we will create a service ticket and may follow up with additional questions and confirm the setup cost based on your request.

Step 2: Prepare your docsign.ca account and points

The service is paid through our points system, which is backed by our docsign.ca website. If you haven't used docsign.ca services before, please register for a free account first and purchase enough points to cover the cost of the customization, as confirmed in Step 1.

Step 3: Complete your Preference setup in the software

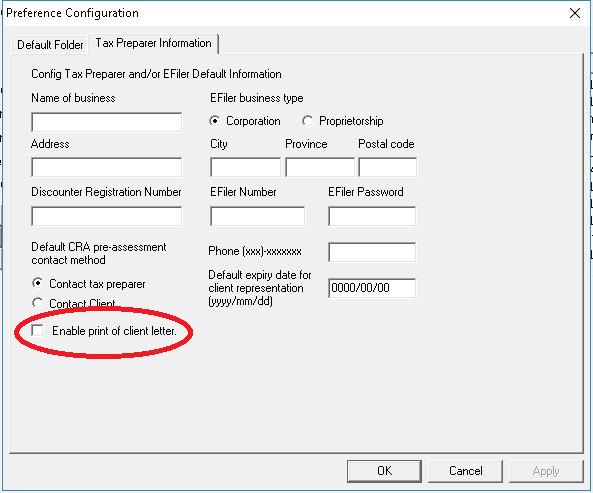

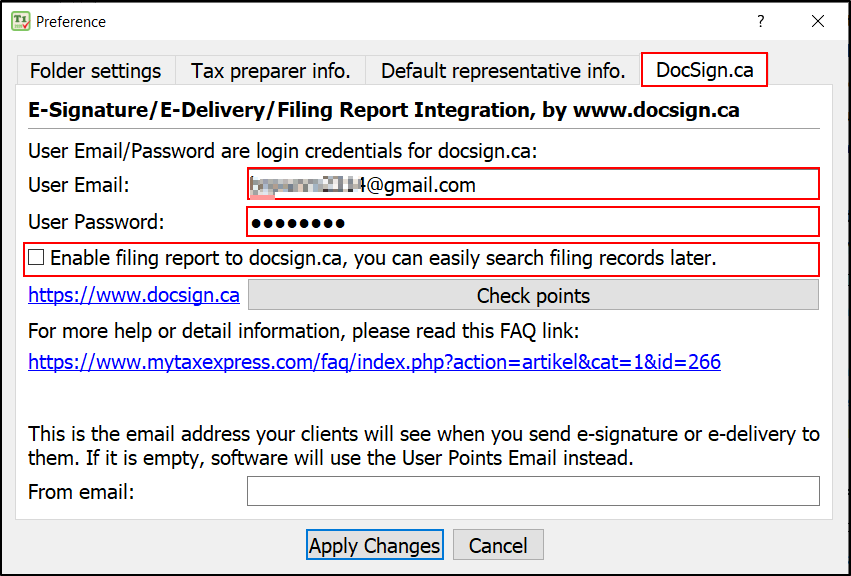

Once the customization is complete, we will notify you through the service ticket. Please complete your Preference settings in the software (accessing by the menu Start | Preference or the Preference icon).

- Enter your email and password you've registered with the docsign.ca website

- Select the option: "Use registered and customized client letter."

- Click the "Apply Changes" button to save all information.

For more detailed instructions about setting up docsign.ca in the software, please read this FAQ.

You are now ready to use your customized client letter in software.

Step 4: Print the client letter

After completing Step 3, your customized client letter will be used when you print a client letter. Simply click the Generate Print icon and then select the "Print client letter" option on the Print options dialog.

Related FAQs

- What is docsign.ca?

- How to purchase points on docsign.ca?

- Set up docsign.ca preference in myTaxExpress/T2Express

- How to access the My Account (Dashboard) page on docsign.ca?

- Track returns you have filed on the docsign.ca website

Author:

Last update: 2024-03-21 06:08

Common » T2Express

Is T2Express software free?

T2Express software has many versions. Only the versions before V2012.2 are free to create tax return print and Internet .cor file; Beginning from V2012.2, a paid license is required to create print and .cor file.

For detail, please check T2Express software information page.

Author: contact mytaxexpress

Last update: 2013-03-27 16:32

Where to find T2Express software download?

Here is the T2Express versions list:

http://www.mytaxexpress.com/t2index.html

You can try the free versions before v2012.2, it will create tax return print or .cor file without license key;

T2Express v2012.2 and after is also free to try, but require a license to generate tax return print or .cor file.

Author: contact mytaxexpress

Last update: 2013-03-27 19:15

Where to download T2Express software?

Our T2 software information can be found here

http://www.mytaxexpress.com/t2index.html

Author: contact mytaxexpress

Last update: 2013-04-07 18:58

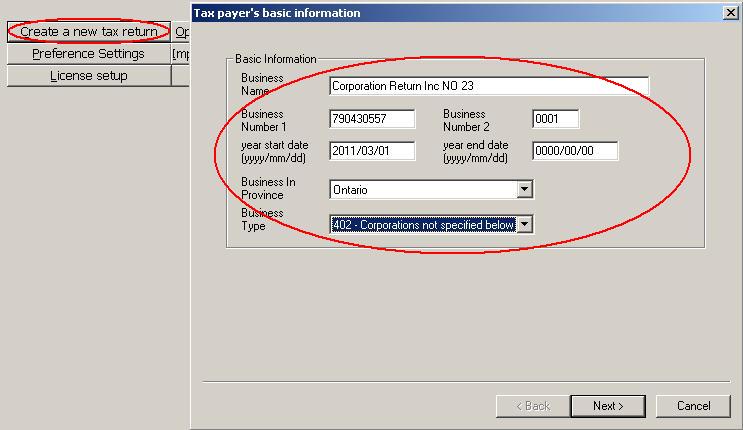

Step 1 - Create a new T2 return

Launch the software first.

Click the New icon at the top, or the New Returns... button at the bottom, of the software, or the menu Start > New Return to open the basic information window, as shown in the following screenshot.

Be sure to double-check the Business number and start/end dates of tax year fields. Those fields are critical information that the software will be used to determine whether the return is the same return or different returns for license usage.

In some older versions, use the Create a new tax return button or the menu Start > Create new tax return instead.

Don't forget to save the return by using the Save icon.

Related FAQs

Author: contact mytaxexpress

Last update: 2023-03-25 15:51

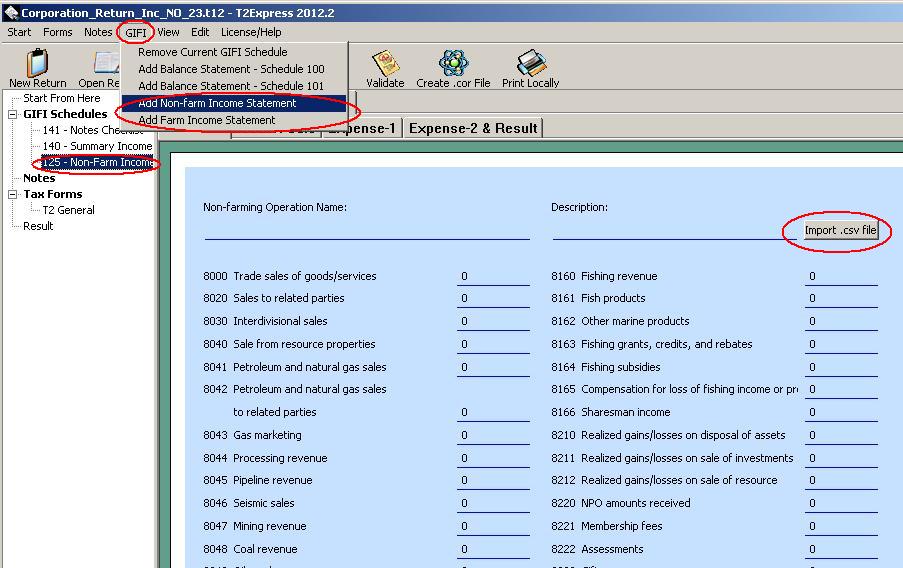

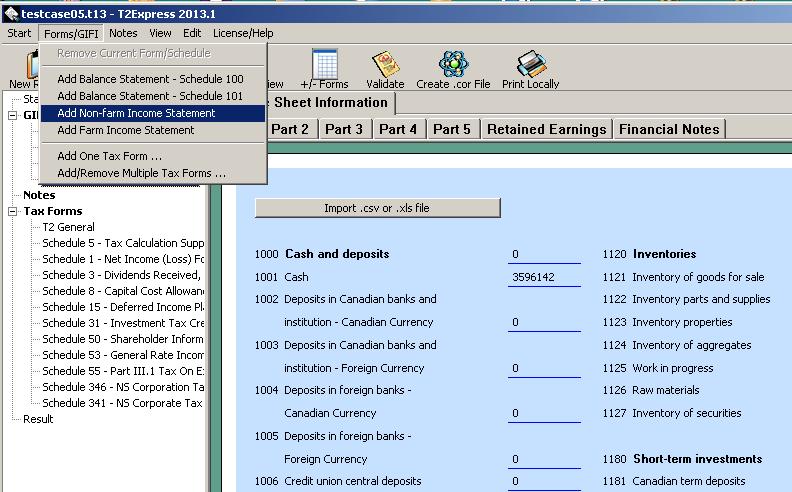

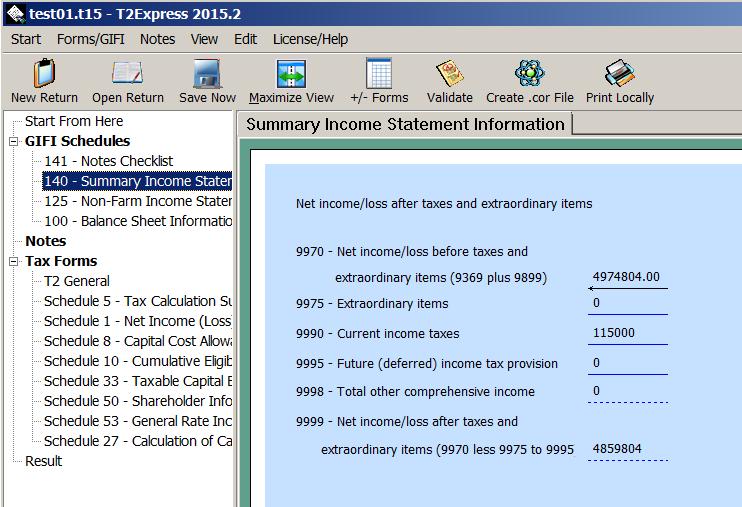

Step 2 - Work on income statement schedule 125

Add a GIFI schedule 125, Non-farm Income Statement, into the tax return to calculate the taxable income of the corporation. For farming income, add Farm Income Statement instead.

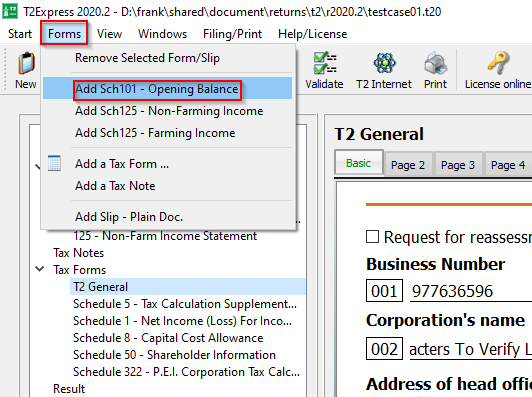

In a newer version of T2Express, Sch125 is added by default. Or you can add it by the menu Forms > Add Sch125..., as shown in the following screenshot.

In T2Express before version 2013.1, schedule 125 is found inside the GIFI menu.

Since T2Express version 2013.1, schedule 125 is moved inside the Forms/GIFI menu.

Related FAQs

Author: contact mytaxexpress

Last update: 2023-03-25 15:52

Step 3 - add balance sheet information GIFI Sch100 ( and Sch101)

At all times, a T2 return must include a tax form GIFI Sch100 (Balance Sheet Information). You can visit the CRA page about the General Index of Financial Information (GIFI).

A Sch101 form is also required when a corporation files its first return after Incorporation or Amalgamation as year start status.

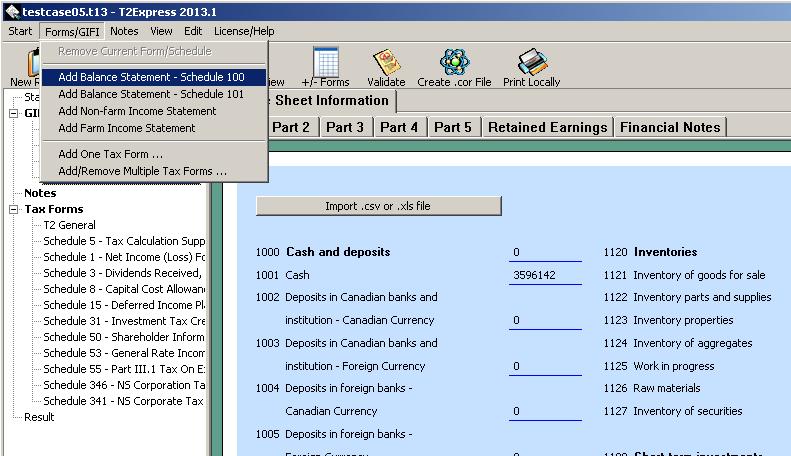

In newer T2Express versions such as 2020.2, schedule 100/101 is found inside the menu Forms.

Screenshot on Windows:

Screenshot on macOS:

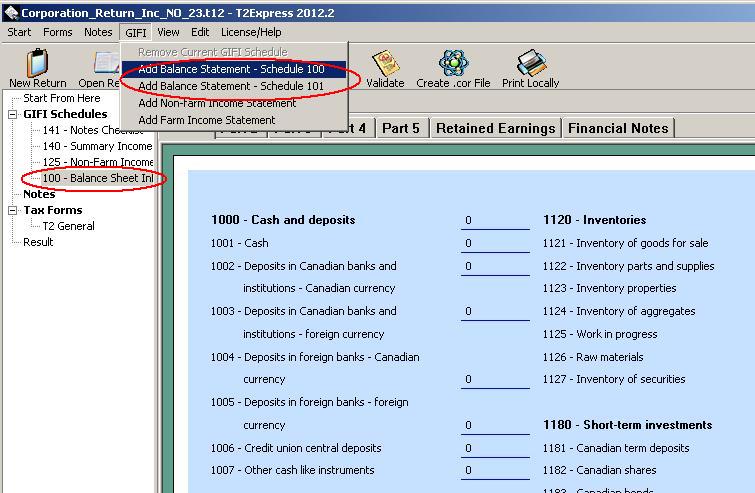

In the T2Express version before v2013.1, schedule 100/101 is found inside the menu GIFI.

Since T2Express v2013.1, the GIFI menu is consolidated into the Forms menu.

Related FAQs

Author: contact mytaxexpress

Last update: 2023-04-08 21:26

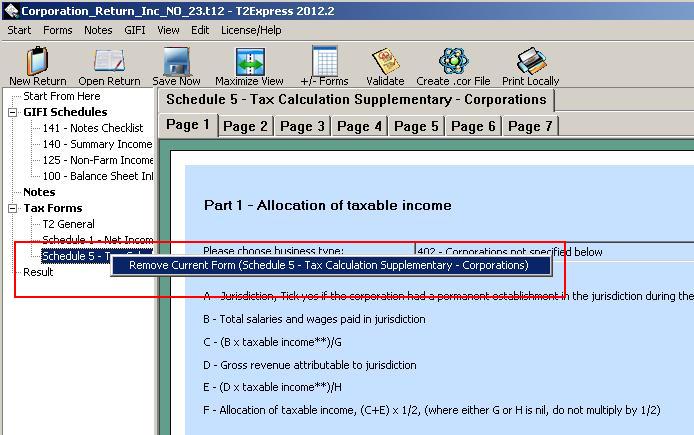

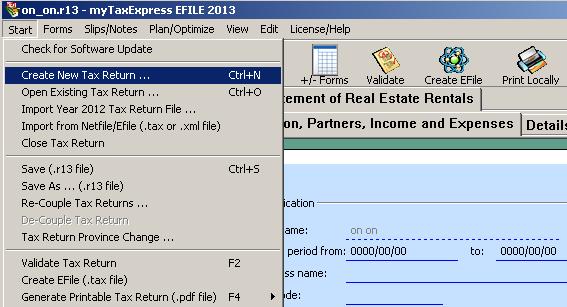

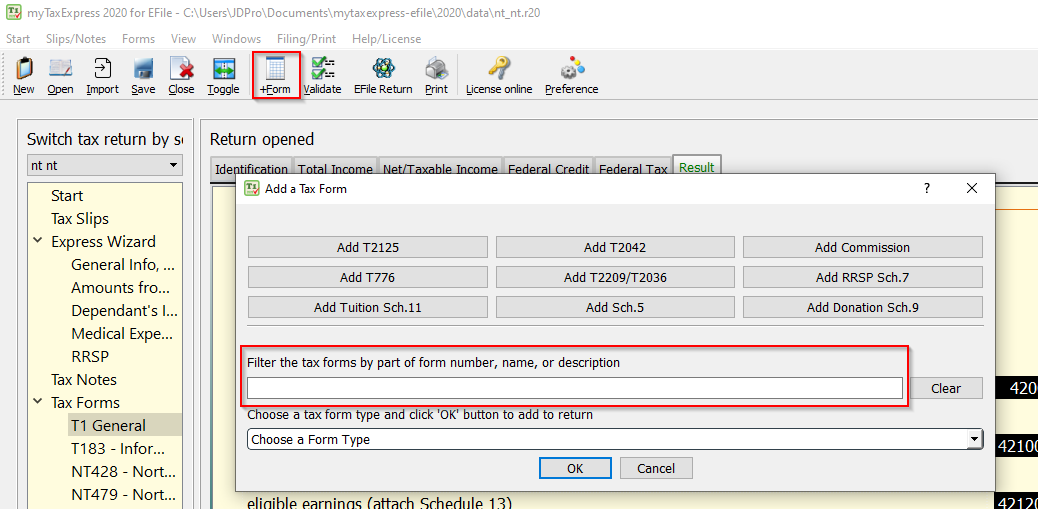

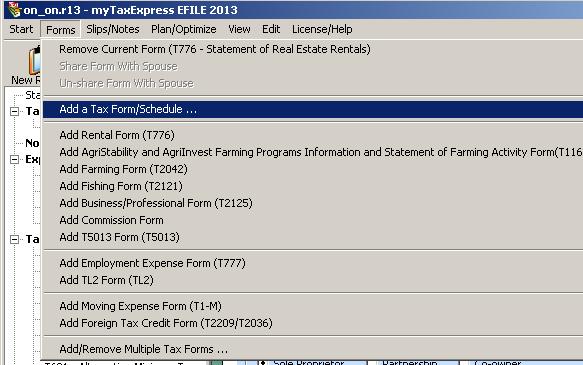

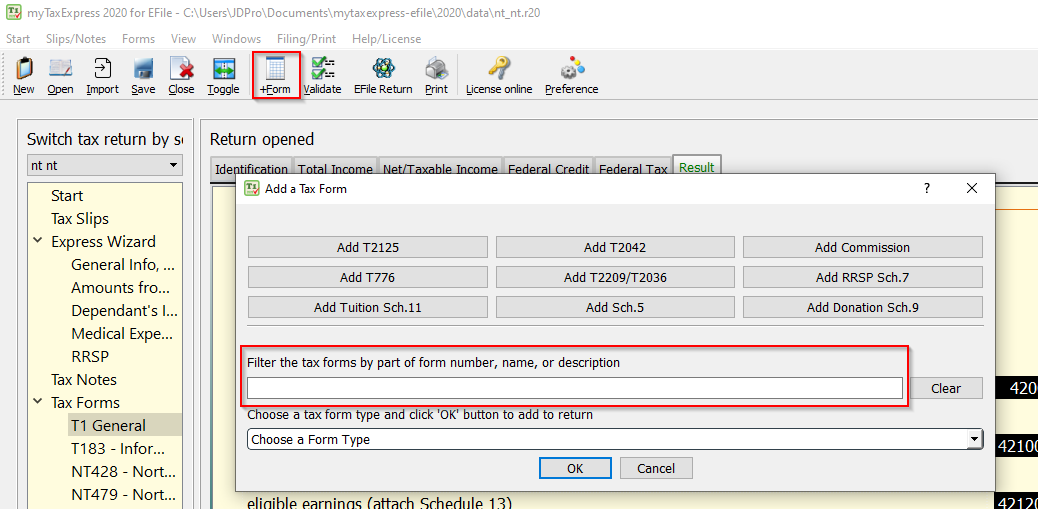

Step 4 - Add/remove other tax forms

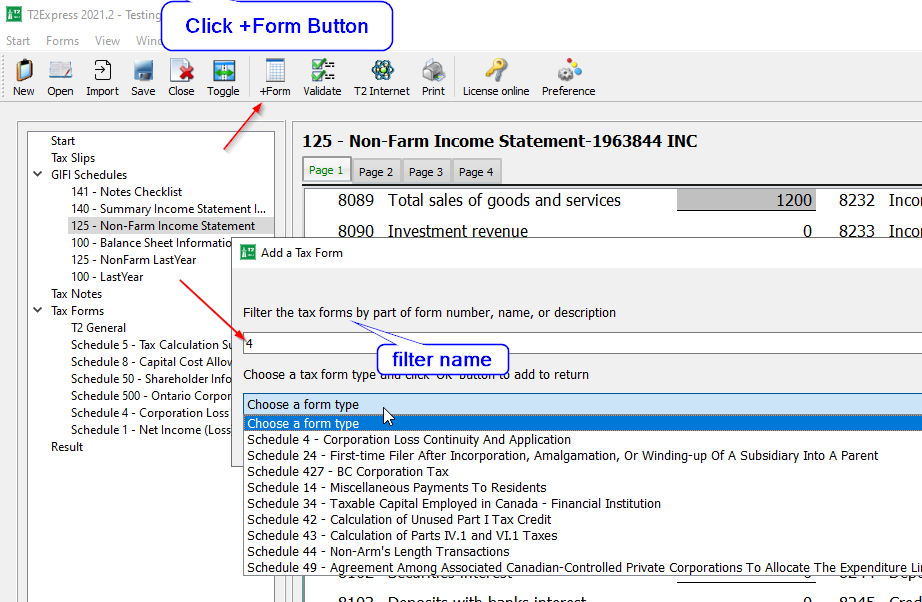

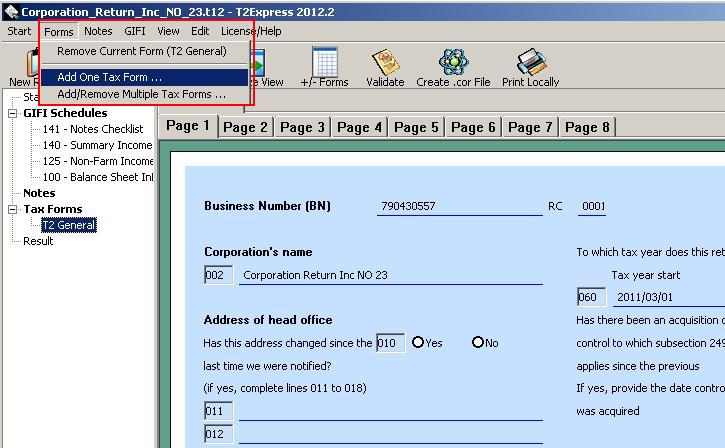

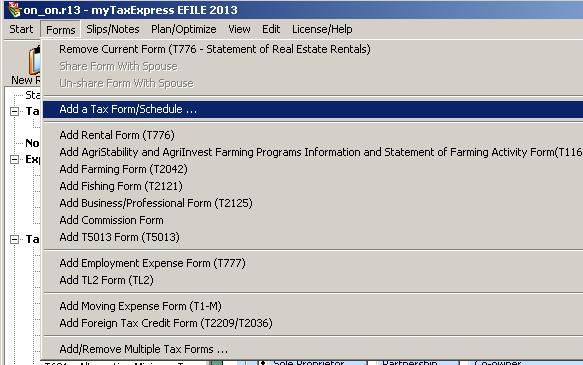

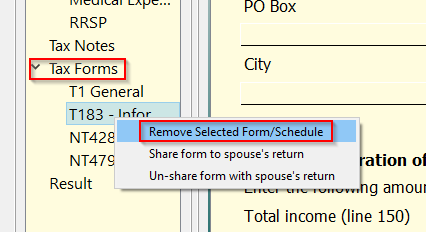

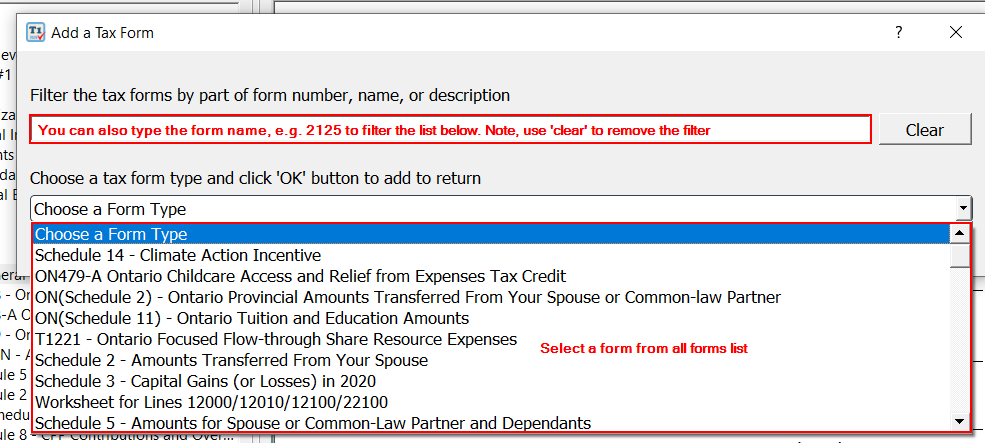

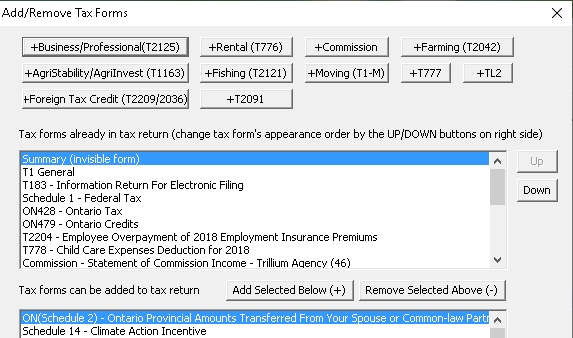

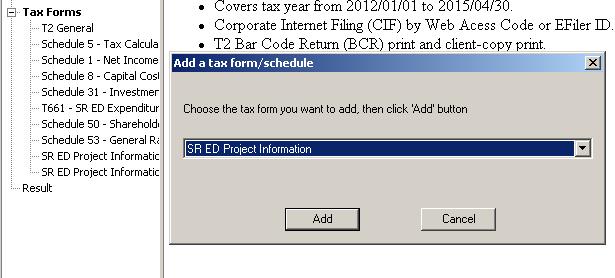

To add other tax forms you can choose the menu Forms > Add a tax form or Forms > Add/Remove multiple tax forms. It may appear slightly different in various versions, see screenshots below.

In the later version T2Express

In the older version T2Express

You can remove a tax form by righ-clicking the form in the left pane and choosing the Remove current form from the pop-up menu.

Related FAQs

Author: contact mytaxexpress

Last update: 2023-03-25 16:04

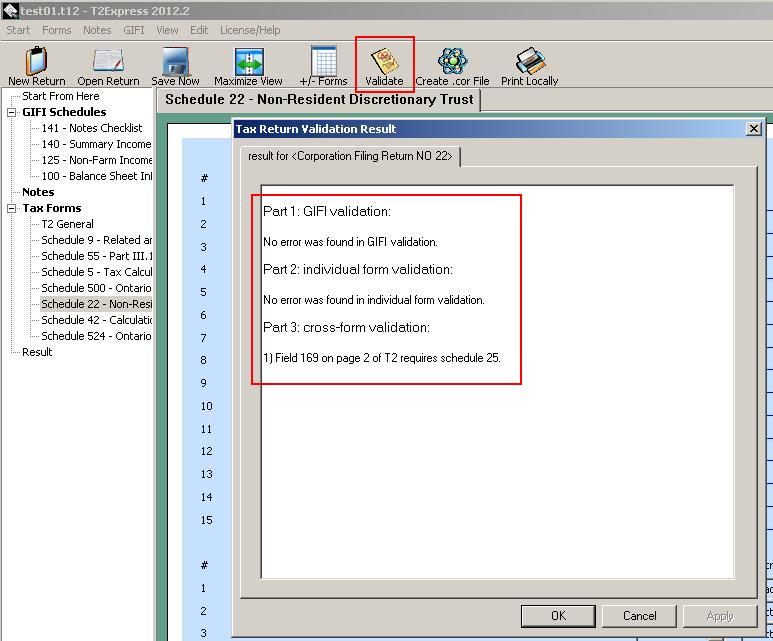

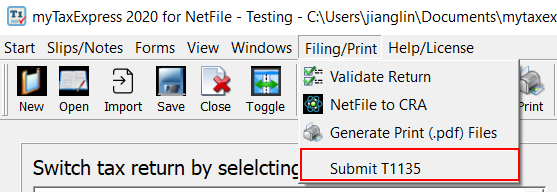

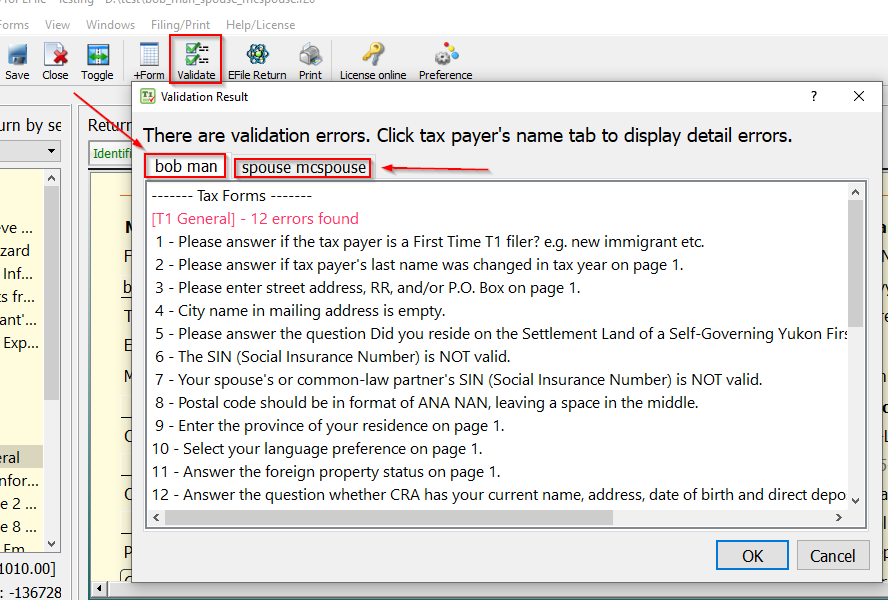

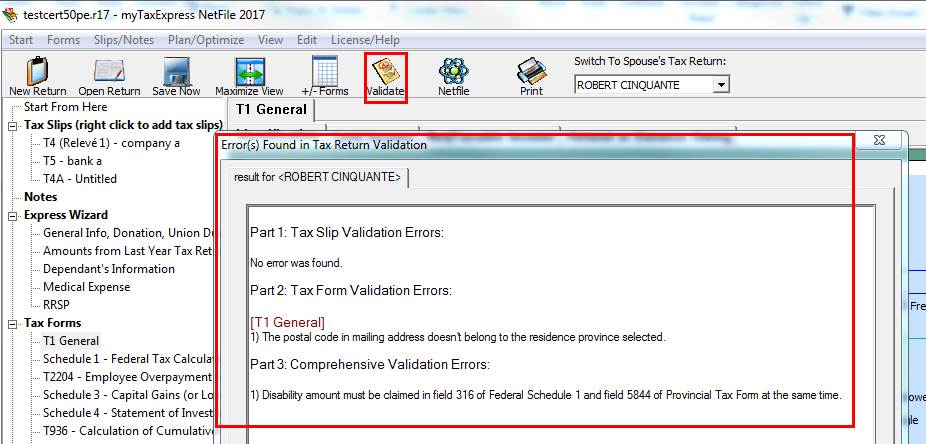

Step 5 - Validate a T2 tax return

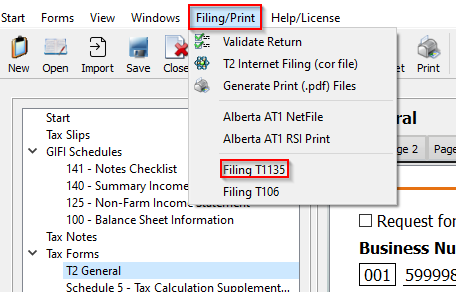

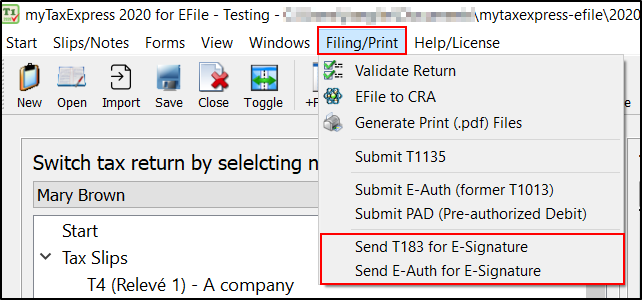

Before you create the .cor file for Internet Filing, click the Validate icon to perform a validation. The software will cross-check the forms. Or you can also access this tool by the menu Filing/Print > Validate Return.

For errors listed in the Validation Result window, follow the error message to fix them one-by-one in order to proceed for Internet Filing.

Related FAQs

Author: contact mytaxexpress

Last update: 2023-03-25 16:21

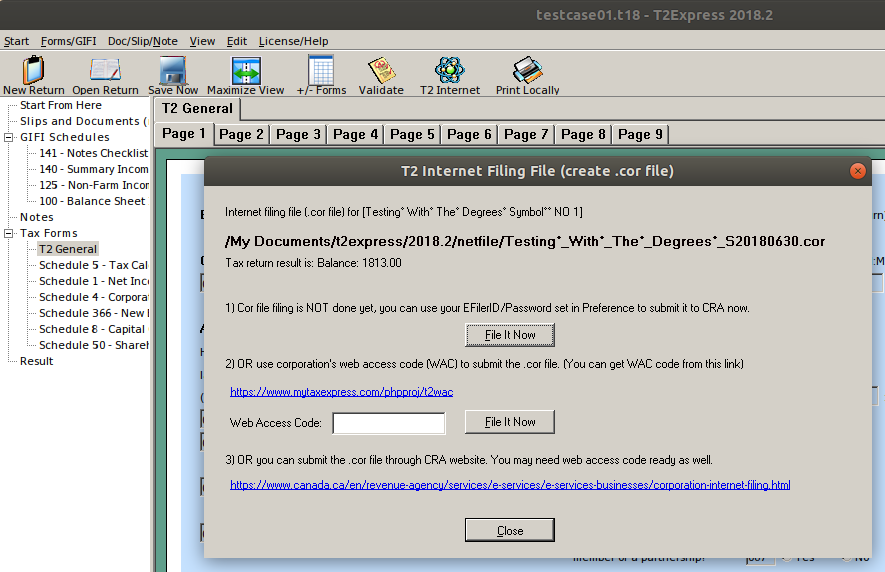

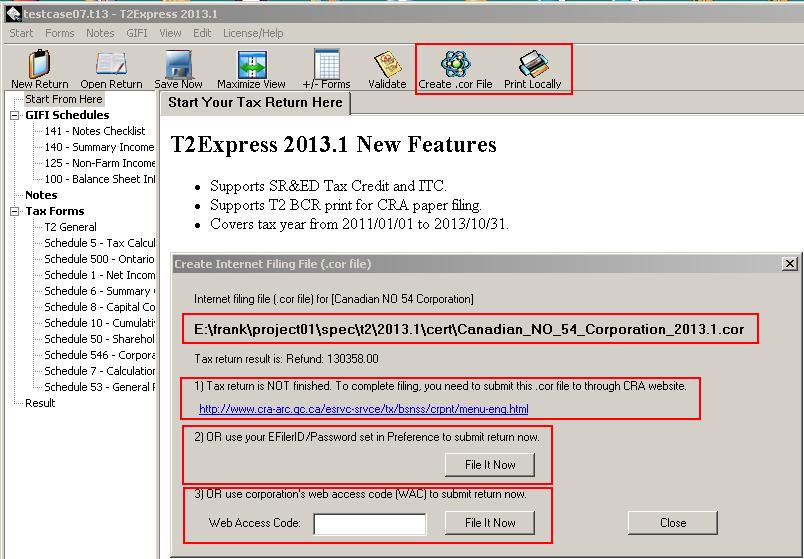

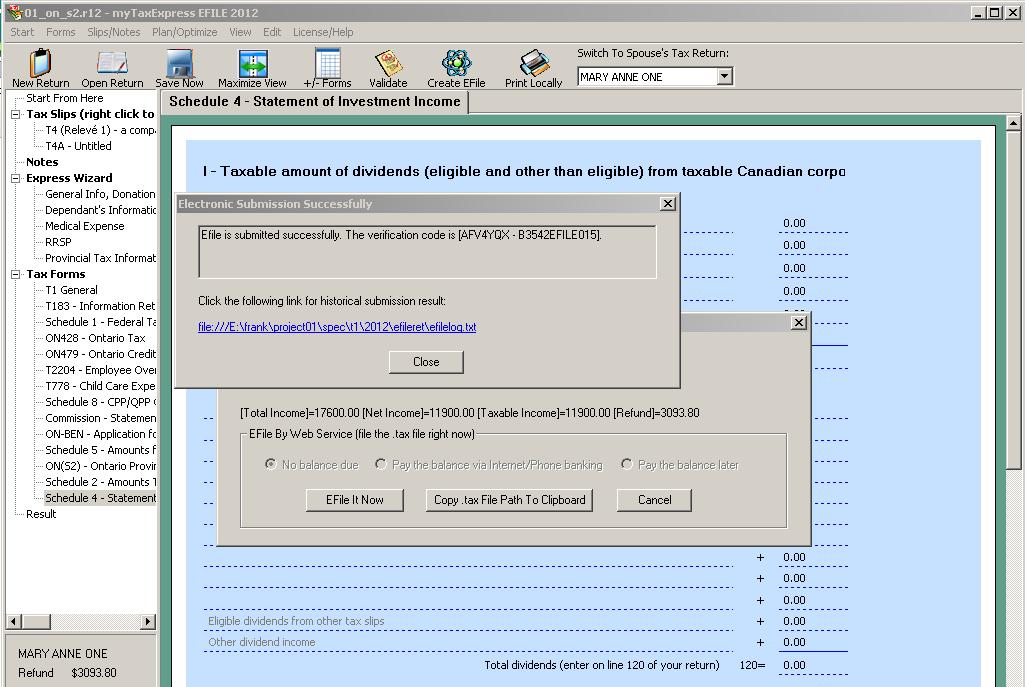

Step 6 - Create .cor file or tax return print

After a T2 return passed the validation process, you can create a .cor file for Internet filing; or generate a printable PDF file (Print function) for the tax return. A sample printable PDF file can be downloaded here.

- EFile the return by the software if you have a valid Efiler ID/password set up in the software.

- Netfile the return by the software if you have a WAC (Web Access Code).

- Upload the cor file manually through the CRA website Corporation Internet Filing page.

Here is a short video to demonstrate the process.

Click the T2 Internet icon to create a .cor file, as shown below. Or use the menu Filing/Print > T2 Internet Filing (cor file).

You may also see some informational messages after clicking the T2 Internet icon. Simply click the OK button to proceed.

In the older version, the icon is named Create .cor File.

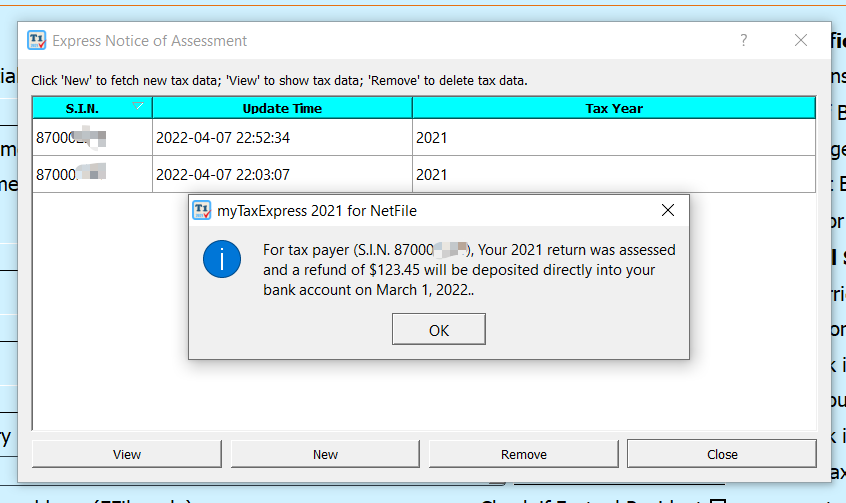

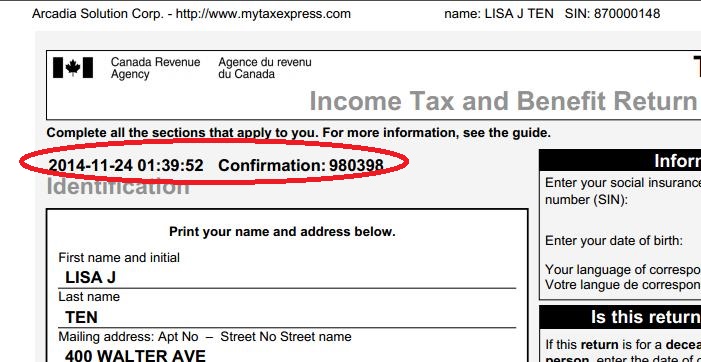

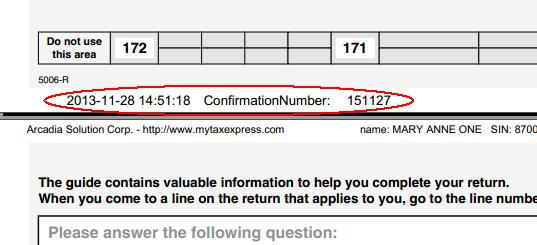

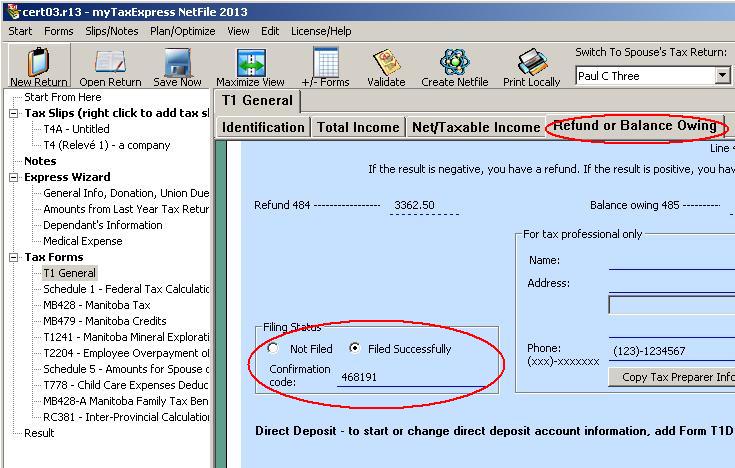

When you file a return in the software directly with your Efiler ID/Password or with WAC, a message window will pop up with a confirmation code if the return is accepted by the CRA system, as shown in the screenshot below.

Similarly, an error message will be displayed if the return is rejected if data in the return file doesn't match some CRA records. In this case, follow the message to correct each error, save the return and try to file again.

Related FAQs

- Where to get Corporate Internet Filing (CIF) web access code (WAC)?

- How to create tax return print?

- Step 1 - Create a new T2 return

- Step 2 - Work on income statement schedule 125

- Step 3 - Add balance sheet information GIFI Sch100 ( and Sch101)

- Step 4 - Add/remove other tax forms

- Step 5 - Validate the T2 tax return

Author: contact mytaxexpress

Last update: 2024-02-22 07:56

Does T2Express generate t2 barcode print?

Most people use Corporate Internet filing by creating a .cor file, and use regular print as company's private hard copy. T2Express software can do Corporate Internet filing.

Since v2013.1, T2Express can also generate 2D barcode tax return print. Choose menu "Start | Print Locally", then choose the option of "For CRA filing", it will generate a pdf file with a few barcodes, which contain all the T2 return filing data and information. You can prin this barcode pdf file using Adobe Acrobat, or Foxit Reader, mail it to CRA tax centre.

Author: contact mytaxexpress

Last update: 2015-09-23 18:08

Where to get Corporate Internet Filing (CIF) web access code (WAC)?

You can file a T2 return's .cor file using the company's Web Access Code (WAC). A unique WAC can be retrieved by submitting basic registered information and the tax-year-end date of a company. Use one of the two methods below to get your WAC.

Method 1: Do it yourself

You can use the following self-serve web link to get the T2 web access code:

https://www.mytaxexpress.com/phpproj/t2wac

Method 2: Contact CRA

You need to contact the CRA Corporation Internet Filing Helpdesk to get a corporate web access code.

| Corporations resident in Canada | 1-800-959-2803 |

| Non-resident corporations We accept collect calls. |

1-819-536-2360 or 1-204-984-3594 |

Alternatively, you may request Web Access Codes by fax. You must provide the corporation name, Business Number, and Tax Year End. Send the request to the attention of the 'Corporation Internet Filing Help Desk' in Shawinigan at 819-536-4486 or Winnipeg at 204-984-0418.

For details, please refer to this link

http://www.cra-arc.gc.ca/esrvc-srvce/tx/bsnss/crpnt/bt-eng.html

Related FAQs

Author: contact mytaxexpress

Last update: 2024-02-22 08:08

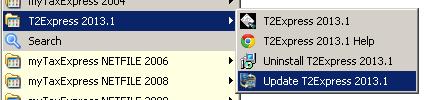

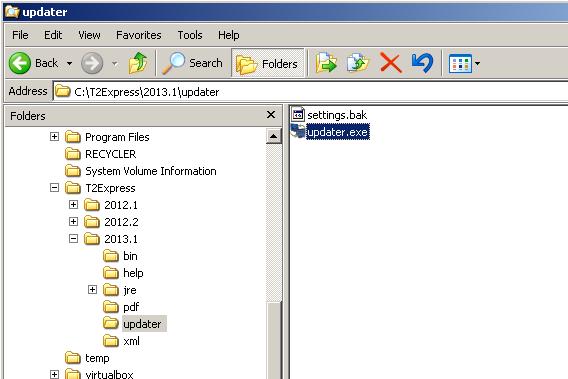

How to update T2Express software to the latest version?

There are two ways to update T2Express to its latest version. The first way is simply to download/install T2Express from the website again. Make sure you close running T2Express before installing the updated software. After software installation, the existing license key and tax return files will still work.

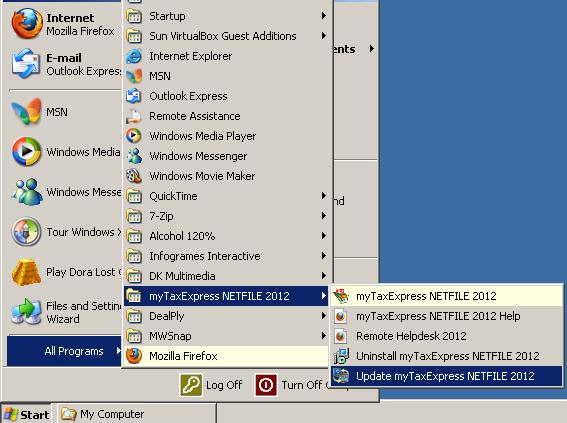

The other way to update T2Express is done by launching the T2Express update program, as seen in the following: from the T2Express program group or directly from the T2Express installation folder

Author: contact mytaxexpress

Last update: 2022-09-07 22:58

Is T2 short version available?

T2 short is a paper filing method only. To file T2 return online, you always prepare a regular T2 return file.

T2 short form basically is a subset of T2 regular form presented in T2Express software. You just need to ignore a lot of fields and tax forms when using T2Express, as if you are using T2 short form. You only need to deal with schedule 1, 8 and 50 (if necessary), plus completing the mandatory GIFI sch100, sch125 and sch141.

If the company is nil income/expense, you can simply have those forms in return, but with almost all figures at zero. Do a return validation, it will tell you what to fix.

We can help you achieve this if you need more help.

Author: contact mytaxexpress

Last update: 2023-06-20 22:23

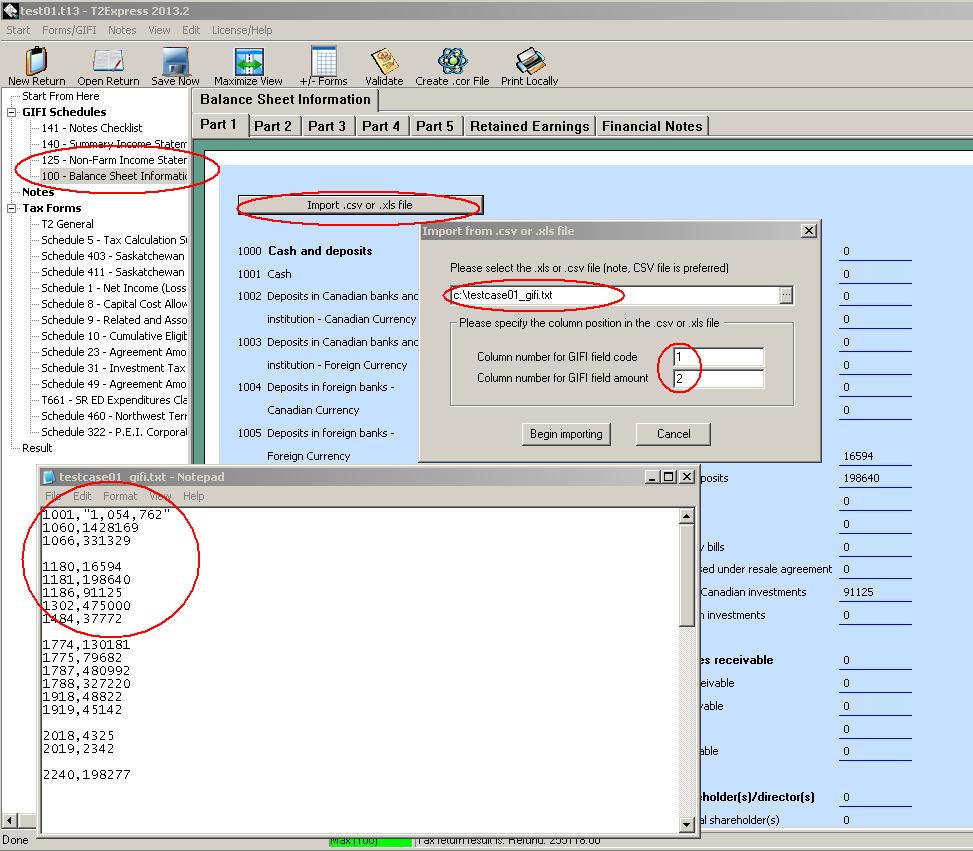

How to import .csv file to income/balance statement?

Usually, we can save a .csv file like the following format from other financial software.

1000,1234.56

1200,2345.67

then we tell the T2Express software that column 1 is field code, column 2 is amount, import this file, will make field 1000 to $1234.56, and field 1200 to $2345.67 in the financial statement.

Author: contact mytaxexpress

Last update: 2022-09-07 22:57

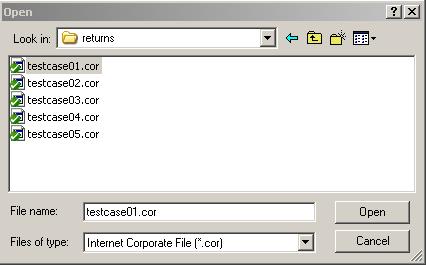

How to import .cor file into T2Express?

Most certified T2 software can do Corporate Internet Filing, it can create .cor files.

T2Express can import .cor file, generated from all certified T2 software, into its own T2 return file. Here are the steps:

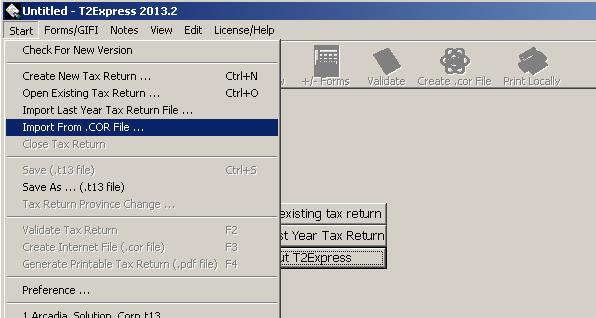

Choose menu "Start | Import from COR file"

Choose the .cor file from the file browse window, then click the 'Open' button

Author: contact mytaxexpress

Last update: 2022-09-07 22:57

How to import previous year t2express return file?

Use T2Express v2013.2 as example. We will show how to import from the .t12 file used by T2Express v2012.2.

- First run T2Express v2013.2, and choose menu "Start | Import from last year return"

- Select the .t12 file you want to convert to new T2 return file

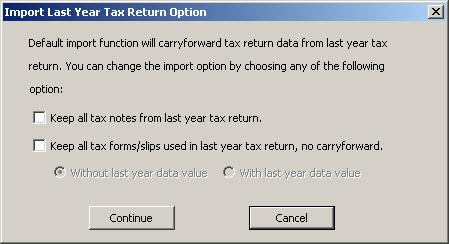

- Choose import option, you can import previous tax notes, and/or keep all previous data amounts

- Finally you will have a new T2 return file

Author: contact mytaxexpress

Last update: 2022-09-07 22:55

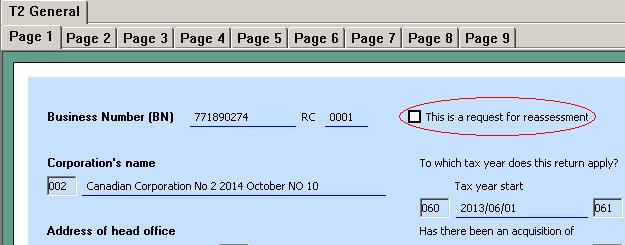

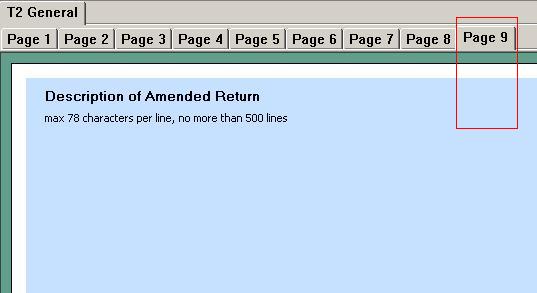

how to amend a t2 return?

- Open the return file in T2Express software first.

- On page 1 of T2, check the checkbox to indicate a request for re-assessment for changes

- On page 9 of T2, describe what changes are made to the T2 return

- To file an amended T2 return, you can always generate a T2 barcode print return and mail it to CRA; Since T2Express version 2014.1, you can submit the amended return by the Internet in the same process as filing the initial T2 return by the Internet after generating the .cor file.

Author: contact mytaxexpress

Last update: 2022-09-07 22:55

How to file Alberta AT1 return by T2Express?

According to Alberta AT1 return rules [click this link], A complete return can be filed in one of the following formats:

i) an AT1 and applicable schedules; or

ii) Alberta return and schedule information (RSI); or

iii ) Alberta Net File return.

Before T2Express v2015.1, AT1 RSI print and Netfile function by T2Express has not been approved by AB Finance. A solution could be that you just mail those AT1 client copy pages generated by T2Express software.

Since T2Express v2015.1, AT1 RSI print and Netfile was certified and available in T2Express software. You can do the filing as you want. You can read this link for more information.

Author: contact mytaxexpress

Last update: 2022-09-07 22:54

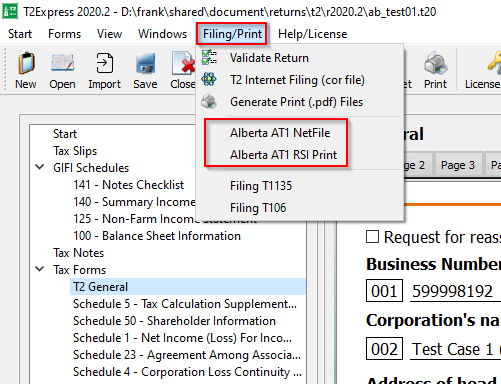

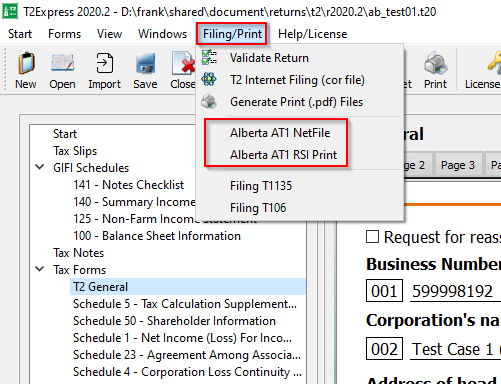

How to file Alberta AT1 return using Netfile or RSI Print?

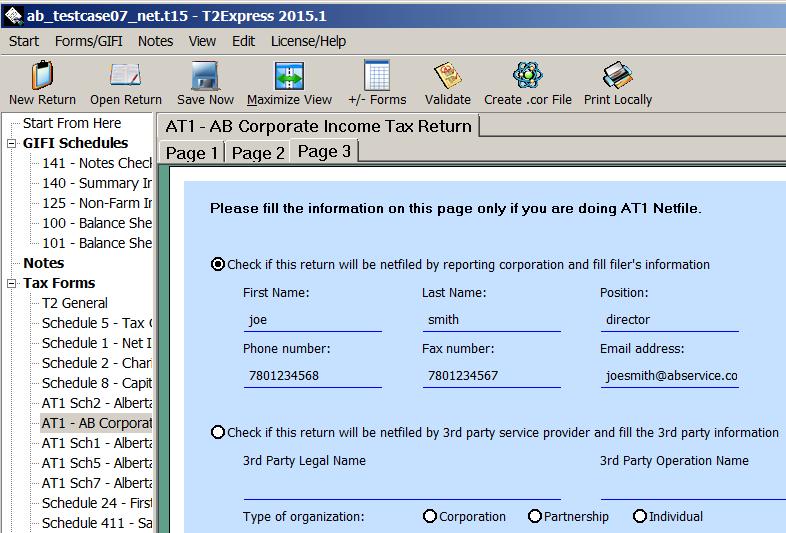

The latest version since T2Express v2015.1 enables Alberta AT1 filing by Netfile and/or RSI Print. To complete the task, you need to do the following:

- You need to purchase a 2-return license for an Alberta corporation. One return license is for T2; the other one is for Alberta AT1 RSI Print or Netfile.

- create or open the return file

- add Alberta AT1 form and other Alberta forms into tax return

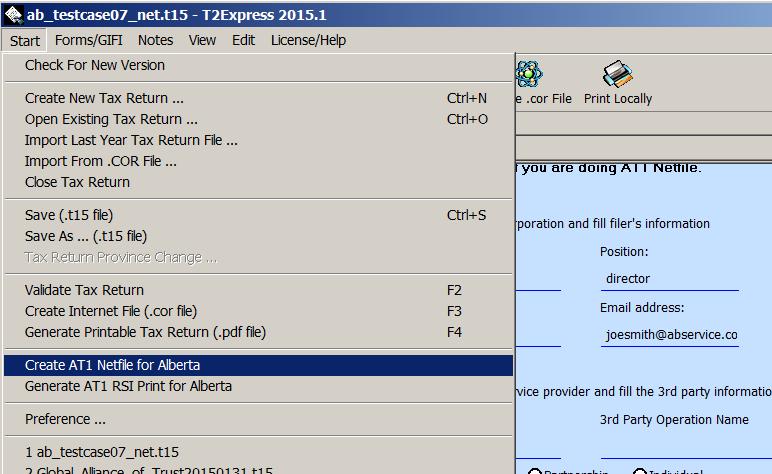

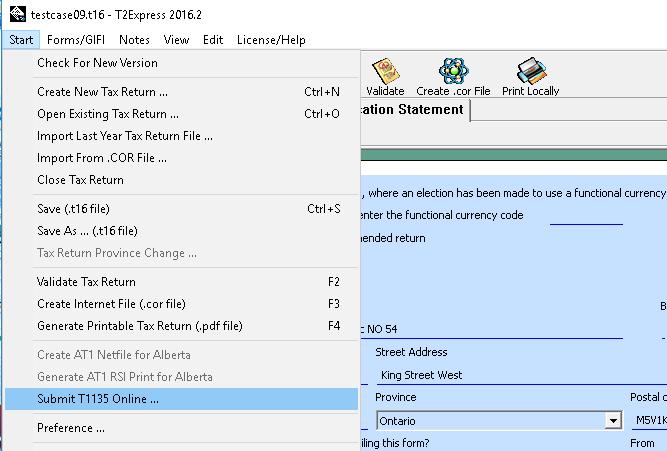

- after you finish the return, you can choose menu "Start | Create AT1 Netfile for Alberta" to do AT1 Netfile.

AT1 Netfile process requires filer information on page 3 of AT1, please complete the filer information before Netfile;

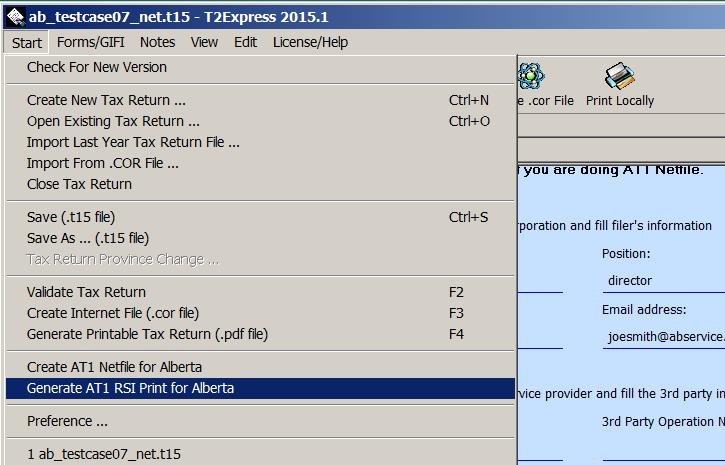

- You can choose menu "Start | Generate AT1 RSI Print for Alberta" to generate .pdf file print to mail to Alberta Finance.

Author: contact mytaxexpress

Last update: 2022-09-07 22:54

I purchased one licence. I would like to generate a .cor file and transmit it. I also like to paper print a copy of the T2 for my records. Is that one licence or two ? Thank you

Author: Tony

Last update: 2019-04-15 23:25

How to resolve error code 395? The error message is: Corporate Internet Filing failed, error code 395, the reason is (According to CRA's records, your corporation is already registered to receive email notifications. Remove your request to sign up for the service and the email address entered. You can add up to three email addresses by accessing notification preferences in My Business Account or Represent a Client.).

Author: James

Last update: 2019-10-25 21:46

How to resolve T2 filing error code 395?

Error code 395 means you already signed up for online email notification. You don't need to set the same contact email address again.

In this case, please go to page 1 of T2, answer No to question 088; and leave email address field 089 as empty. Then you can do the T2 filing again.

Author: contact mytaxexpress

Last update: 2019-10-25 22:07

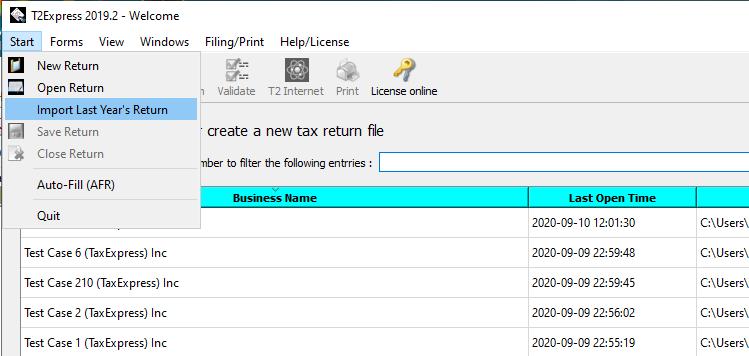

How to import last year's return file using new T2Express software?

Importing last year's tax return is an easy way to start a return for a new tax year. Follow these steps to import last year's tax return on the new T2Express software.

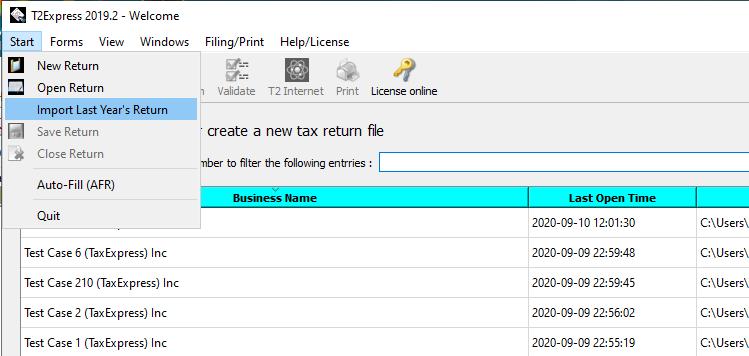

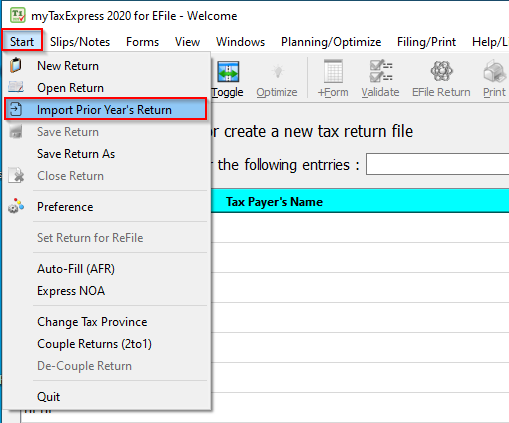

Step 1: Start the new T2Express. Click on the Start menu, and then click "Import Last Year's Return".

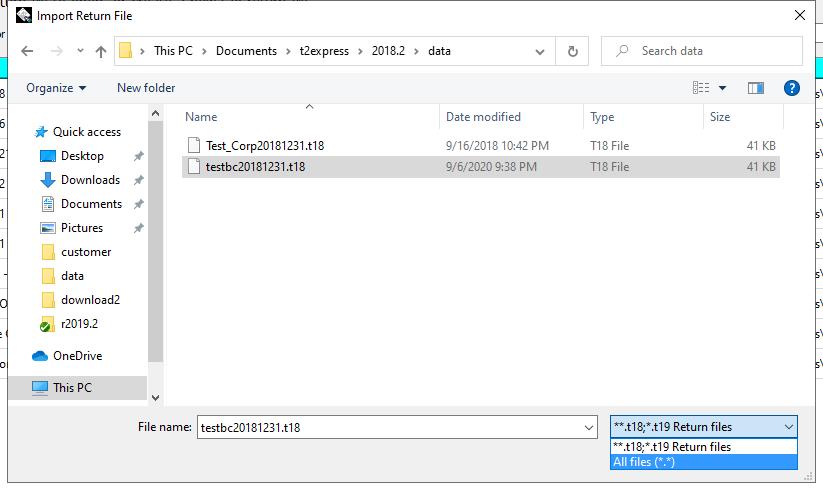

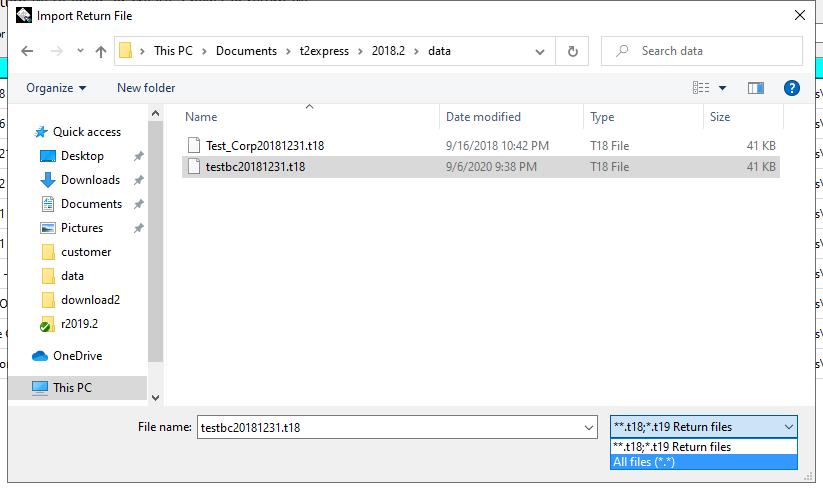

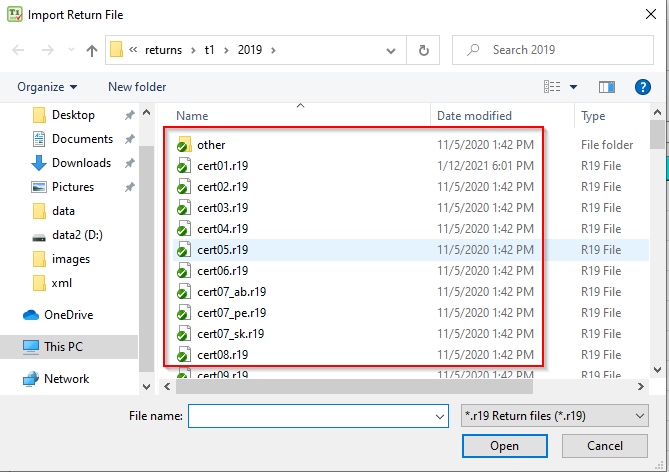

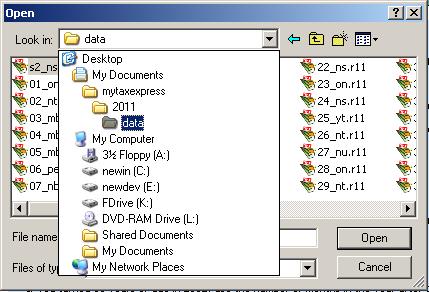

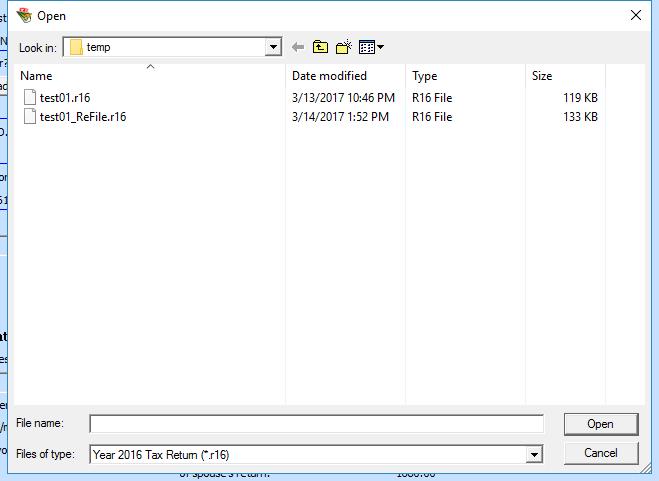

Step 2: A dialouge box will open. Navigate to the file that you want to import. If you can not find last year's return, change the file type to "All files" as shown in the bottom right of the picture.

Author: contact mytaxexpress

Last update: 2022-09-07 22:53

Where are the data files of T2Express version 2022.2 for Windows?

Since T2Express version 2022.2, the Windows version software changes default data return files to a writable folder allowed by Windows system. In this way, T2Express can run friendly with Windows OS and anti-virus software.

C:\Users\<name>\AppData\Local\T2Express_v2022_2

see this screenshot

Author:

Last update: 2022-11-01 21:37

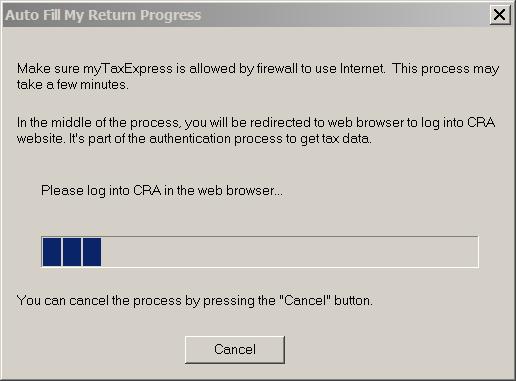

Auto-fill tax data in T2Express

In T2Express software, you can use the auto-fill function to fetch tax data from CRA. Here is a short video to demo the process, especially creating a new return based on the fetched .cor file you filed in prior tax years.

Step 1: Click the menu Start > T2 Auto-Fill option.

You may need to allow the software to access the network on your computer for the first time as the software needs to connect to the CRA server.

Step 2: An Auto Fill Tax Data window pops up. Click the New button and enter the Business Number in the field. Click the OK button to proceed.

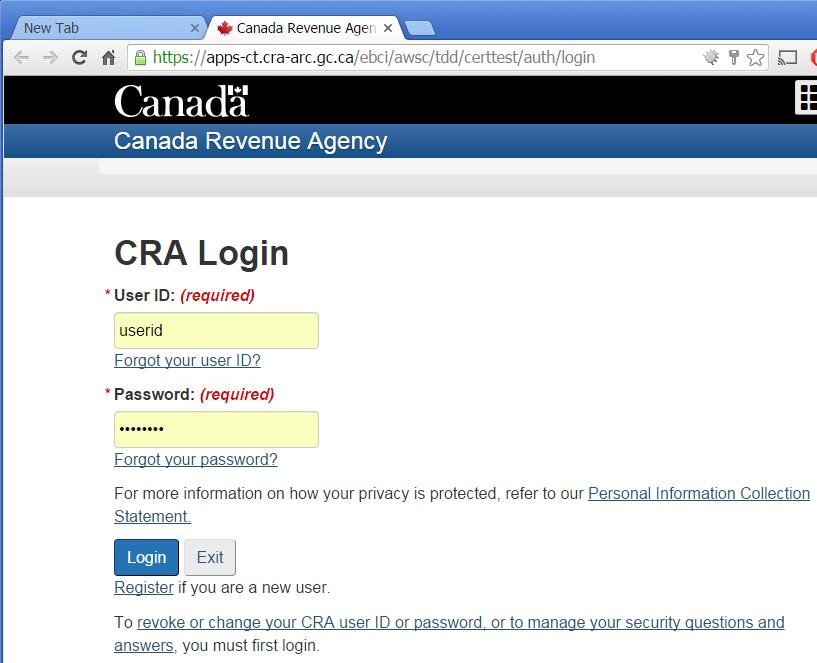

Step 3: The software will launch the default browser on your computer on the CRA login page. Enter the User ID and Password to log in to your CRA account.

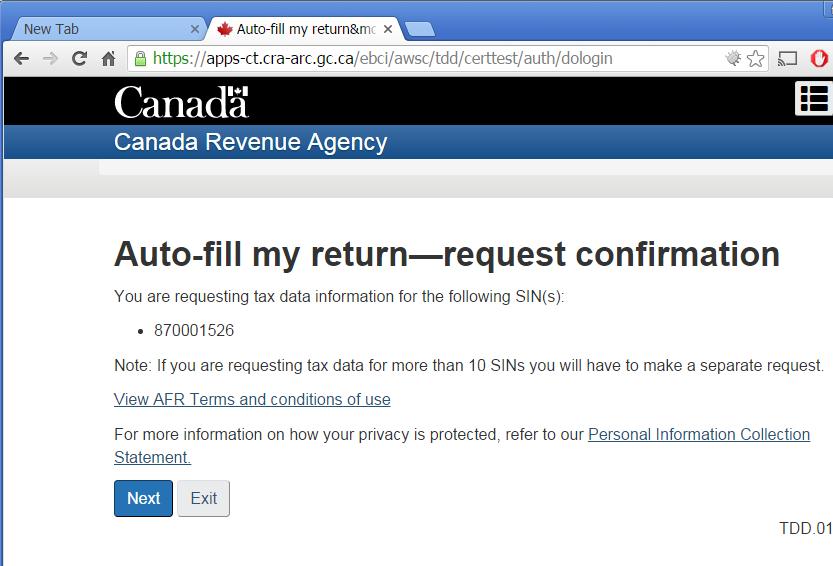

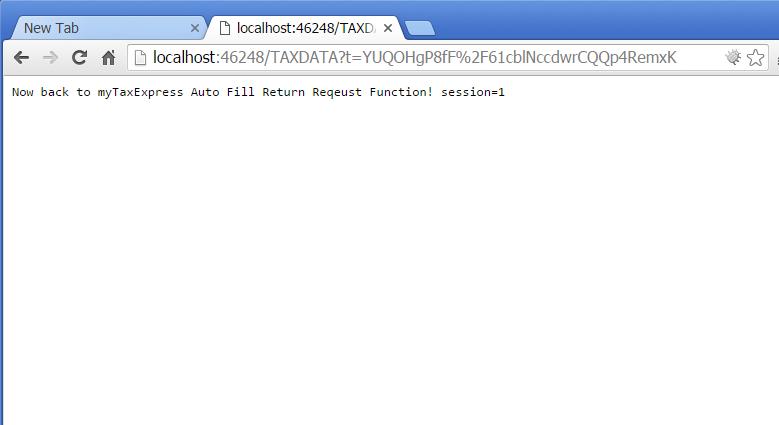

It may take a while to load in the browser, but eventually, you should see a web page similar to the following. Don't click the Logout from CRA, just keep the browser open to keep the connection session active.

Step 4: Now click the software window, and a new Choose Tax Data Option is presented with all tax data files available. Choose the tax data you want to fetch. Click the OK button to proceed.

Step 5: Fetched files are listed with file paths that files are saved/stored on your computer. In the following screenshot, the .cor file is saved in the C:\Users\vuser\AppData\Local\T2Express_v2022_2\data folder.

Step 6 (Optional): We can use the fetched .cor file (the tax year 2017) to create a new return by clicking the menu Start > Import from .cor file option.

The File Explorer pops up, navigate the folder above C:\Users\vuser\AppData\Local\T2Express_v2022_2\data folder, then select the .cor file

A new return will be created based on the .cor file. Ensure to update the start/end dates of the tax year and save the return.

Author:

Last update: 2023-04-13 20:45

How to use T2 Attach-a-doc service on docsign.ca

If you have filed or amended a T2 return within the past 24 hours in T2Express software, you can submit supporting documents to CRA on our docsign.ca website electronically, which integrates with CRA T2 Attach-a-doc service.

Prerequisites

Register a docsign.ca account and set it up in T2Express, if you haven't done so.

You need to enable the "Track returns" feature in the T2Express software first in order to use the attach-a-doc service on the docsign.ca website.

Each submission will charge you 50 points ($5). Please purchase enough points in advance.

Steps to use attach-a-doc service

1. Log in to the docsign.ca website and click the Tax Filings Report icon on your dashboard.

2. Locate the filing record. The record should have Filing Type = T2, and Status = success, with a CRA confirmation number. Note: CRA only accepts submissions within 24 hours of filing.

3. Click the down arrow at the end of the record to expand the Filing message panel. A T2 Attach Documents action icon is enabled and displayed. Click the icon to access the form.

4. On the new screen, enter the required fields and attach documents. A maximum of 5 documents can be attached for each submission.

5. A success or error message will be displayed based on responses from CRA servers.

Related FAQs

Author:

Last update: 2023-11-20 18:47

How to choose T2Express version?

Each version of T2Express software is designed to handle tax returns for a specific period, typically around 3 years. If a tax year start/end date falls in the coverage range of a version, that version can be used to complete and file the tax return for that year.

You may find that multiple T2Express versions can be used to complete a return. In most cases, the latest version is the best choice, as it includes the most up-to-date information on tax changes from the Canada Revenue Agency (CRA).

A list of all T2Express versions along with their coverage details can be found on the T2Express Home page.

For example, let's say you need to file a 2020 tax return for a company that had a tax year from September 1 to August 31. According to the coverage table on the homepage, both Version 2022.1 and Version 2022.2 can handle this return. However, we'll go with Version 2022.2 since it covers a slightly longer tax period, which is useful if you also plan to work on next year's returns.

Related FAQs

Author:

Last update: 2024-04-26 10:44

Common » myTaxExpress » License

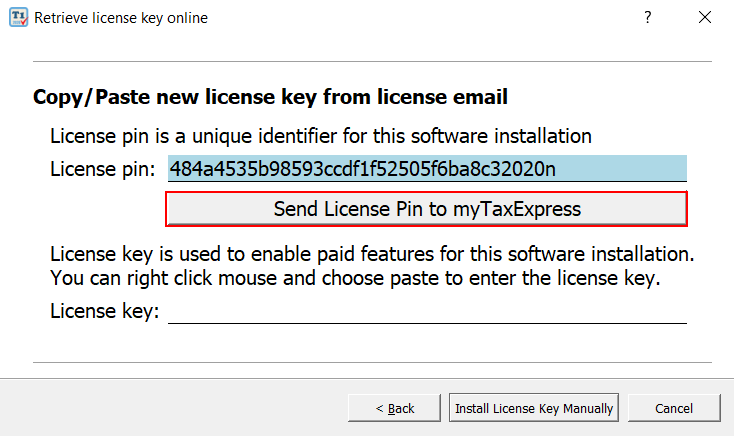

What is a license PIN/Key?

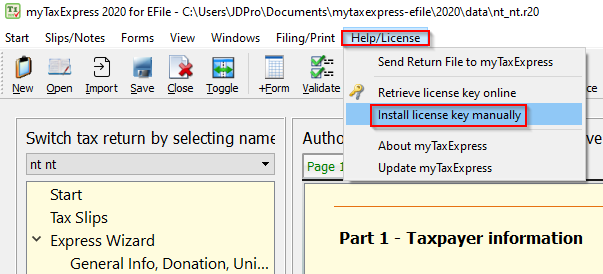

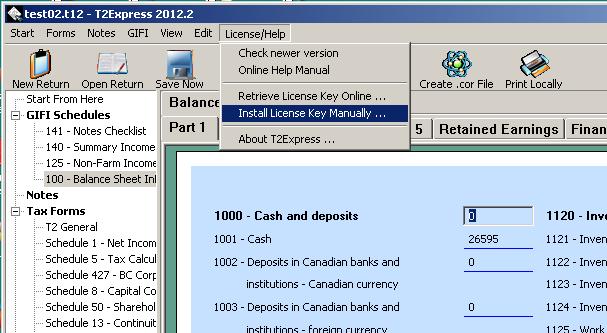

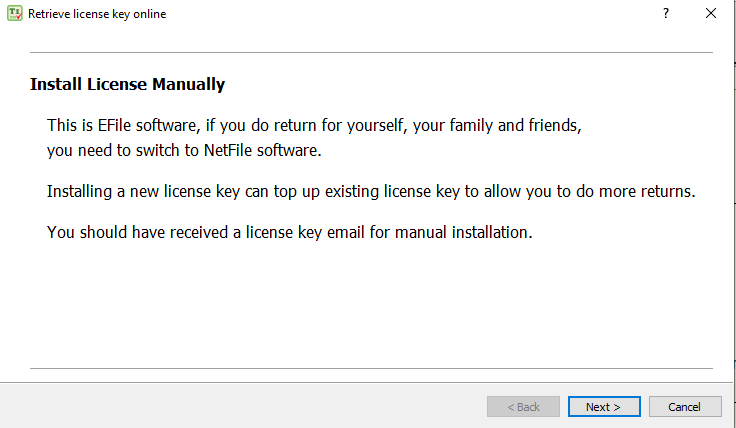

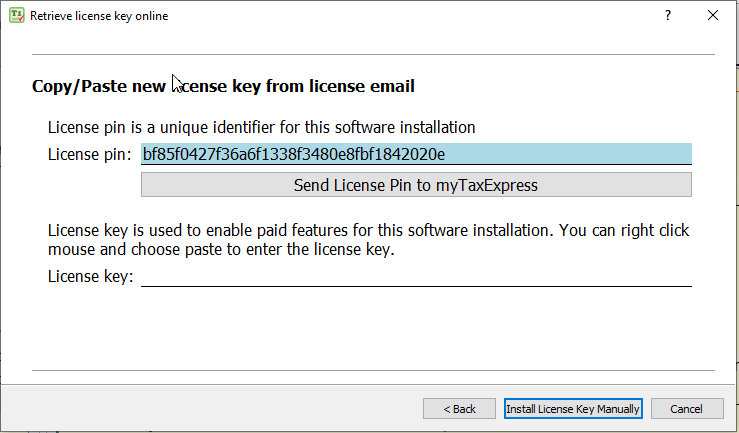

License PIN is a unique string identifying each myTaxExpress/T2Express installation. A paired license key is generated based on the PIN.

Most of the time you can retrieve a license key online by following our license instruction email. However, sometimes you may need to install the license key manually instead.

Related FAQs

Author: contact mytaxexpress

Last update: 2022-04-13 14:57

Do I need a license key to netfile free?

If your total income (field 150 of T1) is less than $25,000 in the tax year 2012, you can use myTaxExpress netfile software to create a tax return print and netfile without a license key. In another word, it's free.

In other tax year, myTaxExpress software free offering may be different. Please contact myTaxExpress for details.

Author: contact mytaxexpress

Last update: 2013-03-28 21:51

How to buy 10-more return license?

It's very easy. You just pay for a new 10-return license. you will get a new verification code. Use the new code to retrieve license key online, myTaxExpress will be upgraded to a new license key to allow you do 10-more returns.

Author: contact mytaxexpress

Last update: 2013-04-30 23:43

How to buy bulk license for other years

If you want to buy a bulk license (more than 10 returns) for other years that are not the latest/current year, please follow instructions below (We use the Year 2015 as an example here):

1. Click the Year 2015 link on the left on https://www.mytaxexpress.com/purchase-ge.html page.

2. Use the "quote the price and make payment here, by Visa, MasterCard or American Express" link to calculate the total amount you need to pay first.

3. If you want to pay with PayPal, click the "Checkout with PayPal" button to redirect to fill in the required information to complete.

Or if you want to pay with a credit card, you can fill in the credit card form at the bottom of the same page, then click the "Submit Credit Card Payment" button.

Author: contact mytaxexpress

Last update: 2022-10-30 17:29

Can 1-tax-return licence work for a coupled tax return?

Author: Hogan Poon

Last update: 2019-04-06 00:51

Common » myTaxExpress » Print

How to get print online?

Author: contact mytaxexpress

Last update: 2015-09-23 18:10

How to create tax return print?

myTaxExpress or T2Express don't print out tax forms directly. Instead, they generate a printable .PDF file. After the .PDF file is created, you can see its file path showing on the screen. Next, you need to run free software like Adobe acrobat reader or Foxit Reader to open the .PDF file, in which you can view or select to print all pages or some pages.

When you try to print a return, the software checks certain important fields to see if it's new or already exists. If the details are the same, it counts as one return and deducts from your license usage once on the first time. But if you change any of those fields and print again, it's considered a new return and will deduct another license usage. So, before printing, check these fields to avoid extra license deductions. For T1 returns, important fields are S.I.N., and date of birth. For T2 returns, those are the business number and tax year start/end dates. For T3 returns, those are the trust account and tax year start/end dates.

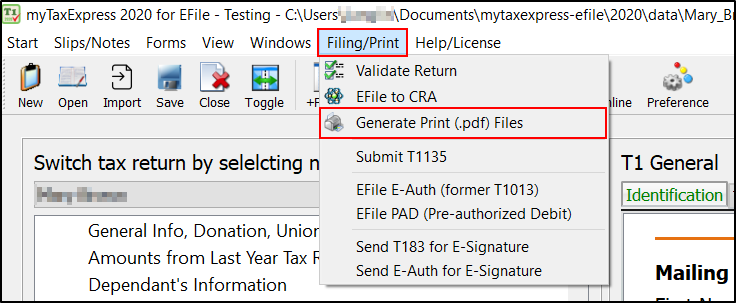

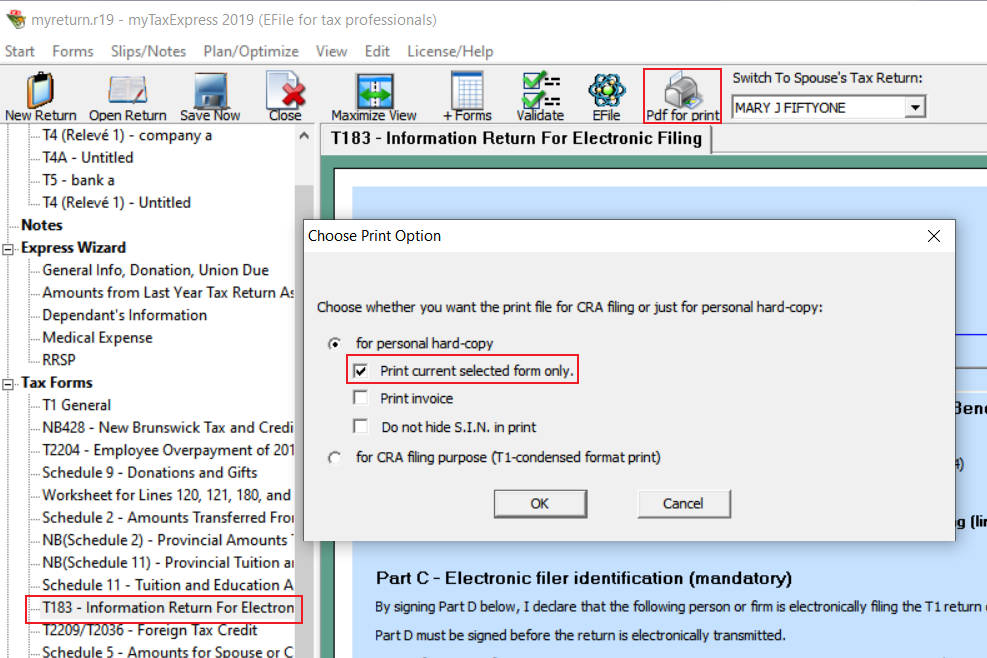

Step 1: To create a printable .pdf file in newer versions of software, first, open the tax return file, then choose the menu "Start | Generate Printable Tax Return".

To create a printable .pdf file in older versions of software, first, open the tax return file, then choose the menu "Start | Generate Printable Tax Return"

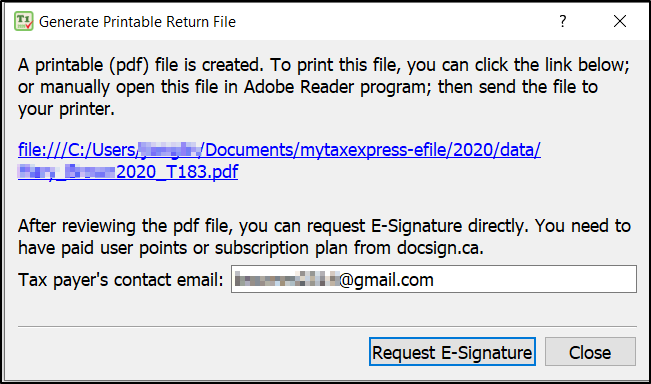

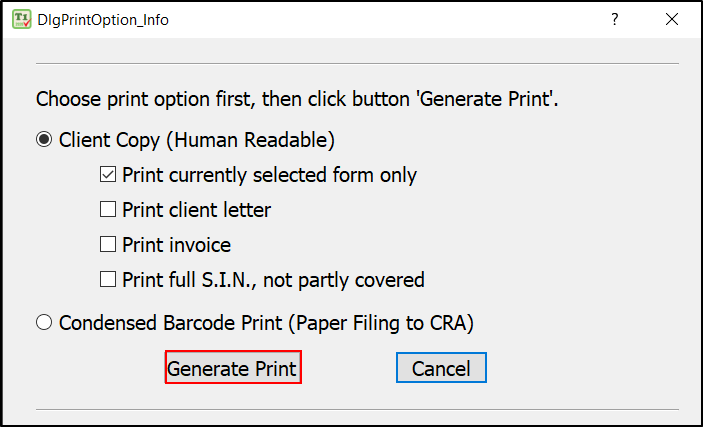

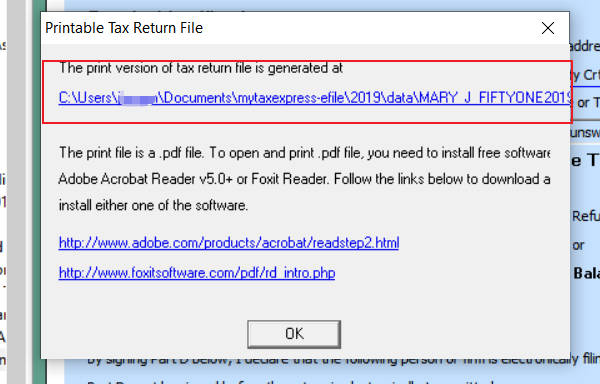

Step 2: After step 1 you will see a similar dialog/window as below. There are additional options to choose from, e.g. just print the current opened form, print full S.I.N etc., Then click the "Generate Print" button to proceed.

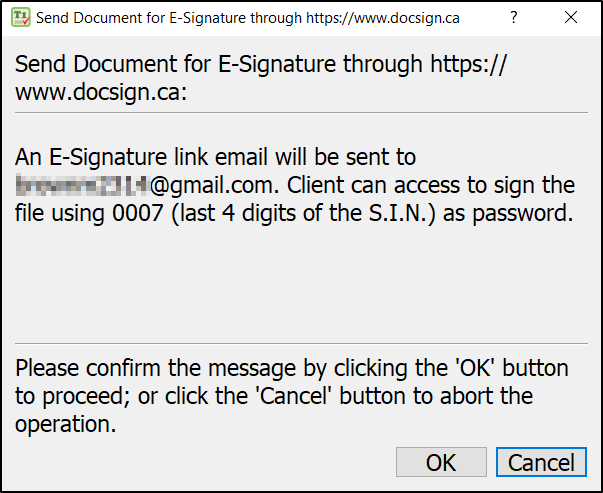

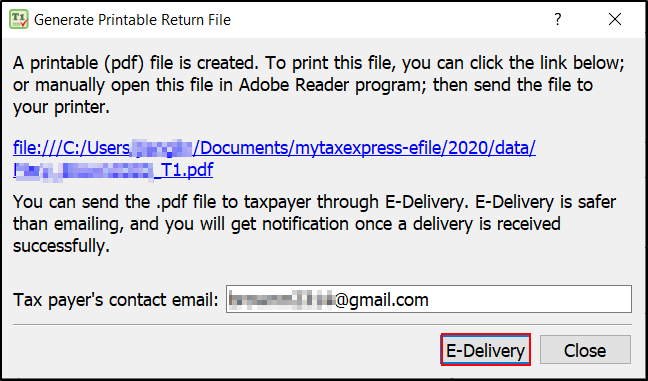

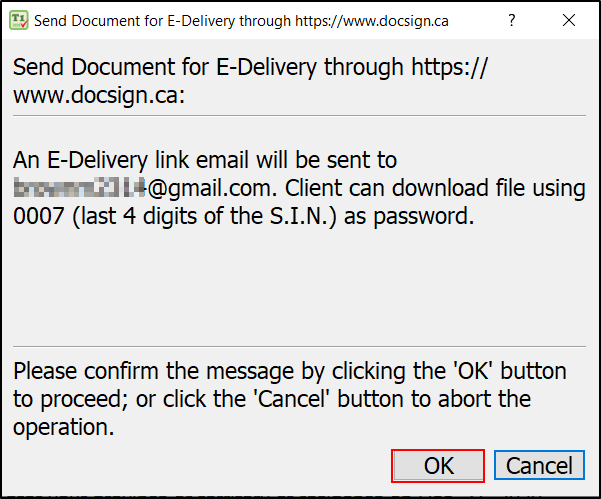

Step 3: If a printable PDF file is generated successfully, you will see the following dialog/window, in which you can see the file path (folder) information to show you where the file is stored on your computer. If you already have pdf reader software like Adobe Reader or Foxit reader installed, you can click the file path to open/view the pdf file right away. You can then close the window by clicking the x on the top-right corner or the "Close" button.

Note: If you are preparing this return for your client, you can choose the "E-Delivery" button to send the .PDF file securely to your client via Document E-Deliver Service offered via the docsign.ca website.

Screenshot in 2022 software:

Screenshot in 2021 software:

Relevant FAQs

Author: contact mytaxexpress

Last update: 2024-03-06 04:42

What's error code -116 when I generate tax return print?

This error happens if any of the following conditions happen:

1. Pdf output folder name, set in "Start | Preference" menu, has non-English characters in it.

2. Tax return file name has non-English characters in it.

If you re-set pdf output folder or rename tax return file, so that only English characters are used in folder path and tax return file name, this error will disappear.

Author: contact mytaxexpress

Last update: 2014-03-17 15:50

I do not have a printer, how do I print somewhere else.

myTaxExpress or T2Express don't print out tax form directly, instead, they generate a printable .PDF file for print. After the .PDF file is created, you can see its file path showing on the screen. Next, you need to run free software Adobe acrobat reader or Foxit reader to open the .PDF file, and select the pages you want to print.

In this case, after .PDF file is created, you can copy the file in a USB drive; then bring the file to another computer where a printer is attached. Finally you run Adobe reader or Foxit reader in that computer to open the .PDF file and print.

Author: contact mytaxexpress

Last update: 2016-01-16 22:39

Common » myTaxExpress » Installation

Where to download myTaxExpress software?

Please use this download link

Author: contact mytaxexpress

Last update: 2013-03-31 17:55

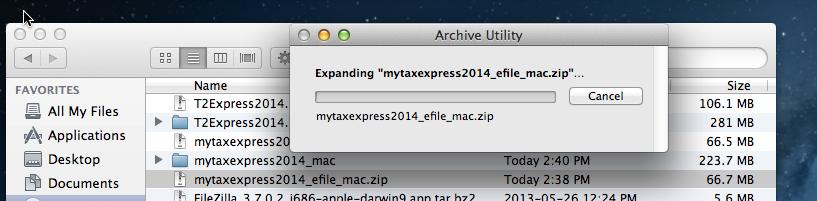

How to setup myTaxExpress (2019 and prior versions) on Mac computer?

1. Download myTaxExpress or T2Express Mac version software (a .zip file). Usually, it is downloaded in the Download folder.

2. Latest Mac OS will automatically unzip the downloaded .zip file in the Download folder; if not, please unzip it by right-clicking the mouse and choosing open from the popup menu. It will unzip the program in the same folder. Unzip creates an App, like "mytaxexpress2012_netfile" for the tax year 2012. Don't manually unzip into the Application folder manually, it must be unzipped in the original downloaded folder.

3. Since Mac OS Sierra, it's required that you move the unzipped App into the Application folder. For detail, you can also read this FAQ item.

4. Double-click the "mytaxexpress 20xx" icon from the Application folder to run myTaxExpress. If you encounter an error of "Unidentified Developer", please keep holding down the Ctrl key and right-click mouse on the App, then choose Open to run myTaxExpress/T2Express software.

Author: contact mytaxexpress

Last update: 2022-09-07 23:16

How to Install myTaxExpress (Windows)?

After downloading the software installer from our website, double-click to execute the installer and follow the installation wizard. The following clip shows how the installation process looks like.

Author: contact mytaxexpress

Last update: 2022-09-07 23:15

How to Install myTaxExpress on Mac

Author: contact mytaxexpress

Last update: 2021-03-10 17:10

Common » myTaxExpress

Should I use netfile or efile software?

Efile is for people who does other's tax returns as business. Efiler must register with CRA first, and have an Efiler ID/password to do tax returns.

Netfile is for people who prepare their own, family or friend's tax returns.

myTaxExpress has both netfile and efile version software, they work very similarly. Netfile and Efile software can also generate printable tax returns. The print can be used to paper filing to CRA.

Author: contact mytaxexpress

Last update: 2013-04-03 16:36

Does myTaxExpress support Quebec tax return?

The answer is NO. However If you only work in Quebec, but lives in other provinces, so your tax province is not Quebec. In this case, myTaxExpress can still do your tax returns.

Author: contact mytaxexpress

Last update: 2013-03-27 17:05

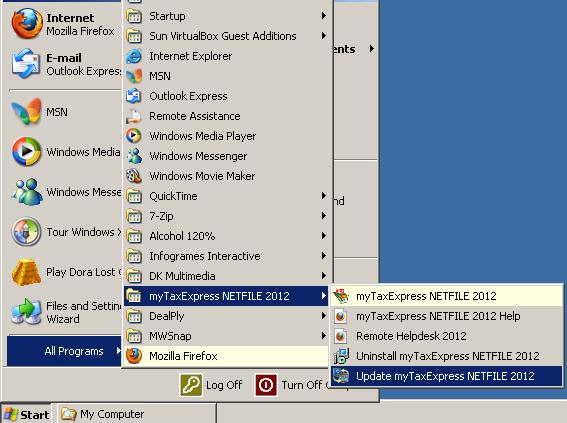

How to update myTaxExpress software to its latest version?

There are two ways to update myTaxExpress to the latest version on Windows, choose either one. Newer versions may not have the 2nd option anymore due to restricted access issues enforced in the recent OS on computers.

1) The simplest way to update software is re-download the latest software version from our website, and re-install.

No uninstallation is required. Close the running myTaxExpress software first. Download the latest software release from our website, and double-click the installer file to re-install. The existing license key and prepared return files will still work after the installation.

2) Please run the myTaxExpress update program as shown in this picture (Note: this method is only available prior to the year 2019 software)

OR

for MacOS, the process of updating mytaxexpress is

1 remove the old version under Applications

2 download the new version from our website and move under Applications

3 New software will pick up existing license key and data return files.

Author: contact mytaxexpress

Last update: 2023-02-09 14:03

How to file a T1 assessment objection?

You can file an objection to CRA's assessment or re-assessment. This is a right given by law. More information and procedure, please read this link

Author: contact mytaxexpress

Last update: 2013-03-27 21:49

How does myTaxExpress identify different return files?

myTaxExpress software uses SIN number to keep track if it's a processed return or not. So please make sure the SIN is correctly entered. Or Before SIN is verified, don't try to generate print or Netfile/Efile, otherwise, software will count 1-return license usage.

Author: contact mytaxexpress

Last update: 2013-03-27 21:53

Where do I look up T1013 submission error code?

IF T1013 submission returns error code T808, which means your EFILE ID is not authorized to submit T1013 yet. You need to consult with CRA. Here are some T1013 error code description:

-------------------------------------------------------------------------------------------------------------------

LIST OF ERROR CLUES

T801

The attached file must contain a minimum of 1 to a maximum of 30 forms

per batch. Please select a valid file of 30 or less forms and try again.

T802

The transmitter’s EFILE number or password is not entered or is invalid.

Please carefully complete both identification fields and try again. If both

the transmitter’s EFILE number and password were entered correctly,

contact your EFILE Helpdesk.

T803

Authentication failed. Access is locked - number of unsuccessful attempts

exceeds access limits. Please contact your EFILE Helpdesk.

T804

The software used to prepare this file was not certified. Please contact

your software developer to obtain the certified version of the software.

T805

The preparer’s EFILE number is not entered or is invalid. Please carefully

complete the field and try again. If the preparer’s EFILE number was

entered correctly, contact your EFILE Helpdesk.

T806

The attached file contains forms completed with different preparer EFILE

numbers. All forms within the file must be completed using the same

preparer EFILE number.

T807

The attached file contains forms completed with different software

products. You can only transmit a file containing forms prepared with the

same software. Please use the same software for each form, re-save the

file and try again.

T808

The efiler number must be authorized to transmit T1013 (Authorizing or

Cancelling a Representative) forms. Please update your account

information by indicating that you want to transmit T1013 forms. Refer to

the “EFILE for Electronic Filers” service at http://www.efile.cra.gc.ca/l-

ccmnt-eng.html for more information

T809

The software vendor code used to prepare the forms is either not indicated

or is invalid. Please contact your T1 EFILE software developer.

T810

The form submitted must be a Form T1013 (Authorizing or Cancelling a

Representative).

T811

The number of forms in the batch is not equal to the number of forms

declared in the file.

T812

The software used to prepare this file was not certified for this tax year.

Please obtain the latest version of this software product.

T813

The unique document number is invalid. Please contact your software

developer.

T829

The EFILE number used to prepare or transmit the Form T1013

(Authorizing or Cancelling a Representative) has not received the

necessary approval. You should contact the EFILE Helpdesk.

T830

According to our records , the representative listed in Part 2 A.has already

been authorized by this taxpayer. A new authorization form is not required

unless the taxpayer would like to amend the original authorization.

T857

According to our records, this authorization has already been submitted to

CRA and it is currently being processed.

A new authorization form is not required unless the taxpayer would like to

amend the original authorization.

T858

According to our records, the unique document number associated with

transmission has already been submitted. Please contact your software

developer.

Part 1 Taxpayer Information

T814

The taxpayer first and last name must be provided. Only alpha characters

and punctuation such as hyphens, apostrophes and periods will be

accepted. Any other character types cannot be transmitted.

T815

Please verify the social insurance number and ensure it is correct.

If this is a new social insurance number, it may not yet be registered with

the Canada Revenue Agency. Please try re-submitting this form in two

weeks.

Authorizations for T3 and T5 accounts cannot be electronically submitted.

T855

Please check the spelling of the taxpayer’s first name.

MODIFIED

Refer to a recent CRA correspondence for accuracy.

If you make a change to the first name, please have the taxpayer sign a

new T1013 with the correct information before re-submitting the form.

Note:

Only alpha characters and punctuation such as hyphens, apostrophes and

periods will be accepted. Any other character types cannot be transmitted.

If a name change was recently submitted, it may not yet be registered with

the Canada Revenue Agency. Please try re-submitting this form in two

weeks.

T856

Please check the spelling of the taxpayer’s last name.

MODIFIED

Refer to a recent CRA correspondence for accuracy.

If you make a change to the last name, please have the taxpayer sign a

new T1013 with the correct information before re-submitting the form.

Note:

Only alpha characters and punctuation such as hyphens, apostrophes and

periods will be accepted. Any other character types cannot be transmitted.

If a name change was recently submitted, it may not yet be registered with

the Canada Revenue Agency. Please try re-submitting this form in two

weeks.

Part 2 – A. Authorize online access

T816

Please verify the RepID provided in Part 2 A. of the form and ensure it is

correct. For information on how to obtain a RepID, if you have not already

done so, please refer to the CRA’s Represent a Client online service at

www.cra.gc.ca/representatives .

T817

Please verify the GroupID provided in Part 2 A. of the form and ensure it is

correct. For information on how to obtain a GroupID, if you have not

already done so, please refer to the CRA’s Represent a Client online

service at www.cra.gc.ca/representatives .

T818

Please verify the business number provided in Part 2 A. of the form and

ensure it is correct. For information on how to register your business with

the CRA’s Represent a Client, if you have not already done so, please

refer to the CRA’s Represent a Client online service at

www.cra.gc.ca/representatives.

T819

In Part 2 A. of the form, please provide either the RepID, the GroupID or

the business number that has been registered with the Represent a Client

online service. Only one of these fields should be populated.

T820

Please indicate the level of permission your client consented to in Part 2 A.

of the form. A taxpayer may consent to a Level 1 or Level 2.

T839

MESSAGE NO LONGER RELEVANT

T840

The RepID entered in Part 2A of the form is invalid or inactive on the

Represent a Client service. For information, please refer to the Canada

Revenue Agency’s Represent a Client online service at

www.cra.gc.ca/representatives.

T841

The RepID entered in Part 2 A. of the form is no longer valid. If you

choose, you may register for a new RepID at

www.cra.gc.ca/representatives .

T842

MESSAGE NO LONGER RELEVANT

T843

The Business Number provided in Part 2 A. of the form matches the social

insurance number provided in Part 1 of the form. Please verify the

business number provided in Part 2 A.of the form and ensure it is correct.

T844

We cannot proceed with your request because the RepID used to prepare

the Form T1013 (Authorizing or Cancelling a Representative) has not

received the necessary approval.

T845

The GroupID provided in Part 2 A. of the form is no longer active with

Represent a Client. If you choose, you may register for a new GroupID

with the CRA’s Represent a Client online service at

www.cra.gc.ca/representatives .

T846

We cannot proceed with your request because the GroupID used to

prepare the Form T1013 (Authorizing or Cancelling a Representative) has

not received the necessary approval.

T847

The business number provided is not registered with the CRA’s online

service Represent a Client. For information on how to register your

business number with Represent a Client, please refer to the CRA’s

Represent a Client online service at www.cra.gc.ca/representatives .

T848

The Business Number you have entered is not eligible to use this service,

based on information received at the CRA from your business.

T849

We cannot proceed with your request because the business number used

to prepare the Form T1013 (Authorizing or Cancelling a Representative)

has not received the necessary approval.

T852

MESSAGE NO LONGER RELEVANT

T853

The business number provided in Part 2 A. of the form is registered, but

not active, with the Represent a Client service. Please contact your

employer for more information.

N/A

Information from Part 2 B. of the form cannot be electronically submitted.

Only representatives who have registered with the CRA’s Represent a

Client service may be authorized through an e-submitted T1013. If your

client wants to authorize you with online access, to act on their behalf with

the CRA, please complete Part 2 A. with your registered RepID, GroupID

or business number. Otherwise, complete Part 2. B, print and submit the

form by mail.

Part 3 Authorization expiry date

T821The expiry date field in Part 3 of the form is incomplete or has an invalid

format. Note that the expiry date cannot be prior to the transmission date.

T850

The expiry date field in Part 3 of the form contains a date that is less than

the transmission date. As a result, the authorization is no longer valid.

Part 4 Cancel one or more existing authorization

T822

The assigned value for the check boxes checked on this form is invalid.

Please contact your software developer.

T823

If you wish to cancel a specific representative in Part 4 of the form, please

provide the first and last name of the representative. Only alpha characters

and punctuation such as hyphens, apostrophes and periods will be

accepted. Any other character types cannot be transmitted.

T824

If you wish to cancel a specific business in Part 4 of the form, please

provide the business name. Alpha and numeric characters, and

punctuation such as ampersands, hyphens, apostrophes and periods will

be accepted. Any other character types cannot be transmitted.

T825

Please verify the RepID provided in Part 4 of the form and ensure it is correct.

T826

Please verify the GroupID provided in Part 4 of the form and ensure it is correct.

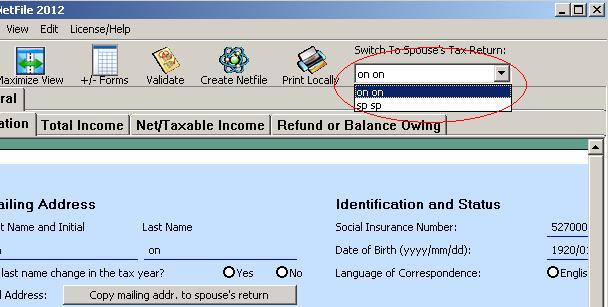

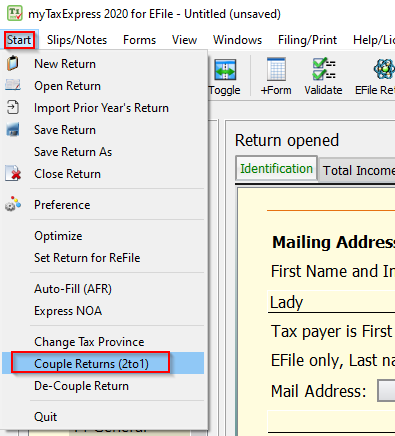

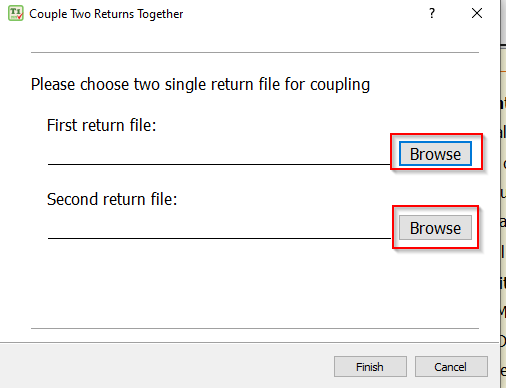

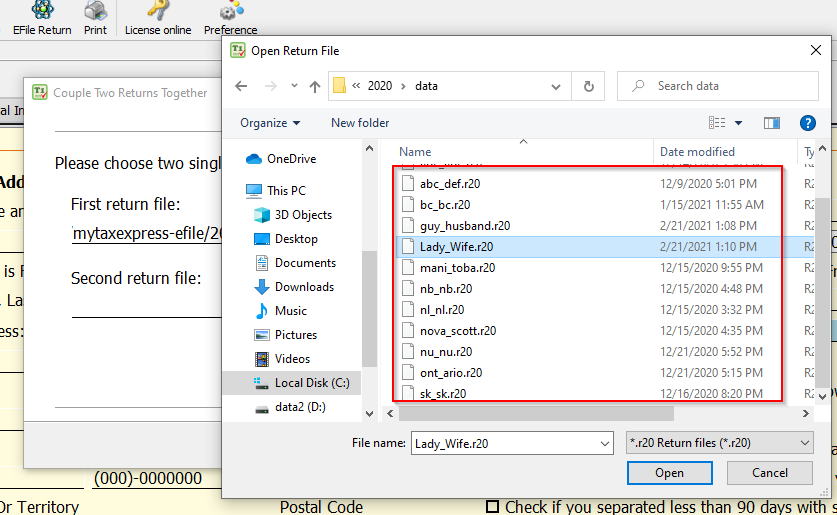

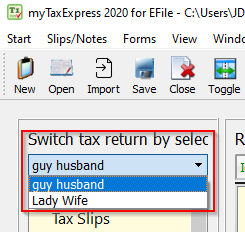

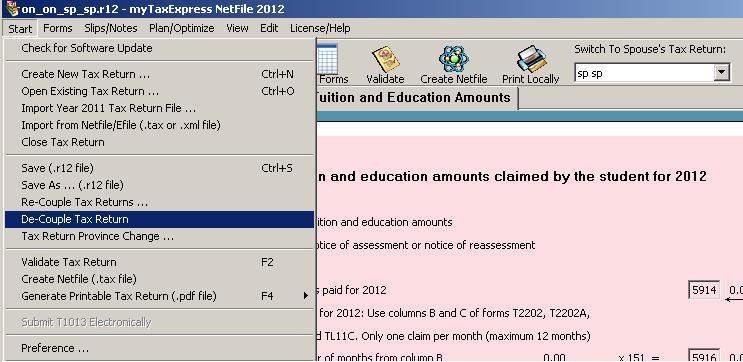

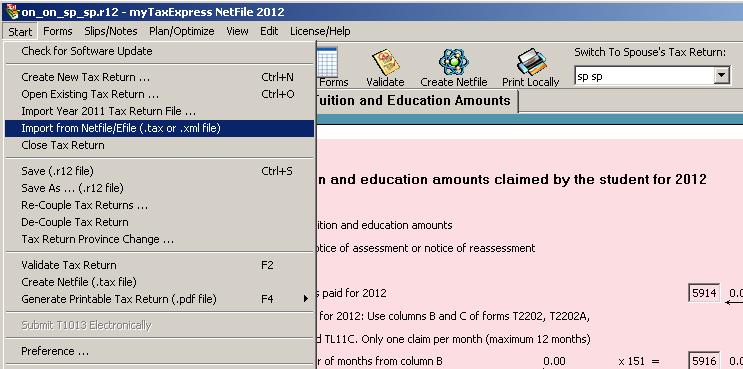

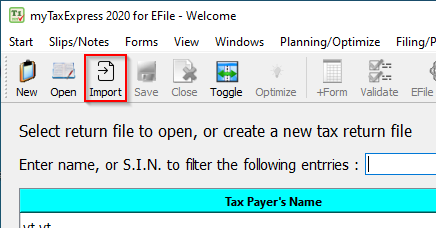

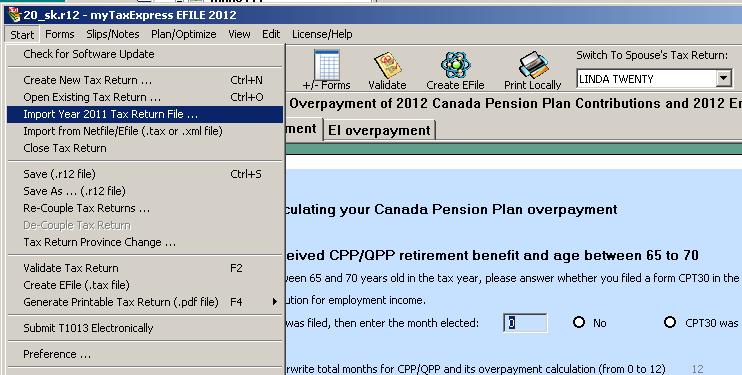

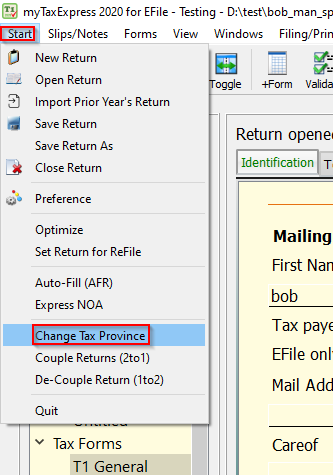

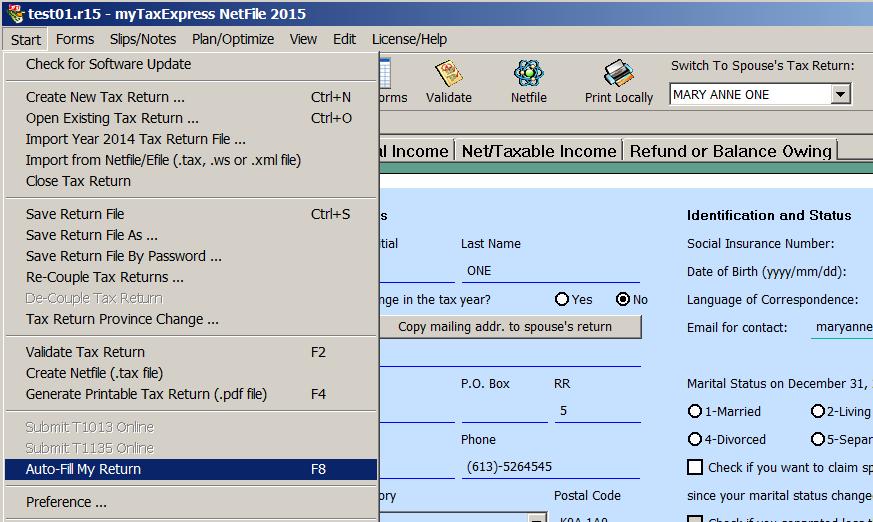

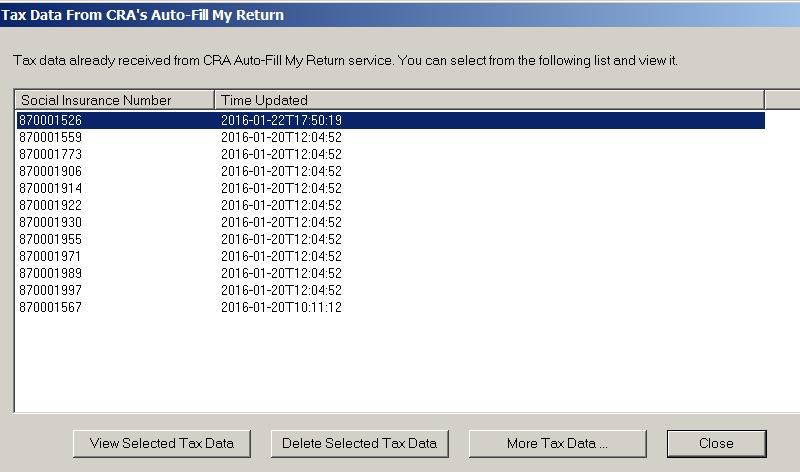

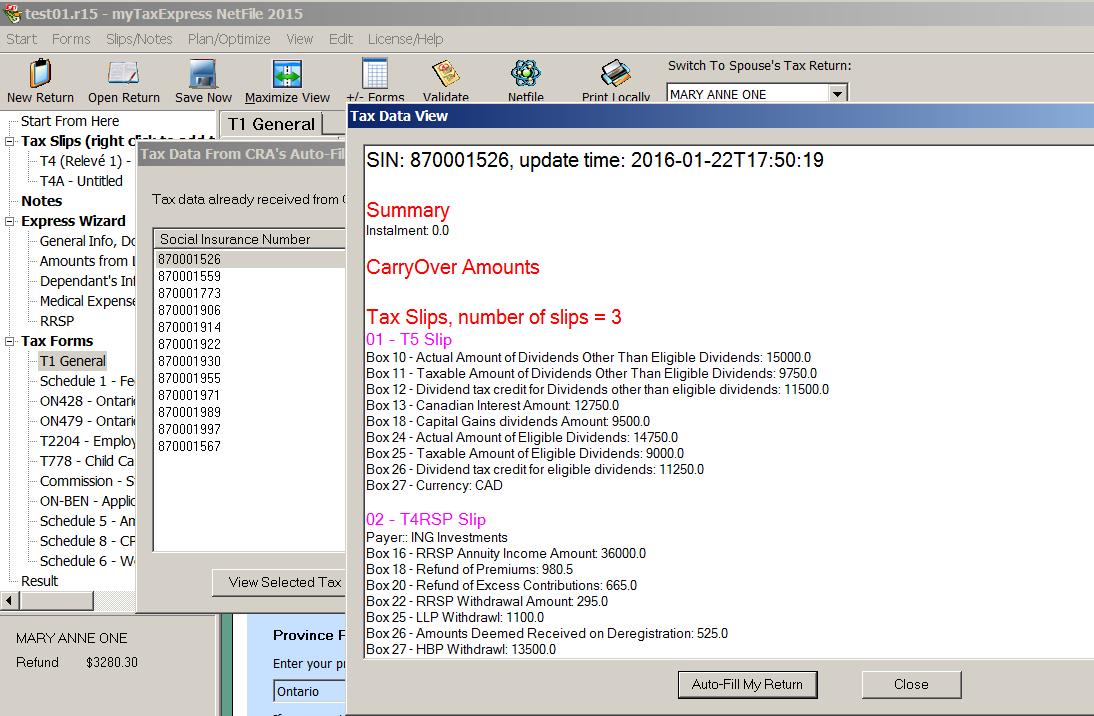

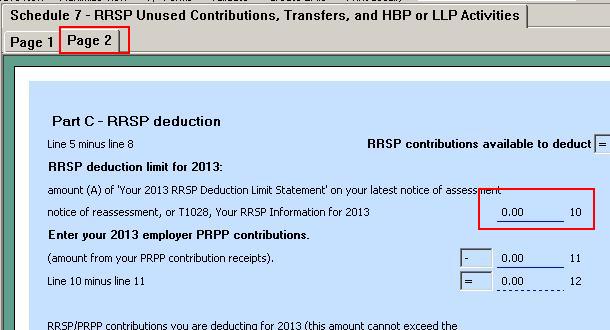

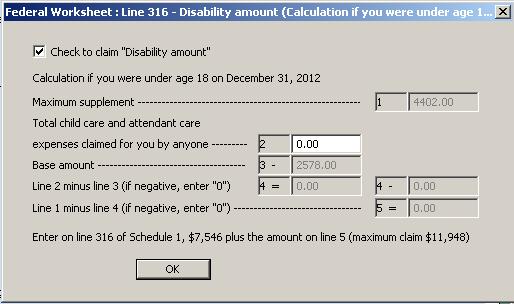

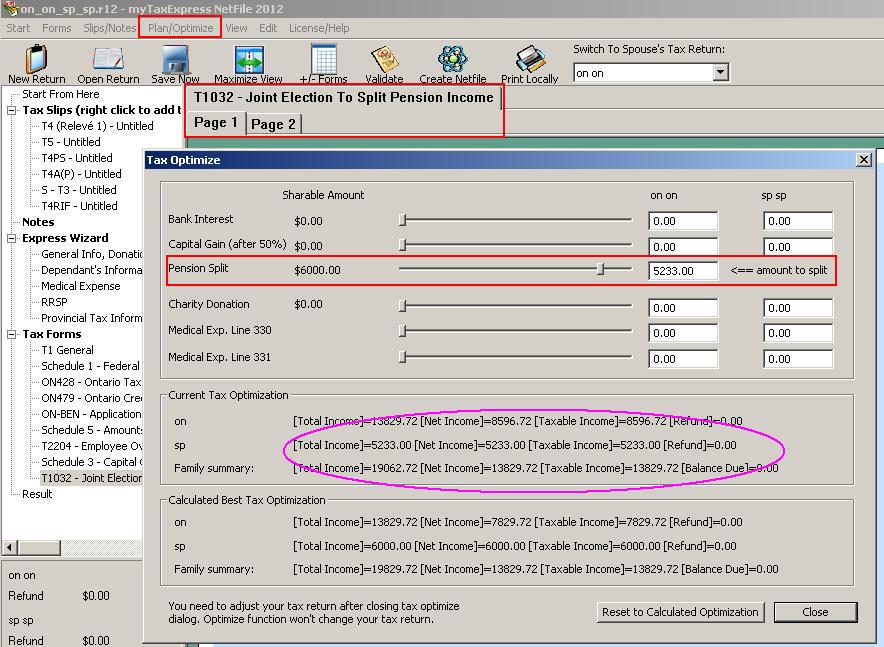

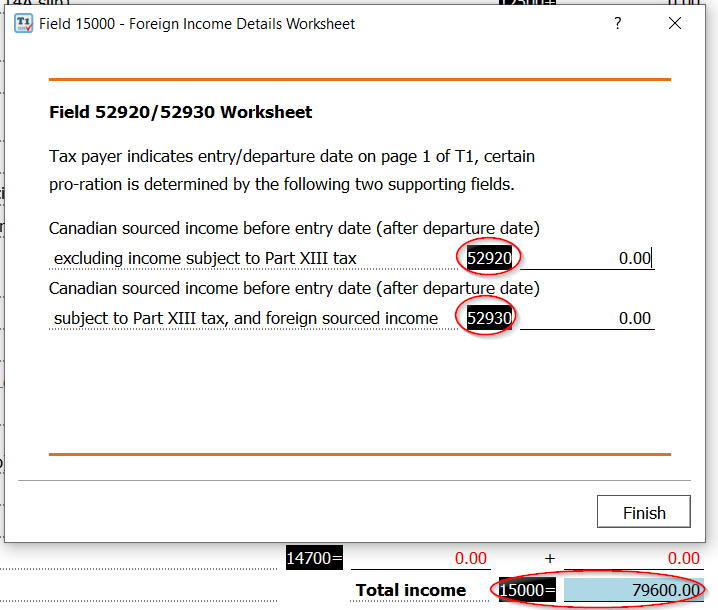

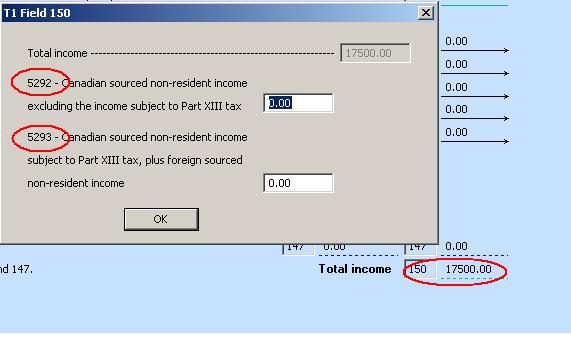

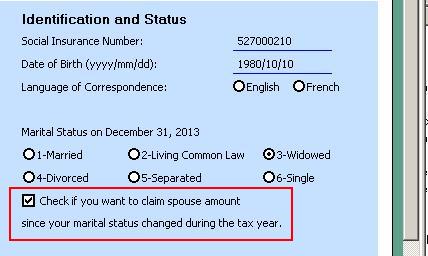

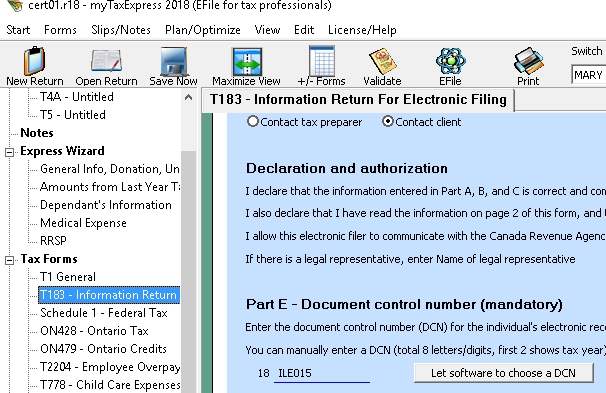

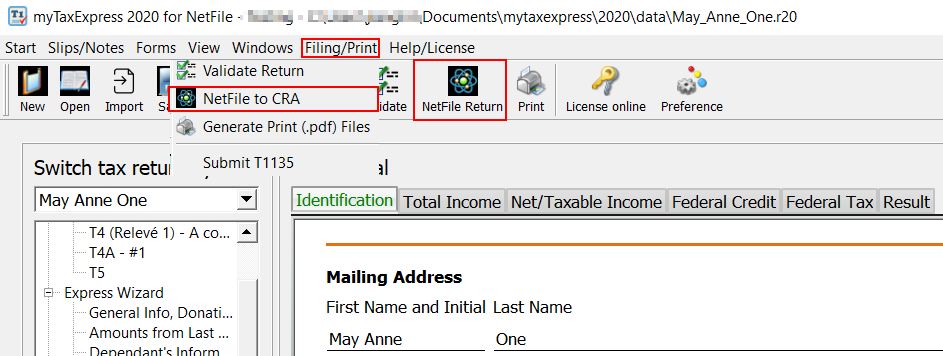

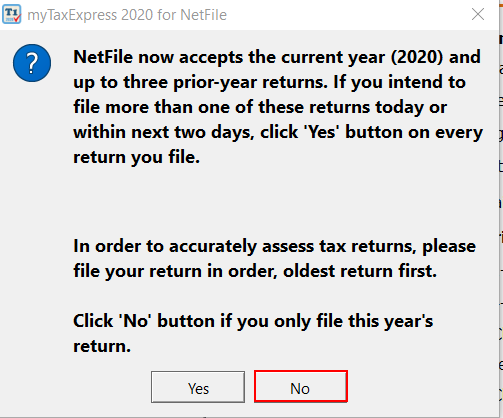

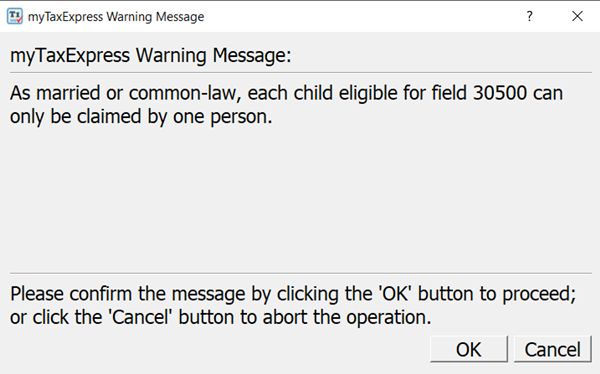

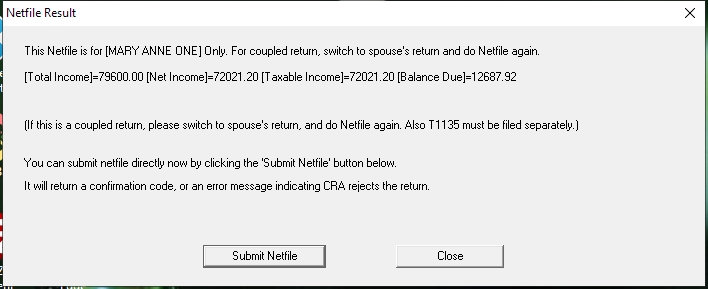

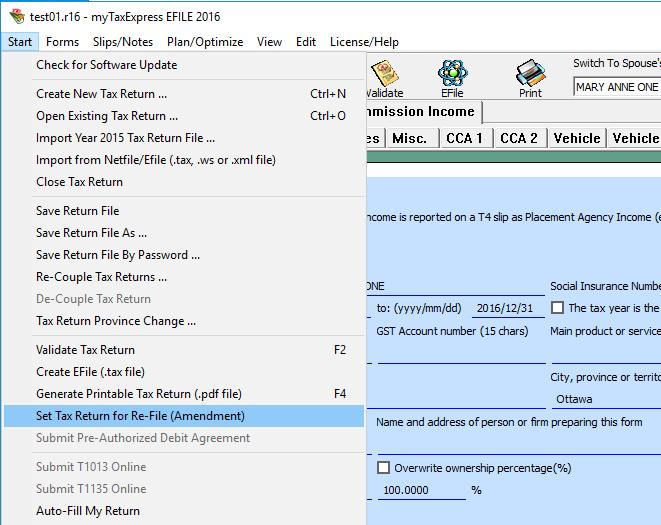

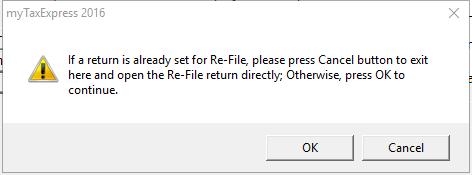

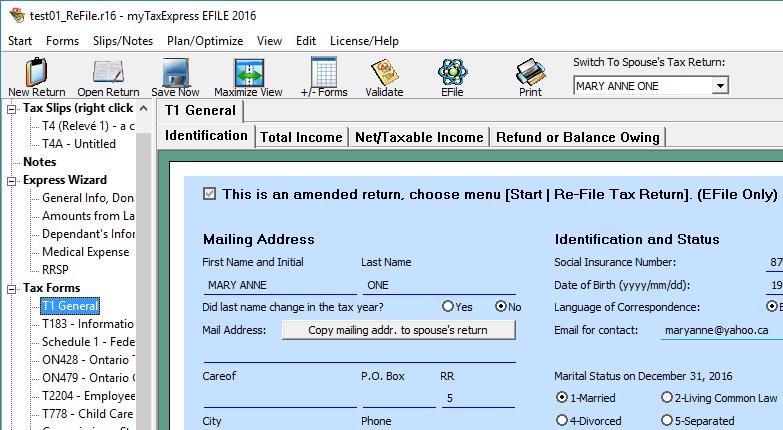

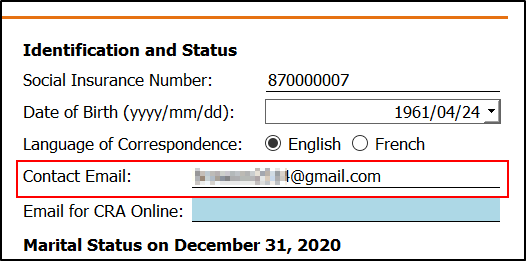

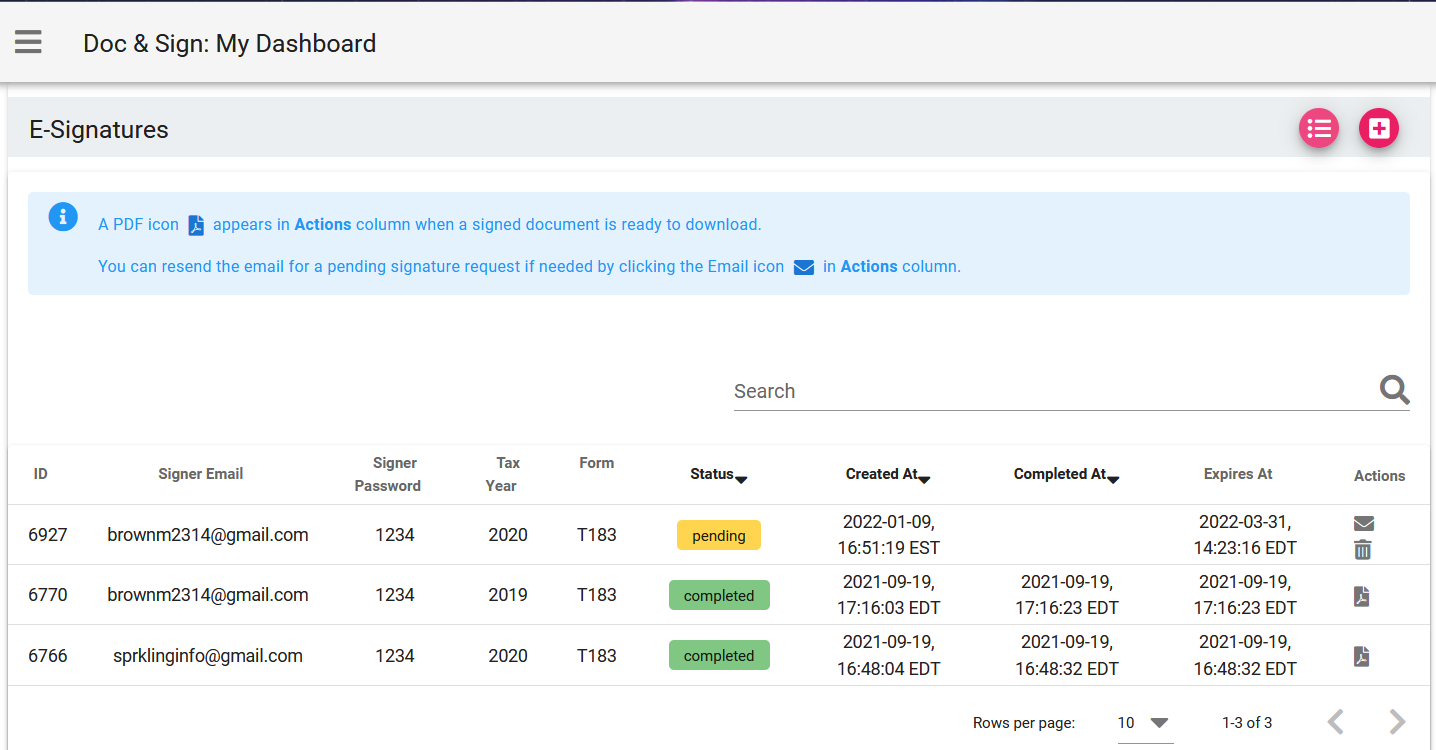

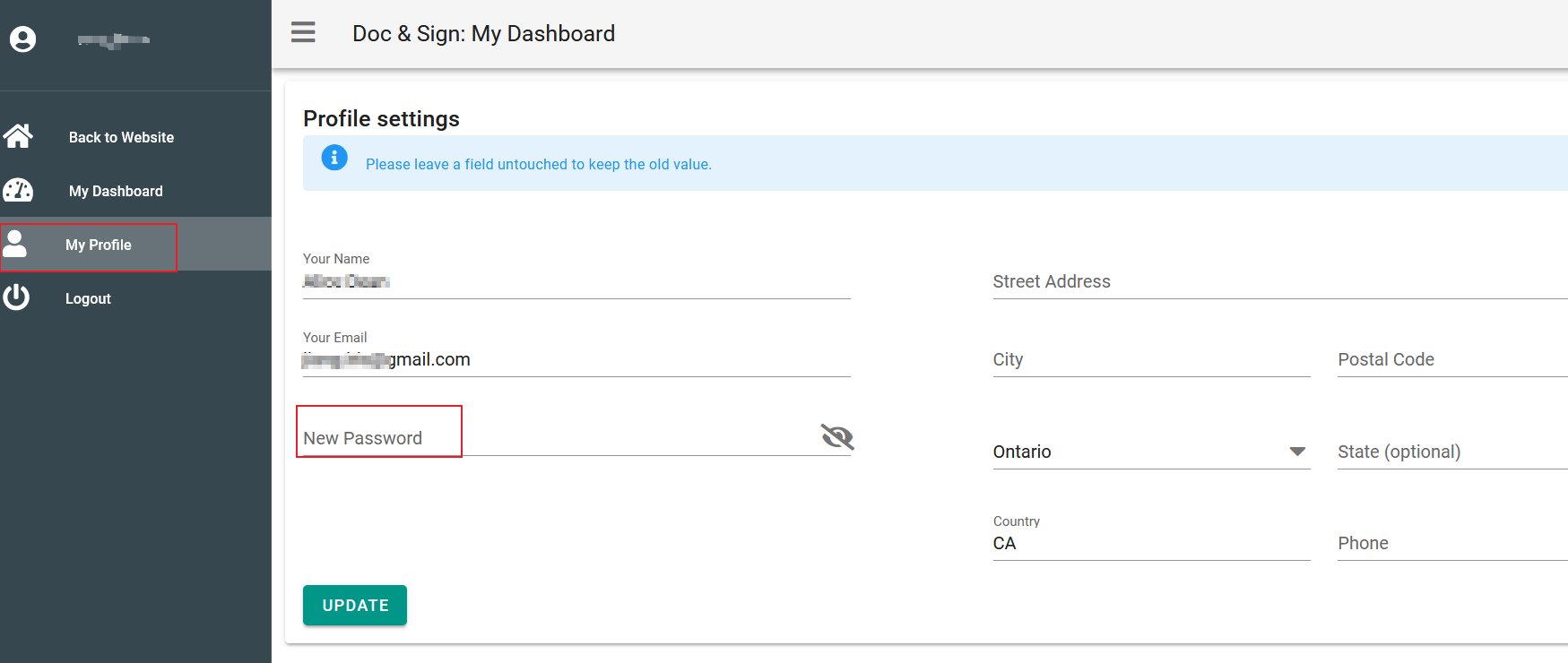

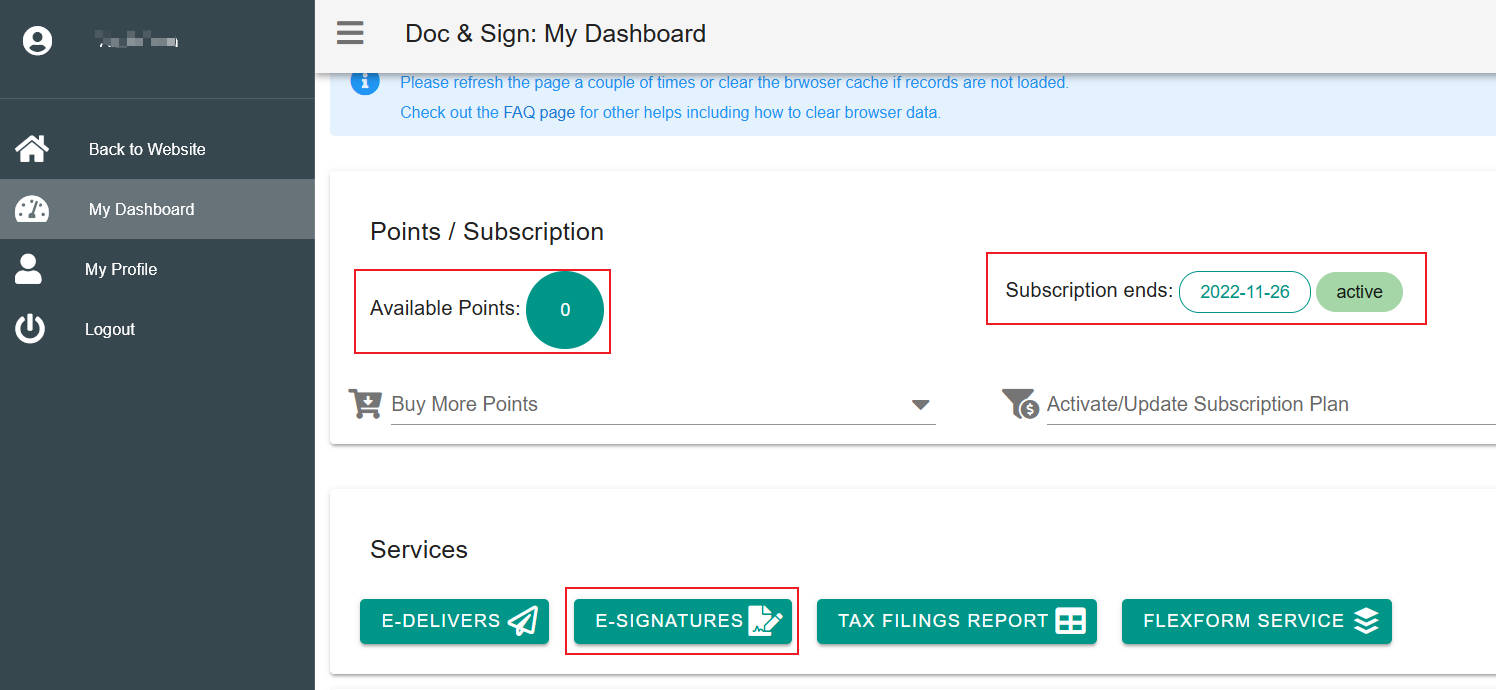

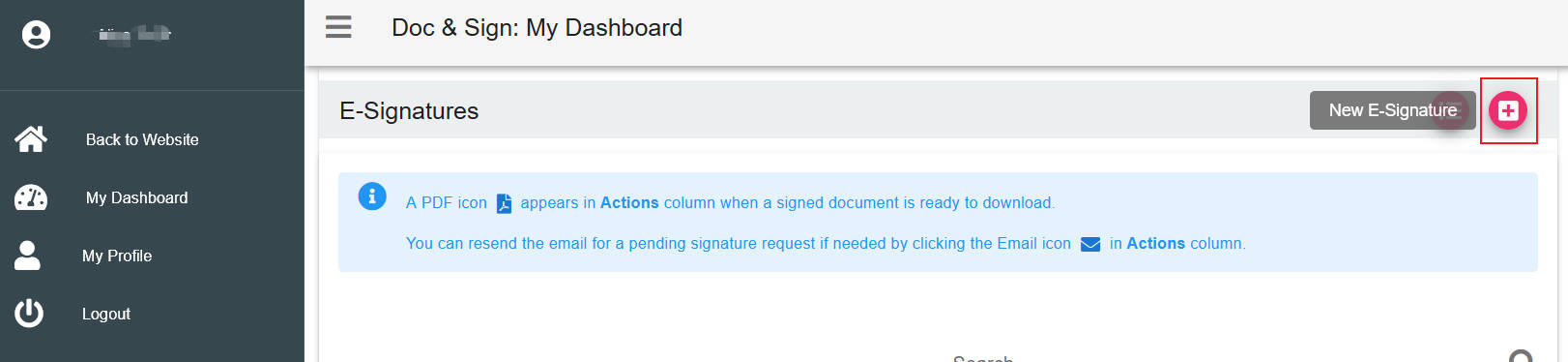

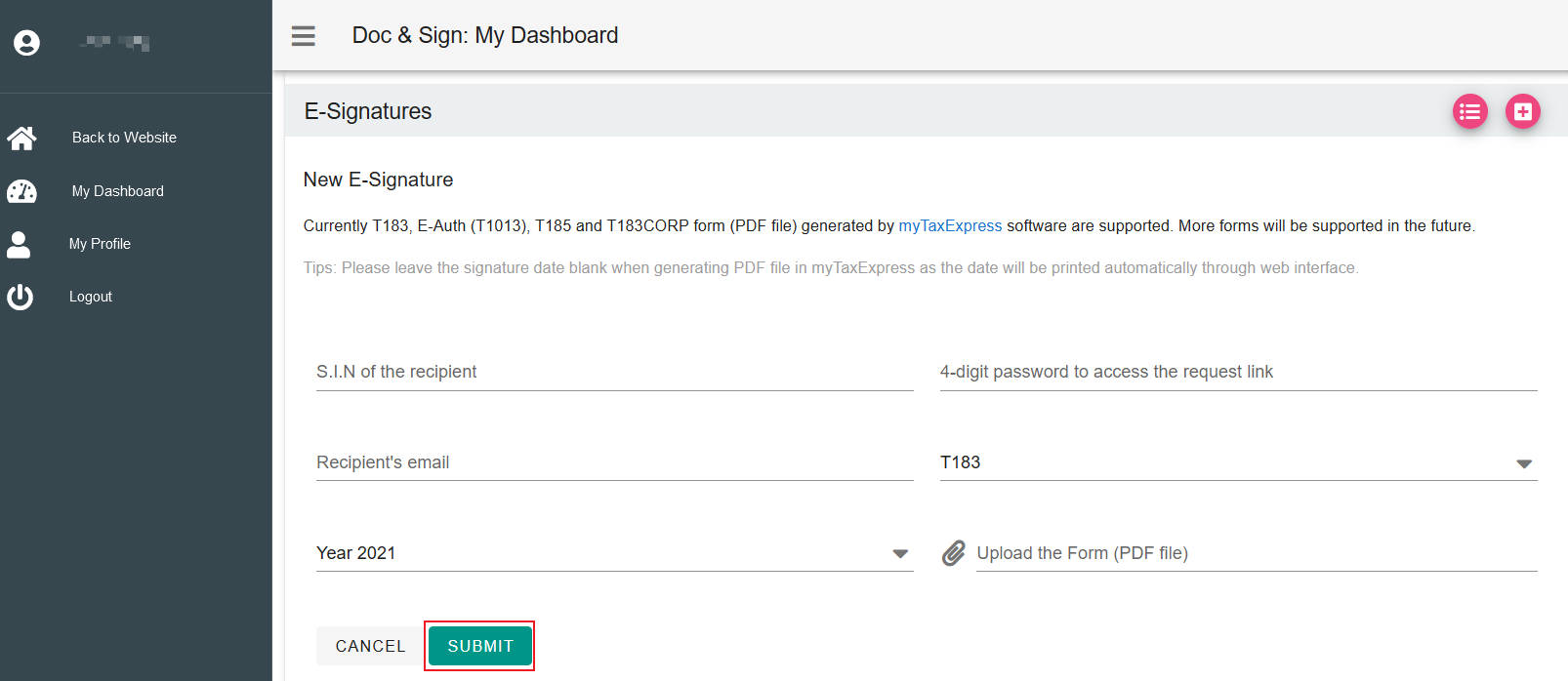

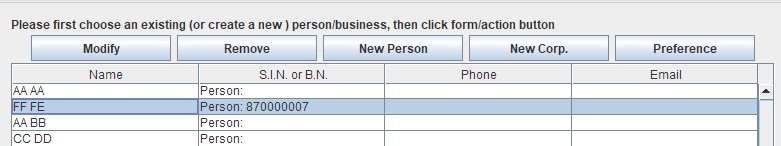

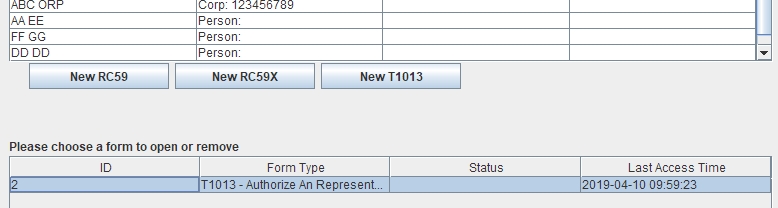

T827